On 14 October 2025 a Fact Sheet providing more information on these changes was released by Treasury.

Given the history of the provisions reflected in the prior Treasury Laws Amendment (Better Targeted Superannuation Concessions) Bill 2023 (2023 Bill), it appears that Treasury intends that this tax will be rebranded as the BTSC tax rather than the Div 296 tax.

Broadly the main change involves a shift from taxing unrealised gains to a ‘realised earnings approach that aligns to existing income tax concepts’. Also, a 40% overall tax rate will apply to the proportion of earnings of a member corresponding to their Total Superannuation Balance (TSB) exceeding $10 million. These changes are proposed to apply from 1 July 2026.

Calculating superannuation earnings

The former Div 296 model:

Previously, superannuation earnings were to be calculated based on changes in TSB from 1 July for each financial year (FY), adjusted for withdrawals and contributions in that FY. Broadly, to recall some criticisms on the former Div 296 tax (as reflected in the 2023 Bill):

· unrealised gains were taxed;

· the $3m threshold was not indexed;

· the superannuation earnings calculation required numerous adjustments for many different types of withdrawals and contributions; and

· losses (negative superannuation earnings) were quarantined and could only offset positive superannuation earnings.

The proposed legislation was complex and has been summarised in prior DBA Lawyers’ articles available here.

The proposed new BTSC tax:

Superannuation earnings will be based on realised earnings that aligns to existing income tax concepts adjusted for certain items such as contributions and pension phase income. Thus, unrealised gains will no longer be subject to tax.

How to calculate BTSC tax:

There are substantial changes to the calculation method. The updated calculation is as follows:

1. The ATO notifies the super fund that there is an in-scope member (ie, a member who has a TSB of $3m+) (an in-scope member is a member of a superannuation fund who has more than $3m TSB attributable to them).

2. The fund calculates realised earnings attributable to that in-scope member and reports this to the ATO.

Note: The trustee of the super fund could attribute earnings to in-scope members using existing processes or on a fair and reasonable basis (as supported by ATO guidance).

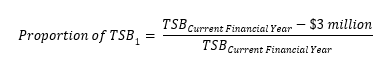

3. The ATO calculates the proportion of the TSB exceeding the $3m threshold as follows:

4. If applicable, the ATO will calculate the proportion of the TSB exceeding the $10m threshold:

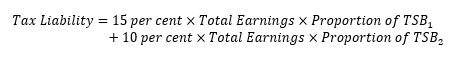

5. ATO calculates the total tax liability of all of that member’s interests:

Note: The tax liability formula gives effect to the two-tiered approach, applying an additional 15% tax on the proportion of earnings corresponding to the TSB between $3m-$10m, and an additional 25% tax on the proportion of earnings corresponding to the TSB above $10m. These apply in addition to the fund’s concessional tax rate of 15%.

Indexing

The thresholds will be indexed with CPI, as follows:

· the $3m in $150,000 increments; and

· the $10m in $500,000 increments.

Thus, indexing of each threshold will only occur when the CPI adjusted figure exceeds the relevant increment amount set out above.

New $10m higher tax threshold

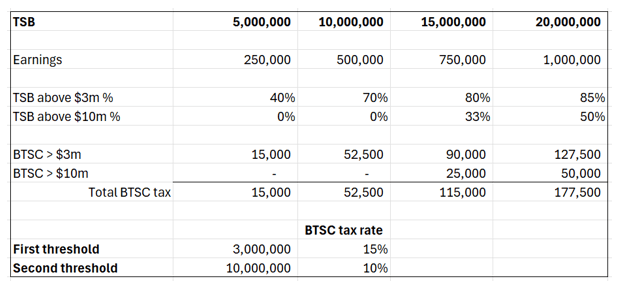

The new $10m threshold will be subject to an additional 25% tax on the proportion of earnings relating to TSB over $10 million (ie, 15% above the $3m threshold plus a further 10% over the $10m threshold). That is, an overall tax rate of 40% on the proportion of earnings corresponding to TSBs above the $10m threshold. Refer to the table below for further details on this point.

Tables and examples

Assuming that the superannuation balance achieves a 5% yield, the attracted BTSC tax liability on earnings on the TSB amounts set out below would be as follows:

This table assumes net earnings are realised income without any capital or franking credits nor any pension exemption tax.

Examples from Treasury paper:

Megan – both APRA-regulated fund and SMSF interests

· Megan is 58 and she is both a member of an APRA-regulated fund and a member of an SMSF and has a TSB of $4.5m, of which $2.3m is in an APRA fund and the remaining $2.2m is in an SMSF.

· In the FY2026-27, Megan had $100,000 in realised earnings from her APRA fund and $200,000 in realised earnings from her SMSF (a total of $300,000).

· The proportion of her $4.5m balance above the $3m threshold is 33.33%. The proportion above $10m is nil.

· Megan’s BTSC tax liability is therefore $15,000 (0.15 x 0.33 x $300,000)

Emma – SMSF member with over $10 million

· Emma is 55 and a member of an SMSF and has a TSB of $12.9m at the end of the FY2026-27. That year she was attributed $840,000 of the fund’s realised earnings for the purposes of this tax.

· The proportion of her balance above the $3m threshold is 76.74% and the proportion of her balance above the $10m threshold is 22.48%.

· Emma’s BTSC tax liability is therefore $115,581 (0.15 x 0.7674 x $840,000 + 0.10 x 0.2248 x $840,000). Note the combined BTSC tax rate on earnings over $10 million is 25%.

Timing

The BTSC tax is scheduled to apply from 1 July 2026 with assessments first being issued for the FY2026-27 after 1 July 2027.

Conclusions

There are substantive changes to these proposed laws and the detail will not be known until after the draft legislation is issued or bill presented to Parliament. We will only have certainty on the final detail and timing of the BTSC tax when it is finally passed as law. We will be monitoring developments and naturally we would be pleased to assist if there are any queries.