This article focuses on the non-arm’s length income (NALI) and non-arm’s length expenditure (NALE) provisions on contributions made to superannuation funds in s 295-550 of the Income Tax Assessment Act 1997 (Cth) (ITAA 1997) on contributions made to superannuation funds.

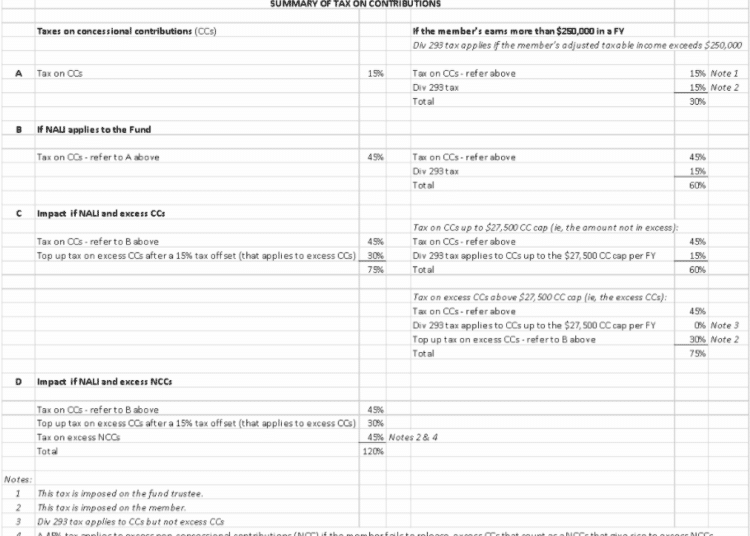

The impact of these provisions can be very severe, and the executive summary below shows that a 75% tax rate applies if a member has excess concessional contributions (CCs) and a 120% tax rate applies if a member has excess non-concessional contributions (NCCs).

A range of professional bodies have requested a carve out for CCs from NALI to provide more fairness and to protect members’ compulsory minimum superannuation guarantee (SG) contributions from being subject to excessive tax rates.

When does NALI/NALE apply to contributions?

The ATO’s view is that a general fund expense such as a $100 discount on an accounting or adviser fee can taint all of a fund’s income (including all ordinary and statutory income). This ATO view is reflected in Law Companion Ruling LCR 2021/2 that issued on 28 July 2021. The following paragraphs are extracted from this ruling (with some modification):

- In some instances, the [NALE] will have a sufficient nexus to all of the ordinary and/or statutory income derived by the fund. For example, a fund may incur expenditure that does not specifically relate to a particular amount being derived by the fund but still has a sufficient nexus more generally to all income derived by the fund …

- Where the fund incurs [NALE] of the nature outlined in paragraph 19 of this Ruling, the nexus between the expenditure and all the income derived by the fund is sufficient for all the income to be NALI …

Where NALI/NALE applies to a specific asset or source of income, the ATO view is that NALI/NALE will generally apply to all future income from that asset or income source (including all ordinary and statutory income). However, unlike a general fund expense that invokes NALE (eg, a $100 discounted adviser fee), where an asset is acquired by a fund for say $100 lower than market value, then it is only all future income from that asset or income source that is NALI.

It is possible for NALI to be invoked in a superannuation fund context by a fund obtaining a lower general expense or a lower specific expense that relates specifically to the contributions in question. However, a fund’s contributions are most likely going to be exposed to NALI due to a lower general fund expense (eg, a $100 discounted adviser fee).

Note that CCs are assessable as statutory income under s 295-160 and s 295-190 of the ITAA 1997. Thus, applying the ATO’s view as shown above in paragraphs 19 and 20 of LCR 2021/1 results in CCs being taxed as NALI. The current tax rate for NALI is 45% for FY2022. However, in addition to this 45% NALI rate, other taxes must be considered such as:

- Division 293 tax under the ITAA 1997. People who earn more than $250,000 in a financial year pay an extra 15% tax on their CCs (below their CC cap) to the extent their CCs exceed the adjusted income threshold which is currently $250,000.

- Excess CC tax. CCs made in excess of the CC cap are included in the member’s assessable income and taxed at their marginal tax rate (we assume the top personal tax rate of 45% in the analysis below). A maximum 15% tax offset applies in your personal tax return.

- A 45 per cent tax rate applies to NCCs that exceed the member’s NCC cap. Broadly, a member can choose to avoid this 45% tax on their excess NCCs if they release the excess amount. If this choice is made in time, the member is taxed on the deemed associated earnings on the excess amount for a prescribed period that starts from the beginning of the relevant financial year.

