There are many Australians struggling to make ends meet. Some have yet to recover from the effects of the GFC. Others are struggling with mortgage repayments in the hot Sydney property market. And the rate of divorce seems to be rising, leaving individuals financially stretched.

As an SMSF practitioner, how can you offer assistance to clients who are struggling to meet immediate living expenses? We all hear about the ATO cracking down on early access to super benefits, but what is the legal way to accessing super before retirement for those clients going through a tough financial period?

There are two conditions of release that enable early access to super under strict, but not complicated conditions, to help relieve some of their financial stress. These two conditions are severe financial hardship and compassionate grounds.

Severe financial hardship

What does your client need to give you?

If your client has reached their preservation age plus 39 weeks:

Written evidence from a government department showing income support payments, dated no more than 21 days before the person’s application for release of their benefits showing:

- Thirty-nine weeks or more of cumulative government income support after attaining the relevant preservation age

- They were not gainfully employed part-time or full-time on the date of the application for the early release

- Proof they are unable to meet reasonable and immediate living expenses

If your client is younger than the above condition:

Written evidence from a government department showing income support payments, dated no more than 21 days before the person’s application for release of their benefits showing:

- Twenty-six weeks or more of continuous government income support and is still in receipt of these payments on the date of the letter

- Proof they are unable to meet reasonable and immediate living expenses

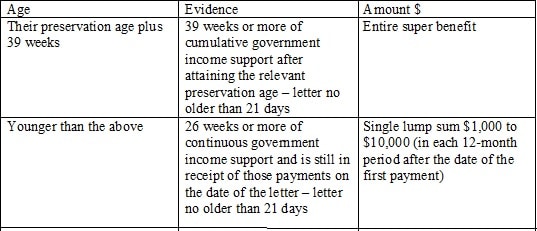

How much can your client take from super under this condition of release (cashing restriction)?

- If your client has reached their preservation age plus 39 weeks, their full super benefit can be accessed i.e. there is no cashing restriction

- If your client is younger than the above point, the member can – in each 12-month period from the date of the first payment – take a single lump sum no less than $1,000 but no more than $10,000

Summary of the severe financial hardship application requirements:

Your client’s preservation age depends on their date of birth and is available on the ATO website.

Compassionate grounds

What does your client need to give you?

Rather than the member applying to their own SMSF trustee for release of their benefits on compassionate grounds, they are required to apply to the Department of Health Services (DHS). There are limited circumstances where super benefits may be released for specified compassionate grounds and, as of 15 June 2015, there have been changes to the way you can apply for these. The application can now be completed online, but if you are unable to do this, the application can be mailed to the DHS with supporting documentation.

Eligibility:

Governed by SIS Reg 6.19A, a person may apply for release on the grounds that is required for:

- Medical treatment or transport

- Prevent bank foreclosure or sale of their principal place of residence

- Modify principal place of residence or vehicle for disability

- Palliative care expenses, death, funeral and burial costs

Depending on which ground the applicant is applying for, the DHS will need evidence to show the applicant doesn’t have financial capacity to meet the expenses, evidence from registered medical practitioners or the mortgagee detailing the financial situation. If the applicant is eligible for more than one ground, a separate application needs to be submitted for each ground. Visit www.humanservices.gov.au and enter early release of super to read more about eligibility and how to apply.

If your client receives a successful determination, your client must provide you with a letter from the DHS allowing the release of the benefits on compassionate grounds and the specified amount. This needs to be provided to the trustee of the SMSF to allow the withdrawal of the member’s benefits. The auditor of the SMSF will require this letter for the compulsory annual audit of the SMSF.

Please note, in Flanagan v APRA 2004, the federal court upheld the decision by APRA to reject a member’s application for early release on compassionate grounds because the applicant sought to extinguish child support payments on the grounds that his principal place of residence was threatened to be seized. The application failed on the basis that Reg 6.19A(1)(b) is limited to the case where a person is obliged to make a payment on a loan by a mortgagee and it also requires the applicant to provide written evidence from the mortgagee 6.19A(5) and (6). Flanagan’s principal place of residence did not have a mortgage on it and the debt he was trying to pay off was not a loan for which he could provide a mortgagee statement as required by Reg 6.19A.

Catherine Price, principal auditor, TABS Super Fund Auditors

Why can you only fix the problem once it’s become a problem? I would like to access my large SMSF cash portion to remove mortgage stress while I get a new job. My mortgage is $5000 per week – but why should I have to wait to actually be in default with the bank before I can access it. That is ridiculous. You will ruin a perfectly good AAA+ credit rating due to one simple lapse in time when cash could be available? Has anyone actually been allowed access early before registering a default with the bank?