If your clients have more than $1.6 million in superannuation pension phase, and/or you have clients with a transition to retirement income stream they wish to continue from 1 July this year, you must read this.

Capital gains tax (CGT) relief

From 1 July 2017, the maximum amount a member can transfer from the taxable accumulation phase to the tax-free retirement (pension) phase will be limited by the new transfer balance cap (TBC) of $1.6 million (indexed). For pension balances in excess of this amount on that date, the member has the option to either:

- Withdraw the excess from the superannuation system; or

- Commute the excess back to the accumulation phase.

Also from 1 July, investment earnings and capital gains generated from transition to retirement income streams (TRIS) will no longer be tax free.

Transitional CGT relief – a special tax concession accessible between now and June 30 – is available to superannuation funds that have members affected by the new TBC, or pay TRISs that will lose the tax-exempt treatment of investment earnings.

Super funds where part of the fund’s investment return is a capital gain on individual assets will be impacted by the changes. These funds include self-managed superannuation funds (SMSFs), small APRA funds (SAFs), and public offer (retail) funds – including wrap accounts – and industry funds offering direct investments, i.e. shares and managed funds.

The CGT relief measure was introduced to discourage the mass selling of pension-supporting investments before 1 July 2017. The intent of the new rule is to provide CGT relief on the gains accrued before that date, so as not to disadvantage members who are required to commute a pension due to the new TBC, or are impacted by the TRIS tax changes. CGT relief preserves the tax exemption for these accrued capital gains on selected investments by resetting the cost base of those investments to their market value.

For members who currently have more than $1.6 million in pension phase and choose option two (above) or have a TRIS, the legislation provides transitional CGT relief for assets owned by the fund on 9 November 2016 (being the date the legislation entered Parliament).

Importantly, CGT relief is not automatic – the trustee of a super fund must choose for the relief to apply for a CGT asset in the approved form.

For those assets that become taxable, i.e. that are transferred back to accumulation phase or support a TRIS, an irrevocable election can be made on an asset by asset basis to reset the CGT cost base to its market value, with the fund deemed to have sold and re-purchased the asset at that market value. This means the fund is only exposed to CGT on future growth in the asset value from that point.

CGT relief is quite complicated. Different rules apply depending on whether the fund currently uses the segregated or proportionate (unsegregated) method in determining its exempt current pension income (ECPI). Furthermore, from 1 July 2017, SMSFs and SAFs in some circumstances will no longer be able to use the segregated method in determining the ECPI.

Segregated method

An asset or group of assets is transferred from the pool of assets supporting the current income in-stream, to an accumulation pool.

The transfer and deemed sale and re-acquisition can occur at any point from 9 November 2016 to 30 June 2017, meaning the availability of market values during this time is key.

The deemed sale to market value occurs as part of the exempt pension assets, so the capital gain is ignored for tax purposes.

Income and capital gains arising from those assets after the move into the accumulation pool is subject to tax.

For funds using this method, there will be no adverse CGT consequences of applying the relief and resetting the cost base of eligible assets to market value. Based solely on this outcome, in all likelihood it will be the most appropriate course to reset the cost base, provided the market value is greater than cost. Nevertheless, this should be assessed on a case-by-case basis, with the investment merits of the assets selected also taken into consideration.

Proportionate method

The deemed sale occurs on 30 June 2017, meaning this is the important valuation date.

The resulting notional capital gain may be included as part of the 30 June 2017 assessable income of the fund, with the actuarially determined exempt pension factor applying to determine how much is taxable.

Alternatively, the fund can defer the notional capital gain until the asset is actually realised for CGT. The actual capital gain arising on the real disposal using the refreshed cost base (adjusted for any subsequent cost base adjustments) will also be included in that year.

In addition to resetting the cost base to market value, the date of acquisition for the purpose of applying the one-third CGT discount will also be reset. That is, you will re-start the 12-month holding period required to apply the one-third discount. So, care needs to be taken where an eligible asset is planned to be sold within 12 months of resetting the cost base.

