Jobs and wages are likely to grow strongly and households are likely to release pent-up demand using up excess savings as they travel more freely within and across borders. Credit creation should rise given the strength of household balance sheets that have been bolstered by government support payments and constraints on spending in the last two years. While being reined in, fiscal spending remains supportive.

The pace of expansion should slow as 2022 progresses as the reopening boost fades, labour markets tighten and interest rates rise, at least in the US. Goods demand should moderate as consumers run out of things to buy for the home, but this will be offset by increased spending on live entertainment like theatre and sporting events.

Worker power rising

Tightening labour markets are shifting the power toward workers, especially in the US. The number of workers in the US may take several years to recover from the drop in 2020, adding to wage pressure in the meantime. Companies are incentivised to invest more in productivity, but this takes time to realise. Job openings remain well above the number of unemployed people so unemployment should continue to contract throughout the year. US unemployment was 4.0% in January 2022, well below the peak during the pandemic, but remains above the pre-pandemic low of 3.3%.

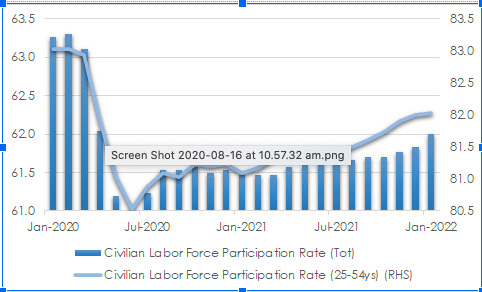

US participation in the workforce fell during the initial Covid-19 outbreak as individuals retired, decided on a sea-change or stayed at home to look after their own or their family’s health. A slow recovery in participation is underway, especially amongst prime age (25–54-year-old) workers. However if this does not continue, a faster pace of rate rises may be justified. Overall numbers of workers in Europe and Australia are recovering more rapidly because of government incentives during the initial shutdowns that tied individuals to their employers.

CHART 1: US PARTICIPATION RISING SLOWLY

Source: St Louis Fed

Inflation to fall, but not by as much as markets expect

Inflationary pressures are likely to be heightened through 2022, declining in time, but persistent enough to force the US Federal Reserve to tighten earlier than previously expected.

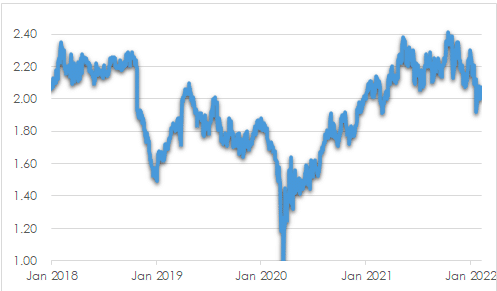

The medium-term outlook is unlikely to be as benign as is currently priced in by financial markets so volatility can be expected as reality sets in over time. US inflation should ease from the current 5-6% per annum pace to closer to 2-3% by early 2023. Markets are pricing in just 2% per annum inflation over the next five years.

CHART 2: US 5Y IMPLIED INFLATION FORECAST FALLING

Source: St Louis Fed

Supply was overwhelmed last year by strong spending on goods fuelled by fiscal stimulus and home-bound consumers unable to spend on services. Supply was further constrained by labour shortages due to shutdowns, Covid-19 infections, retirements or lifestyle choices. To protect profit margins, many companies passed their elevated costs on to customers through higher prices.

Supply chain disruptions should ease through 2022 as order backlogs improve, inventory levels recover and demand for goods subsides as spending switches toward services. Elevated energy costs should ease given the likelihood that US shale producers will raise production to take advantage of higher prices.

However wages costs may take an extended period to slow. Labour markets are tightening while the strength of demand is encouraging employers to pay up to attract workers. Rents may also strengthen as affordability concerns and higher mortgage costs increase demand for leases over purchases.

High government debt levels, digitisation and aging populations will encourage inflation lower, but several other longer-term factors prevent reversion to levels prevailing prior to the pandemic.

Globalisation is partially unwinding due to rising geopolitical concerns related to outsourcing to low-cost regions like China. Populist policies and efforts to reduce rising income inequalities encourage more local manufacture which is less efficient. Reduced investment in fossil fuels may inflate energy costs while the transition to green energy sources occurs.

Central banks are showing an acceptance of inflation at least modestly above target to help overwhelm deflationary forces that reduced inflation in the decade prior to the pandemic. Governments have shown a willingness to spend to encourage job creation and higher inflation as a means of reducing the value of government debt.

Central banks pivot to less accommodation but not restriction

In the last few months, central banks have shifted their policy stance toward removing the extraordinary stimulus in place since the start of the pandemic. Inflation is now too high to ignore. The period of ultra-loose settings that supported asset prices and encouraged investor yield-searching and acceptance of higher risk is ending. The policy shift reduces chances of inflation breakout while raising the possibility of policy error leading to an avoidable recession by tightening too quickly while economic growth is slowing.

The US Federal Reserve may quickly move to halt monthly asset purchases, increase cash rates and reduce the size of its balance sheet. However its dual mandate of maximum employment and inflation of 2% over the long term will prevent the Board from more aggressively targeting prices.

A reasonable goal in the next eighteen months is for a Federal Funds Rate around the 1.5% prior to the pandemic. This level should be seen as less loose rather than tight. Should inflation be around 3% by this time, the cash rate after inflation of -1.5% would still be very supportive of economic expansion.

Inflationary pressures are not as strong in other key regions. European inflation is largely due to supply side constraints and energy costs that should subside before too long. Remaining labour market slack constrains wages growth. The European Central Bank is likely to raise rates this year, but probably at a modest 50 basis point annual pace. Australian rates may not rise so swiftly as inflation does not have the impetus demonstrated in the US. Recommencement of immigration this year should constrain wages growth at around 3% per annum.

Investment strategy

Concerns over higher interest rates appear overstated for now. The recovering economy will be able to absorb the rise in interest rates, particularly as monetary authorities are likely to retain their broadly supportive bias. Long term bond yields are likely to drift higher in time, but not enough to drag the economy into recession. Strong demand should help many companies offset wage rises while production pressures ease with rising mobility. Geopolitical risks such as Russia/Ukraine are likely to have only a temporary impact on asset prices.

Although earnings growth is slowing, it remains positive and therefore supportive for equities. We prefer stocks over bonds given the ongoing recovery, the likelihood that longer term inflation will at least modestly exceed market expectations and the removal over time of extraordinary monetary accommodation. Our additional portfolio cash is at the ready as market volatility presents opportunities for value-adding purchases.

We prefer companies with strong pricing power, able to pass elevated costs to customers, and those with less labour intensity and exposure to higher wages. Companies with enduring earnings growth and strong cashflows will become increasingly important as economic growth slows through the year. Higher interest rates should sharpen the market’s focus on valuation, so we are even more wary of overpriced, unproven businesses such as some of the current no-profit technology firms. Industrials and materials should be supported by the ongoing economic recovery and relative valuation advantage. Finally, investing in companies with healthy and growing yields is attractive given the more challenging environment for capital appreciation.

We remain underweight fixed interest assets and prefer shorter duration exposures which offer better value than longer term securities. We have a modest allocation to mainly high-quality credit securities which offer only modest absolute returns despite the recent lift in margins. The solid business outlook should provide fundamental support. Most companies will be able to handle the rise in borrowing costs in the next two years. We would welcome further spread widening as an opportunity to add to credit exposures.

Andrew Doherty. director, AssureInvest