The ATO extended the lodgement deadline to give accountants more time to prepare for the latest changes. Those firms with licenses are using this time to prepare the statements of advice (SOAs) for their clients. But what if you don’t have a license?

There are a number of changes clients may have missed and not knowing them could adversely affect their retirement. I believe accountants have a duty of care to ensure their clients are informed about these changes and whilst without a license you cannot give advice, you can give non-specific advice and tax advice.

Total Super Balance and how it affects contributions

The total Superannuation Balance (TSB) includes the accumulation account balance, retirement account balance and any other money in super, less structured settlement contributions.

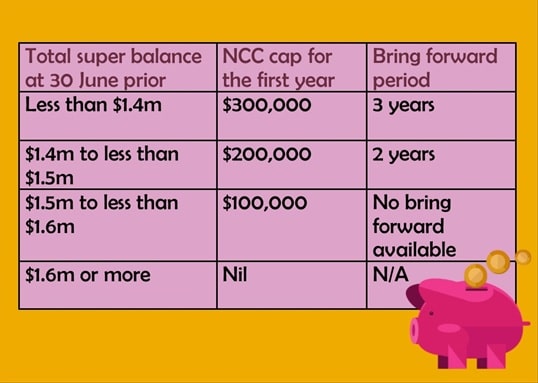

After 30 June 2017 if your client’s TSB is over $1.6 million they are unable to contribute, however if they have a TSB of over $1.4 million and are eligible for the three year bring forward rule their contribution is restricted as per the table below.

Note, however, that even if the bring forward rule is triggered, for any unused portion, in subsequent years, the client’s TSB must still be under the general transfer balance cap at 30 June prior in order for any NCCs to be permitted.

Bring Forward Transitional Arrangements

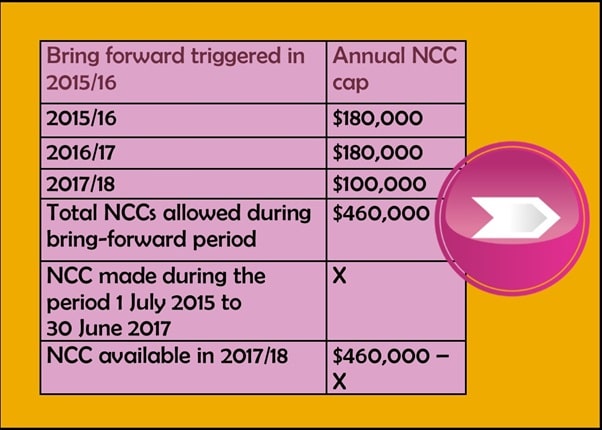

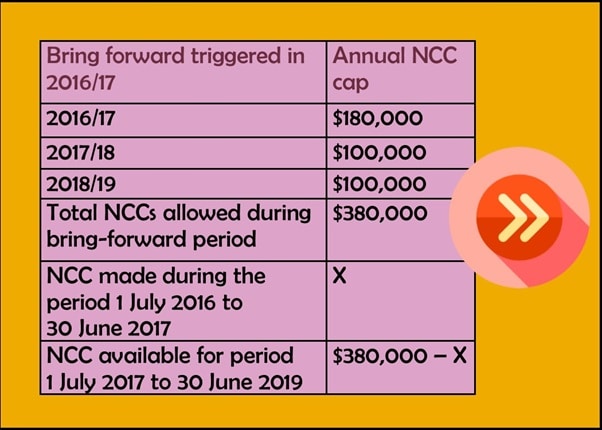

Whilst most clients are aware of the lowering of the NCC cap what they aren’t aware is that if they trigger the three year bring forward rule the unused portion after 30 June 2017 is adjusted under transitional arrangements. How they are affected depends on what year the bring forward rule was triggered. However if they contribute prior to 30 June they still have the entire cap available. This is a significant incentive to ensure that anyone who has triggered the bring-forward provisions makes contributions prior to 30 June 2017.

For example if the bring-forward cap was triggered in the 2015/16 year. If they contribute before 30 June 2017 they can contribute $540,000 however on 1 July 2017 any unused portion available to them decreases by $80,000.

Similarly if the bring forward cap was triggered in the 2016/17 year. On 1 July 2017 the unused portion available to them decreases by $160,000.

So making the contribution prior to 30 June 2017 is essential.

Remember also that after 30 June 2017 regardless of the transitional arrangements outlined above the TSB still needs to be less than $1.6 million to be eligible to use the remaining NCC cap.

Transition to Retirement Income Streams (TRIS) & CGT relief

With the removal of the tax exemption on earnings in a TRIS, clients need to decide whether they intend to have their TRIS continue as is, commute it and leave it in accumulation or commence an account based pension (ABP) – assuming of course they satisfy the conditions to commence an ABP. There are also CGT relief provisions allowing those who are in a TRIS to reset the cost base of the assets.

Now without a licence you cannot advise on pensions, you can however, prepare the calculation scenarios for the CGT relief as that is tax advice. But be careful as you cannot advise the client whether they should choose to reset the cost bases – just the tax consequences of each option.

For example – when you reset an asset it is a deemed sale and repurchase – meaning the CGT discount period is reset. If you reset an asset and sell it within 12 months there are tax consequences.

Additionally if a fund was unsegregated and has a significant portion of assets in accumulation resetting the cost base will trigger a capital gain that will either need to be paid or deferred until the assets sale. Using current market values you can calculate the approximate tax consequences on resetting the cost base of the assets.

$1.6 million transfer balance cap

Clients whose member accounts exceed $1.6 million are usually your bigger clients, and therefore if they don’t have a financial planner you may want to consider suggesting they seek advice. As with the TRIS pensions without a licence you cannot advise clients to commute part or all of their pensions. You cannot advise them whether they should leave the money in accumulation or remove the excess from superannuation.

For clients with a member balance exceeding $1.6 million it is imperative that there is some paperwork – being a minute or pension documentation – advising their fund of their decision prior to 1 July 2017 otherwise they can be subject to excess transfer balance tax.

These clients also have the CGT relief provisions available to them and similarly to the TRIS clients you can provide them with CGT reset scenario calculations without a licence.

LRBA Changes

Finally clients with LRBAs especially those nearing the $1.6 million cap need to be aware that legislation is tabled in parliament that may affect them.

These are the biggest changes to superannuation in the last decade and there is a lot to take in. The licensing requirements may have restricted your ability to give advice directly but if you don’t inform your clients of the changes they may fall through the cracks.

Deanne Firth, director, Tactical Super

The transfer balance cap, CGT relief, and changes to TRIS’s are all contained in Taxation legislation. If a trustee of any superannuation fund, including an SMSF, requests information on these changes from a tax professional then they are entitled to receive it. If the Trustee then communicates it to members, that “personal advice” is their concern and subject to its own exemptions. If you want to get into semantics about if a member and trustee are one in the same (“like minds”), then lets talk about “capacity”. Accountants can take some comfort if the SMSF Trustee they are advising is a company, not the member, so the personal advice argument is refuted by case law a mile long. If that isn’t enough, read ASICs INFO 216 about what an accountant can still do or say with the appropriate disclaimers….it’s quite refreshing!

So by your analysis if an unlicensed accountant discusses that changes to TRIS means the super balance used to support the stream is no longer tax free that is “advice”. It is called tax advice and accountants are allowed to give it.

It is not just if you give advice, it is if you are perceived to give advice. I would be interested to see how some of these approaches go if there is a dispute because if you even discuss something in passing FOS generally view it that you are perceived to have given advice. I’m not sure if FOS however deals with a dispute if you aren’t licensed.