It’s important to note that under both methods, the choice made needs to be documented in the approved form before lodgement of the fund’s 2016-17 annual return. The election is irrevocable and trustee(s)/members cannot change things if they subsequently realise they got it wrong.

What should I do now?

Important decisions must be made in the lead-up to 30 June. With only a few months to go, now is the time to consider whether claiming CGT relief on certain investments is worth pursuing for relevant clients. This choice will have a direct effect on the amount of income tax paid in future years.

First, you need to assess whether your clients are affected by the new rules. Do you have a client with:

- An SMSF or SAF that has at least one member with more than $1.6 million in pension phase across all super funds and where that member is required to commute some or all of their pension in the SMSF or SAF to comply with the TBC?

- A defined benefit pension caught by the new 16 times pension multiple rule as well as an SMSF, SAF or retail/industry fund with direct investments paying a pension that faces being wholly or partially wound back from 1 July to accumulation phase as a result of the TBC?

- A retail/industry fund with direct investments requiring a pension restructure?

- A TRIS commenced before 9 November 2016 that faces losing the tax-exempt treatment of its investment earnings from July 1?

If any of these arrangements apply, you need to consider:

- What method is the SMSF or SAF using to claim ECPI?

- Which fund assets are eligible for CGT relief?

- Is the current market value of the eligible asset at the time of the re-set more than its cost base?

- Will the asset be disposed of within 12 months of the date of the re-set?

- Is this asset likely to increase in value in the future or is it a defensive investment not subject to price variation?

- What is the ECPI percentage of the SMSF or SAF expected to be in the year the affected assets are sold? This may include the impact of other members entering pension phase increasing this percentage.

- For those members with a TRIS, are they able to satisfy a condition of release so that there is the potential to convert the TRIS to a standard account-based pension and retain the tax exemption on earnings (subject to the $1.6 million TBC)?

It’s a case of ‘doing the numbers’ to assess the effect of choosing the relief and whether the fund will apply the deferral. If the client chooses CGT relief, it will result in a permanent modification of the investment’s cost base, but if CGT relief is not chosen, the cost base for tax calculations will be the original purchase price.

For SMSFs, the decision to claim CGT relief and organise this is up to the fund trustee(s), who are also the members.

For SAFs, members who identify CGT relief opportunities must work through the trustee.

For public offer (retail) funds – including wrap accounts – and industry funds offering direct investments, it will be up to members to take the initiative and approach their trustee where they believe they have an investment worth claiming CGT relief on. They will need to obtain directions from trustees on what they expect.

Remember, the choice to reset the cost base and to defer any notional gain is an irrevocable election and must be made by the due date for lodgement of the fund’s 2016-17 annual return. The choice must be recorded on an approved form and trustees must keep records of chosen investments for future reference.

Remember

CGT relief measures only apply in the following circumstances:

- Where a client is in pension phase and exceeds the $1.6 million cap and needs to make arrangements to meet the TBC by year-end; and/or

- Where a client has a TRIS and wishes to continue with this income stream from 1 July and wants to re-structure to meet the new rules.

Where the CGT relief measures do not apply

The CGT measures are not to be used merely to refresh a client’s cost bases, where they don’t meet the above circumstances. The Explanatory Memorandum (EM) supporting the implementation of this law makes this aspect crystal clear. The other element made clear in the EM is that strict anti-avoidance measures and penalties will apply where these rules are misused.

Example 1

Your client has a pension account with investments valued at $2 million. Under the new $1.6 million TBC, $400,000 (20 per cent) must be either withdrawn or transferred into a taxable accumulation account.

One of the investments in pension phase is 1,000 shares CSL Limited bought for $66.55 on 30 June 2014 – cost base of $66,550. If the share price on 30 June 2017 is $110, the $110,000 market value of the shares includes an unrealised gain of $43,450 since acquisition.

As 20 per cent of the value of investments in pension phase must be either withdrawn or commuted back to accumulation phase, if the latter is chosen, then compensation is provided to deal with the fact that investments in accumulation phase are taxable. This compensation comes in the form of CGT relief where, if the client chooses the transfer option, they can elect to reset the cost base of the shares to their value on 30 June.

