On average, Australian women retire with up to $113,660 less than men in their superannuation1, a significant statistic when you also factor they are likely to live longer than men2.

There are a variety of reasons for the gap3, such as that women are more likely to:

- be primary carers for family members.

- work in part-time or casual jobs.

- take career breaks related to caring responsibilities or pregnancy.

- hold lower paid roles.

- be less represented in senior executive positions.

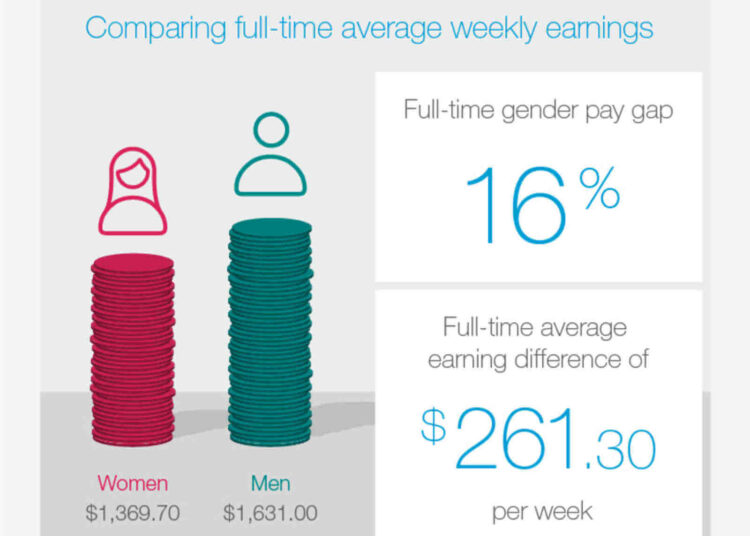

Source: Workplace Gender Equality Agency (WGEA) Gender pay gap statistics – February 2017. The gender pay gap is the difference between women’s and men’s average weekly full-time equivalent earnings, expressed as a percentage of men’s earnings.

Advisers are in the unique position of being aware not only of their clients’ finances, but also their lives and goals. They may know when a client needs to reduce work time to care for an elderly parent or may be going through a divorce.

While the challenges of reducing the superannuation and retirement gap is bigger than strategic financial advice, working with your clients on strategies to help reduce their gap can help to improve their choices later in life. The earlier your clients begin, the more time they have to build their balances. Even those who leave starting until later may be better off.

For some clients, focusing on superannuation-specific strategies may best suit their financial needs and circumstances. Others may be able to consider other investment options as part of their overall retirement planning.

Here are some superannuation strategies you may wish to consider with your clients.

- Concessional contributions

Depending on each client’s financial situation, the ability to salary sacrifice or make additional concessional contributions, may be an option to increase their superannuation balance.

Concessional contributions are capped at $25,000 per year and are taxed at 15%, which may be less than your client’s marginal tax rate – although an additional 15% tax is applicable to higher income earners – so may form part of a tax-effective strategy to support retirement and superannuation goals.

- Non-concessional contributions

Clients with the financial means to do so could consider making non-concessional contributions to their superannuation. The cap on these contributions is up to $100,000 per year if their total superannuation balance is less than $1.6 million and, if they are aged under 65 years, your client may be able to bring forward up to three years of non-concessional contributions allowing a contribution of $300,000 in one go. Some clients could also consider making small regular contributions, similar to an enforced savings plan, as part of their superannuation strategy.

- Spouse contributions

Some clients in married or defacto relationships may consider spouse contributions. Where the client earns low or no income, their partner may be able to claim a tax offset of up to $540 under certain conditions if they make a non-concessional contribution to the client’s superannuation fund. They may also be able to split their concessional contributions with their partner. Refer to the ATO guidelines at ato.gov.au for more information.

