This article examines the proposed changes in the draft legislation using case studies to illustrate how ECPI would be claimed.

For simplicity and ease of expression, we refer to ‘pensions’ in this article rather the tax term ‘superannuation income streams’. All references to legislation are to the Income Tax Assessment Act 1997 (Cth) (ITAA 1997).

We also refer to funds being partly or fully in pension phase to convey the extent to which a fund is paying exempt (retirement phase) pensions (eg, account-based pensions) compared to accumulation phase benefits at a point in time in an income year.

This article only covers ECPI issues associated with prescribed pensions — ie, allocated, market linked or account-based pensions.

Background

Two recent developments have significantly impacted how funds claim ECPI in recent years.

The first development is the disregarded small fund assets (DSFA) rule in s 295‑387. This rule, introduced with effect from 1 July 2017, broadly precludes small funds (including SMSFs) claiming ECPI under the segregated method where any member of the fund who is a retirement phase recipient (in any fund) has a total superannuation balance exceeding $1.6 million at the end of the prior income year.

Funds that are subject to the DSFA rule cannot choose to actively designate particular fund assets to support the trustee’s liabilities to pay pensions (ie, as segregated current pension assets). Moreover, under the current law, such funds can only claim ECPI under the unsegregated or proportionate method in s 295‑390 even if the fund is fully in pension phase for the entire income year.

Thus, a 100% ‘pension fund’ is required to obtain an actuarial certificate to confirm the 100% ECPI exemption.

The second development concerns guidance issued by the ATO in relation to their administrative approach to ECPI that was published on the ATO’s website in late 2019 (QC 21546). In broad terms, the guidance can be summarised as follows:

- For 2016–17 and prior income years, the ATO will not apply compliance resources to reviewing actuarial certificate calculations under the unsegregated method where the certificate covers the whole year, even if a fund may have been 100% in pension phase for part of the financial year

- For the 2017–18 income year onwards, the ATO expects SMSFs to calculate ECPI and obtain actuarial certificates in line with the following:

o Unless a fund is subject to the DSFA rule for an income year, the fund must claim ECPI using the segregated method for any period that the fund is 100% in pension phase.

o Where an SMSF uses the unsegregated method for part of an income year an actuarial certificate is required to claim ECPI for that period — ie, unless active segregation is implemented (if available).

o Only one actuarial certificate is required for the period or periods the unsegregated method is used, even if an SMSF changes ECPI method multiple times in an income year.

The above ATO guidance gave rise to a number of difficulties and concerns when it was published and it continues to be a source of extra administration for many SMSFs that are subject to the ATO’s view on deemed segregation.

This is because in many cases funds are forced to calculate ECPI based on multiple discrete ECPI periods, eg, where:

- the fund is fully in pension phase for one or more periods during an income year; and

- the fund is partly in pension phase and partly in accumulation phase for one or more periods during an income year.

This ATO view can increase the administration burden on funds that are not subject to the DSFA rule unless certain steps are taken to prevent deemed segregation, such as maintaining a small accumulation balance at all relevant times to simplify ECPI.

This ATO view represented a departure from established industry practice. For instance, typically SMSFs that were partly in pension phase and partly in accumulation phase during an income would calculate exempt income using the unsegregated method for the full income year, even if there were one or more periods where the fund was 100% in pension phase.

We now consider how the proposed changes impact claiming ECPI.

Actuarial certificate relief for pension funds

The draft legislation effectively removes the actuarial certificate requirement for 100% ‘pension funds’ by modifying the definition of a DSFA in s 295‑387 as follows:

(3) However, the fund is not covered by subsection (2) for an income year if, at all times during the income year, all of the assets of the superannuation fund would, apart from subsection 295-385(7), be segregated current pension assets.

Section 295‑385 of the ITAA 1997 contains the rules for the segregated method and includes the following exclusion:

(7) Also, disregarded small fund assets are not segregated current pension assets.

Thus, this proposed change effectively overcomes the exclusion in s 295‑385(7) and allows funds that are 100% in pension phase at all relevant times to treat assets as segregated assets for ECPI purposes.

Consider the following example:

Example 1

Peter is the sole member of the Peter SMSF. Peter is age 67 and the fund is fully in pension phase. Peter has an accumulation interest in a retail superannuation fund and his total superannuation balance at the end of the prior income year is greater than $1.6 million.

Current law

Under current law, the assets of Peter’s SMSF are subject to the DSFA rule. Therefore, Peter’s SMSF trustee can only claim exempt income under the unsegregated method in s 295‑390. Accordingly, an actuarial certificate is required to support the fund’s exempt income claim despite the exempt percentage being 100%.