Using the CSL shares as part of the value of the investments commuted back to accumulation phase, with the market price of $110, resetting the cost price means that future gains attributable to these shares will be based on this price and not the original $66.55 (subject to any cost base adjustments CSL may subsequently receive, such as a return of capital).

If the client doesn’t reset the cost base and they sell the shares for $110 in the future, a net capital gain of $28,967 (being $43,450 net of the one-third CGT discount) arises. This is then adjusted for the portion that will still be ECPI, with a $5,793 taxable gain attributed to the 20 per cent accumulation account and $23,174 being a tax-free gain under the pension rules.

The taxable gain of $5,793 is added to the fund’s income for the financial year and taxed at 15 per cent. The bottom line is tax of $869.

Example 2

Your client has one SMSF with $1.6 million in pension phase on 30 June. He has a second SMSF with $1 million in pension phase that will be rolled back to accumulation phase.

Thus, where the investments in the second SMSF have a value greater than their original cost, their CGT cost base can be reset to the higher value which will be used to calculate any future CGT liability on assets in accumulation phase when the investments are sold. Importantly, the pension must cease on or before 30 June.

The decision to stop the pension must be minuted along with the date, as well the adjustments required in the fund’s financial records to document the commutation. Obviously, the fund must pay the required minimum annual pension payment up to the time it is commuted.

From 1 July 2017, the first SMSF will no longer be able to use the segregated method in determining its ECPI and will be required to use the proportionate method and obtain an actuarial certificate to determine the pension exempt factor. However, as this fund solely comprises a pension member, 100 per cent of the earnings and capital gains should be tax exempt.

Example 3

Claiming CGT relief can be more complex where a fund has two or more members.

Take an SMSF with a retired member with $2 million in pension phase and a second member, still working, with $1 million in accumulation phase.

Under the TBC, the pension must be reduced by $400,000 to $1.6 million by 30 June – resulting in the fund on 1 July having $1.6 million in pension phase and $1.4 million in accumulation phase.

By this date, the fund has the option of resetting the cost base of any assets and having the notional capital gain either included in its 2016-17 assessable income or deferred until the assets are actually sold. This applies to funds that operate on a pooled (unsegregated) basis where any taxable income is split in proportion to the value of a fund’s investments in pension and accumulation phases.

On 30 June, the market value of the SMSF’s sole asset, a commercial property, is $3 million. The cost base of this asset is $2.25 million and thus there is an unrealised capital gain of $750,000 before discounting and the ECPI adjustment.

If the trustee(s)/members elect to re-set the cost base on this asset, the resulting notional capital gain will be included in the fund’s assessable income in 2016-17. Alternatively, this notional gain can be deferred until the property is sold.

Choosing not to reset the cost base is an option for the trustees if they think it is likely the fund will have a higher proportion in pension phase when the property is sold. This could be because the second member is considering retiring in the next few years, which would have the effect of increasing the tax-exempt proportion of the fund. Withdrawing benefits from accumulation accounts may also achieve this.

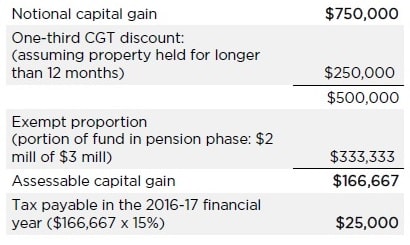

Here is a comparison of the tax position under each option:

Notional capital gain included in 2016-17 assessable income

The capital gain included in the fund’s assessable income for the 2016-17 financial year is:

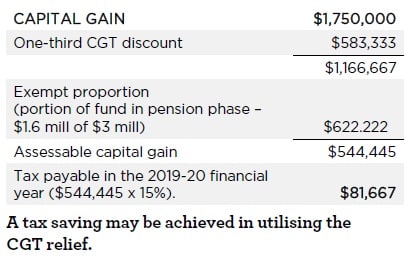

Notional capital gain deferred until asset is sold

Instead of paying tax in the 2016-17 financial year, the trustees may choose to defer the inclusion of the gain in the fund’s annual return until the asset is sold.

