According to research released by Roy Morgan, some 80 per cent of Australia’s total net household wealth is tied up in just two places: the family home, and superannuation. Since Australia’s last recession in the early 1990s, both have proved critical in building household wealth.

Property has been in a largely unstoppable bull market, with our residential housing market now worth just under $6 trillon on aggregate, whilst our superannuation system now has more than $2 trillion in assets, due to compulsory inflows as well as performance, with growth funds returning close to 8 per cent per annum since 1993.

The results are undeniably impressive, but we can’t help but wonder: are housing and super too big for our own good?

On the face of it, the question seems absurd. After all, property, at 50 per cent of total household wealth, underpins our status as the wealthiest nation on earth, according to the Credit Suisse Global Wealth Report for 2014. Meanwhile, our superannuation system is well respected internationally, typically earning a podium finish in the Mercer Global Pension Index.

Be that as it may, both distort our economy, and limit our future growth and prosperity in important ways.

How housing holds us back

Rising property prices have been a major contributor to the “wealth effect”, supporting discretionary spending, and have also helped spur home construction, though that is likely to peak in 2016.

The problem is that higher house prices have not been supported by wages, with the house price to household income ratio in Sydney for example rising from 3.4 in 1985 to 11.4 in 2015. Not surprisingly, this has led to an explosion in Australia’s household debt to disposable income ratio – from barely 50 per cent to over 175 per cent – in the past two decades.

Saving for a deposit has also never been harder, with LF Economics suggesting the average household now needs to save for 6 years to build a home deposit, compared with barely 3 years in the 1990s.

Of course, once a deposit is built and a property purchased, new home owners are left in fear of higher interest rates, especially as many are dedicating a higher portion of their income to mortgage repayments today compared with those who were buying property in the early 1990s, even though rates were circa 10 per cent higher back then.

That extra deposit money, as well as the large portions of income dedicated to interest and principal repayments, both represent a lost opportunity for Australia since they are funds that cannot be spent or invested elsewhere.

The problem with superannuation

Superannuation also holds back the country in important ways because it largely deprives would-be entrepreneurs and small business people of capital. Consider that with superannuation, we are effectively saying to an entire nation that from the day they start work until the day they retire, their largest financial asset will be “ring fenced”, and they will have no access to it.

Imagine an enterprising 35-year-old who may have built up $100K inside superannuation, which they would like to access so as to fund a new business initiative. In this country, they can’t do so; instead, they’ll be forced to use their money to bid up the price of pre-existing assets.

Thought of another way, entrepreneurial Australians cannot use their money to chase their own dreams because the system forces them to fund someone else’s pre-existing dream, be that shares in Commonwealth Bank or federal spending initiatives through ownership of Australian government bonds.

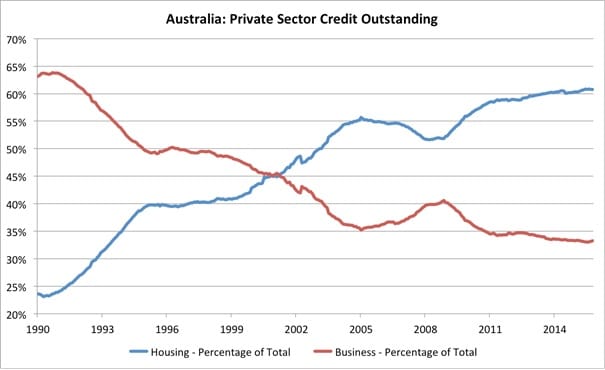

The lack of access to capital for entrepreneurs and small business people is especially relevant considering the preference of Australian financial institutions for funding housing rather than productive enterprise. Housing loans now make up more than 60 per cent of Australian private sector credit outstanding, versus barely 30 per cent for business loans. The evolution of this trend is seen in the following chart.

Source: RBA

How can new businesses ever get off the ground, or small businesses grow, if people can’t use their own capital to fund them, especially when our banks are increasingly reticent to do so?

Reality for everyday Australians

To reinforce why housing and super are now holding us back, it’s important to appreciate a few key facts regarding the finances of everyday Australians. As it stands right now:

• Australia’s savings rate is just 9 per cent. That includes compulsory superannuation of 9.5 per cent

• According to an ME Bank survey, fewer than 50 per cent of households are saving anything on a monthly basis, while those that are saw their average saving per month drop 15 per cent

• Australian wages are growing at just 2.3 per cent per annum, the lowest rate on record

• Australia’s household debt to GDP ratio is over 120 per cent, one of the highest rates in the world

• Cost of living pressures are real. Official inflation may be low, but price rises for the must haves (health care, education, insurance, transport) are running at 2 to 3 times the pace of overall CPI increases.

Is it any wonder that discretionary retail is struggling whilst the budget supermarkets of this world flourish, or that the sharing economy is growing, or that there has been a 15 per cent increase in the percentage of young Australians who choose to live at home since the GFC, or that businesses are struggling to increase sales and remain reticent to invest?

We for one do not think so.

In short, many Australians have never been more indebted, have wages that aren’t keeping up with the rising cost of living, and have little to no free savings that they can invest.

A vast majority of what wealth they do have is ring fenced into the roof over their head, which has never been more expensive to obtain or maintain, while their largest (if not only) financial asset is off limits until retirement.

This inhibits their ability to build their own business, or provide funding for those entrepreneurial Australians running the small businesses that are critical to our national prosperity.

Conclusion

This article is not advocating the end of compulsory superannuation, nor for a serious downturn in the value of Australian property.

If the ideas boom is to mean anything, and if our nation is to benefit from the opportunities our proximity to Asia offers us, then a much larger portion of our capital must find it way to productive enterprise and new business.

Jordan Eliseo, chief economist, ABC Bullion