Under the proposed legislation

If the draft legislation is enacted, the assets in Peter’s SMSF can be treated as segregated current pension assets because Peter’s SMSF is fully in pension phase — ie, at all relevant times during the income year. Importantly, the trustee of Peter’s SMSF can disregard any gain (or loss) that is made in respect of its CGT assets under s 118-320.

Choice of ECPI method

The draft legislation also seeks to address the problem discussed above regarding forced deemed segregation that arises under the ATO’s current administrative approach to ECPI.

In broad terms, this is achieved by creating a choice in respect of treating fund assets as either segregated current pension assets or not where a fund is fully in pension phase for part of an income year. The choice is not available where:

- at all relevant times in the income year, the fund is fully pension phase; or

- the fund is subject to the DSFA rule for the income year.

To illustrate how the proposed legislation will impact ECPI, consider the following example:

Example 2

(All dates below occur in chronological order in the same income year.)

Sarah and John are members of the S & J SMSF. They have equal account balances.

On 1 July, John’s entitlements are entirely in pension phase and Sarah only has an accumulation interest in the fund.

On 6 November, Sarah retires and commences an account-based pension with her entire account balance.

On 20 January, John makes a non-concessional contribution of $100,000.

On 1 February, John commences a second account-based pension with his accumulation entitlements in the fund.

Both John and Sarah have a total superannuation balance below $1.6 million.

Current law

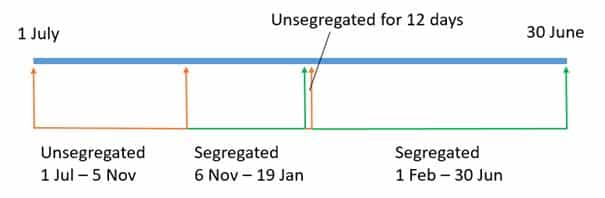

Under current law, S & J SMSF will need to calculate ECPI having regard to the following four accounting/ECPI periods:

- Period 1: 1 July to 5 November — The fund is initially unsegregated due to Sarah’s accumulation entitlements in the fund.

- Period 2: 6 November to 19 January — The fund becomes segregated on 6 November due to Sarah retiring and commencing a pension.

- Period 3: 20 January to 30 January — The fund ceases to be segregated due to John’s contribution to the fund.

- Period 4: 1 February to 30 June — The fund becomes segregated again on 1 February 2019 when John commences his second pension with accumulation entitlements.

These ECPI periods are depicted visually in the diagram below for illustrative purposes:

Importantly, no actuarial certificate is available for the two segregated periods, and an actuarial certificate will be required for the two unsegregated periods, ie, for the period 1 July to 5 November and for the period 20 January to 31 January.

Under the proposed legislation

Under the proposed legislation, the trustee of the S & J SMSF will (optionally) be able to choose to treat the fund’s assets as being not segregated current pension assets for the two periods that the fund is fully in pension phase. This choice will be available for each deemed segregation period because the fund is not 100% in pension phase for the entire income year and the fund is not subject to the DSFA rule.

If the trustee of the S & J SMSF makes this choice, eg, to simplify the fund’s ECPI affairs, an actuarial certificate can be obtained covering the entire income year and all exempt income can be claimed under the unsegregated method.

Naturally, the choice to claim ECPI under the unsegregated method for the entire income year would need to be properly considered, having regard to the whole circumstances of the fund and relevant advantages and disadvantages. This could include:

- The advantages and potential cost savings of streamlining the fund’s ECPI claims for the income year.

- The timing of CGT events — this is a relevant consideration because capital gains (and losses) are disregarded under s 118‑320 if segregation is maintained for relevant periods of deemed segregation.

Conclusions

The draft legislation appears to be a step in the right direction in relation to ATO’s current administrative approach to ECPI claims for small funds. In particular, the proposed changes will address the redundant requirement that 100% ‘pension funds’ being required to claim ECPI under the unsegregated method where the fund is only paying prescribed pensions, and it restores the role of choice of ECPI method that was removed under the ATO’s strict approach to deemed segregation from mid-2017

The consultation process on the draft legislation and associated explanatory materials is open until 18 June 2021. Submissions can be made to superannuation@treasury.gov.au.

By William Fettes (wfettes@dbalawyers.com.au), Senior Associate, and Daniel Butler (dbutler@dbalawyers.com.au), Director, DBA Lawyers