In June 2020, the property is sold for $4 million realising a capital gain of $1 million (from the rest cost base of $3 million). After applying the one-third CGT discount and the exempt proportion – say for simplicity 53 percent ($1.6 million/$3 million) – the fund calculates its net capital gain for the 2019-20 year of $313,333.

The fund adds its deferred capital gain of $166,667 to this net capital gain, bringing its total net capital gains for the 2019-20 income year to $480,000.

Thus, tax payable in the 2019-20 financial year is $72,000 ($480,000 x 15 per cent).

Election to reset cost base not taken

If the election to reset the cost base was not taken so that the cost base remained at $2.25 million on the property being sold for $4 million, the resulting tax position is:

Are you confident in providing this advice to your clients?

This opportunity is complex and must be addressed with your SMSF clients, sooner rather than later. The advice in most instances will be a combination of tax, super and investment advice that must be presented to clients as a statement of advice (SOA).

Areas of caution for accountants

- Does your Australian Financial Services Licence (AFSL) cover the extent of the advice your client requires? For example, if assets need to be rolled out of pension phase back into superannuation phase, which assets are better held in super and which in pension? It’s all about expected future returns so this is investment advice which is not generally covered by an accountant’s limited AFSL.

- Do you have the expertise and experience in house to provide this advice in a compliant SOA?

Questions to ask yourself when preparing the advice

- Is the advice directed to the SOA trustee or the individual members?

- Will this change depending on segregated or unsegregated assets?

- Will multiple SOAs need to be generated?

Don’t risk providing incomplete, incorrect or non-compliant advice to your valued clients.

By Colin Lewis, head of strategic advice and professional development and Catherine Chivers, manager – strategic advice, Perpetual Private

Thank you for this information. I have done much reading and are becoming increasingly confused.

1 I would like to clarify as to what is required to define using the segregated method.

You mention in example 2 that the monies for the accumulation account for post 1/7/17 are held in another SMSF.

Please confirm, is it a MUST that the accumulation assets be kept in an alternate SMSF to be called segregated, or can they simply be in the same SMSs but the accumlation and pension assets be segregated by being held in nominated distinct separate bank (and trading) accounts, and minuted as segregated.

We have a husband and wife SMSF. Both of our assets have been segregated from the outset -ie we each have 2x segregated Pensions (one for NCC funds and one for Concessional funds) and an accumulation account. We each have pensions over $1.6m each.

Can we continue our segregated pensions and accumulation accounts to be able to be deemed segregated method for your examples for post 1/7/17, or do we need to remove the accumulation assets and place these into a different SMSF fund to be able to call the accumlation and pension assets as segregated?

My understanding is that if the assets are segregated, then we can chose which assets we place in accumulation account and which assets we place in pension account, and thus these 2 accounts may grow at their own individual rates. In contrast, if they are not deemed as segregated accounts, then the ratio of pension and accumulation accounts will remain forever the ratio the actuary determines for accum/pension market values on the 1/7/17?

You mention in example 1 being the proportional method that “using the CSL shares as part of the value of the investments commuted back to accumulation phase’….. this appears to me that we can cherry pick what assets go into accumulation even in the non segregated ie proportional method ie we could chose to select the low growth assets such as cash for accumulation accounts, and select the high growth assets to place into pension accounts.

If having the pension and accum asset in the one SMSF means one must be proportional, does this mean:

1 that you add the sum of all the tax of both the accum and pension assets and then apply pro-rata figure of accum/pension ratios on 1/7/17? If so, then you need to have CGT relief for all assets that are in pension and accum, and your examples only talk about CGT relief for accum assets.

2 or, you get the tax of the defined assets you selected to go into the accum account. If so, then why get the pro rata discount as well?

I would value your clarification as you writings appear to differ from other advisors.

Thank you.