- Government superannuation co-contributions

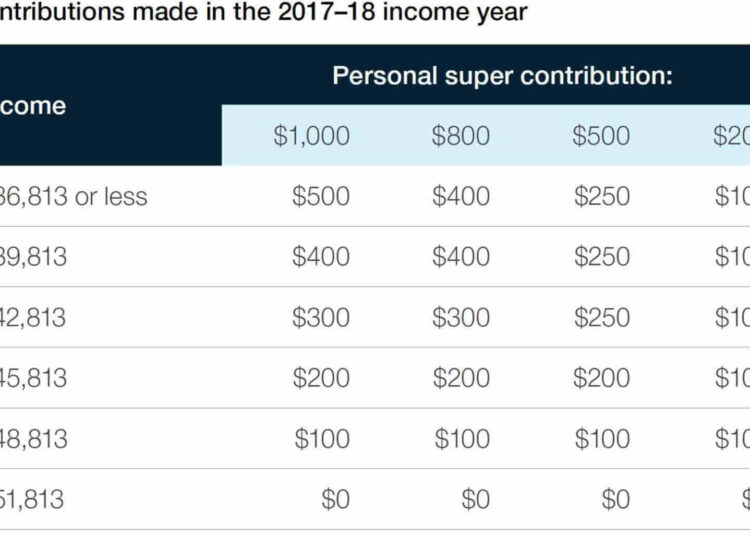

The government may also make a superannuation co-contribution to your client’s superannuation account up to a maximum of $500 if they are a low or middle-income earner and make a non-concessional contribution to their superannuation. To be eligible in the 2017/2018 financial year, they must:

- Make an eligible personal (after tax) super contribution

- Earn less than $51,813 before tax

- Be less than 71 years old at the end of the financial year

- Have more than 10% of their total income come from employment related activities, carrying on a business or a combination of these.

- Not hold a temporary visa at any point during the financial year (unless you are a New Zealand citizen or it was a prescribed visa).

- Lodge their tax return for the financial year.

Source: ATO

- Low income superannuation tax offset

If your client earns $37,000 or less, they may be eligible to receive a ‘low income superannuation tax offset’ from the government into their superannuation account. This represents a refund of the tax paid on the concessional contributions they or their employer made to their superannuation account during the financial year, up to a total of $500 annually.

- Downsizers scheme

From, 1 July 2018, eligible clients aged over 65 years old and planning to sell their primary residence of 10 years or more may wish to consider the option to contribute up to $300,000 from the proceeds of the sale to their superannuation. Each member of the couple is also able to contribute up to $300,000 from the same sale to their superannuation. Eligible contributions are exempt from the concessional and non-concessional caps on superannuation contributions and clients do not need to meet rules around existing maximum total superannuation balances, the work test or maximum ages for contributions.

More information about this is available at ato.gov.au

- Small business owners

Eligible clients with a small business may also wish to consider contributing the proceeds of selling their business (or business assets) to their superannuation under either:

- The small business 15-year exemption which means clients may not need to pay capital gains tax on the proceeds of a business asset held for at least 15 years and in turn, may be able to contribute those proceeds to their superannuation without this affecting non-concessional contributions caps.

- The small business retirement exemption which allows a capital gains exemption on the proceeds of a business up to a lifetime limit of $500,000. Eligible clients under the age of 55 years must contribute the proceeds into a complying superannuation fund and this will not affect their non-concessional contribution cap.

There is a limit for these types of contributions, which for 2017/2018 is $1,445,000.

- SuperCheck

It can be easy for anyone to forget they have superannuation balances in different locations so it can be valuable to run a search with the ATO or your client’s superannuation provider to check for lost superannuation. Even finding small amounts could assist your client down the track, but also allows you and your client to consider any fees they may be paying on their superannuation in different options and what insurance they may have access to in the different accounts.

- Superannuation account balances by age and gender, October 2017, Ross Clare, Director of Research, ASFA Research and Resource Centre.

- Australian Institute of Health and Welfare placed average lifespan of a child born in 2013-2015 to be 80.4 years if male and 84.5 years if female in a report dated 7 February 2017.

- Workplace Gender Equality Agency, Superannuation & gender pay gaps by age group – August 2016 and Australian Bureau of Statistics Gender Indicators – August 2016

Information current as at May 2018. This information does not take into account your personal objectives, financial situation or needs and so you should consider its appropriateness, having regard to your personal objectives, financial situation and needs having regard to these factors before acting on it. This information provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such. This information may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, no company in the Westpac Group accepts any responsibility for the accuracy or completeness of, or endorses any such material. Except where contrary to law, we intend by this notice to exclude liability for this material. Any super law considerations or comments outlined above are general statements only, based on an interpretation of the current super laws, and do not constitute legal advice. This publication has been prepared by BT Financial Group, a division of Westpac Banking Corporation ABN 33 007 457 141 AFSL & Australian credit licence 233714.