The following extract from the ATO’s website (refer to QC 19749) illustrates the severe tax rate that can apply to excess NCCs even where NALI does not apply:

From 1 July 2017, if you do not or cannot elect to release your excess concessional contributions, you could be taxed up to 94%. This is because any excess concessional contributions that is not released from the fund count towards your non-concessional contributions cap.

Would NALI apply to a large APRA fund as well as to an SMSF?

The short answer is yes. However, the ramifications of NALI being applied to a large APRA fund can be ginormous. The following table reflects the impact on NALI applying to contributions to:

- a SMSF where each of two members has contributed $27,500 to their SMSF; and

- a large APRA fund, which at 30 June 2020 had over 2.3 million members with $180 billion of assets and $12,159 million in contributions (assuming all these contributions are CCs).

|

SMSF |

CCs |

|

|

Mum |

27,500 |

|

|

Dad |

27,500 |

|

|

Total |

55,000 |

|

|

Tax |

||

|

Tax at 15% |

8,250 |

|

|

Tax at 45% |

24,750 |

|

|

Extra NALI tax |

16,500 |

|

|

Large APRA Fund |

||

|

FY2020 financial statements |

||

|

CCs |

12,159,000,000 |

|

|

Tax |

||

|

Tax at 15% |

1,823,850,000 |

|

|

Tax at 45% |

5,471,550,000 |

|

|

Extra NALI tax |

3,647,700,000 |

|

The ATO appears to be aware of the above risks given its comments in the following paragraphs in LCR 2021/2:

- It is particularly important for trustees of large APRA … funds to have appropriate internal controls and processes in place … Having appropriate controls and processes should form part of the fund’s tax risk management and governance framework.

- Nevertheless, the Commissioner is alive to concerns that a finding that general fund expenses are non-arm’s length is likely to have a very significant tax impact on the complying superannuation fund, even where the relevant expenses are immaterial.

What is interesting here is the ATO’s view that a lower general fund expense can have a sufficient nexus to all of a fund’s income (including the fund’s statutory income which includes CCs). The ATO reasoning here also results in the case of the large APRA fund being subject to NALE relating to say a $100 accounting fee discount to 2,300,000 plus members’ compulsory minimum SG contributions being subject to a 45% or higher tax rate. Based on the large APRA fund’s FY2020 financial statements discussed above, this would increase its tax on CCs alone by around $3,647 million (assuming there were no excess contributions).

We submit that CCs should be excluded from NALI as CCs are a contribution of capital to a fund and are not in the nature of income; CCs are only deemed by statute to be income (ie, statutory income). There is unlikely to be much causal connection between a lower expense and the contributions that a fund may receive.

Analysis showing a 45% to 120% tax rate on contributions with NALI

The attached spreadsheet shows the detailed analysis of how we calculated the tax rates shown in the Executive Summary below.

|

EXECUTIVE SUMMARY |

|

|

(assuming NALI applies to the fund) |

|

|

Maximum tax rate as set out in greater detail below |

|

|

Tax rate

|

|

|

CCs |

45% |

|

CCs with div 293 tax |

60% |

|

Excess CCs |

75% |

|

Excess NCCs |

120% |

The spreadsheet shows the assumptions and thinking behind the calculations. Please note that the tax rates in the spreadsheet and Executive Summary reflect nominal and not effective tax rates. Naturally, if you think there is any error, we would welcome your feedback.

Advisers need to be aware of the above tax rates that can apply to contributions as many do not factor in the NALI risk when providing advice. Given the considerable uncertainty surrounding NALE and NALI following the finalisation of the ATO’s views in LCR 2021/2 and how easy it is for these rules to be invoked, advisers, especially tax advisers and those providing financial product advice, should start including appropriate warnings to clients of the substantial tax rates that may apply on contributions. Unless they do so, a client who incurs greater than 15% tax on their CCs may seek recovery via legal recovery proceedings.

Conclusion

As you may glean from the above, NALE/NALI can result in some nasty impacts to superannuation funds and members. There are numerous professional bodies seeking legislative change to the NALE/NALI provisions including having contributions (including compulsory minimum SG contributions) excluded from NALI. Hopefully, there is some change forthcoming soon to ensure a better outcome.

By Shaun Backhaus, senior associate and Daniel Butler, director, DBA Lawyers

Annexure – Spreadsheet