Making sense of your new education requirements

As accountants come to terms with a raft of new regulatory requirements, it’s pertinent to take a comprehensive, step-by-step look at what their new education obligations entail.

If you’re an accountant who is confused about the initial training requirements to become licensed, you are in the majority. And with good reason. Did you know that:

• There are a range of licensing options available, each with different training needs?

• There are different (albeit overlapping) training requirements for responsible managers versus someone who is providing advice – and if you are a responsible manager who provides advice, you need to make sure you meet both requirements?

• Licensees can and do interpret the training requirements differently, depending on the scope of their authority, and whether they are imposing minimum, industry standard or above industry standard benchmarks on their advisers?

Add to that the reforms the government is proposing to financial planning education from July this year and it’s nothing short of a dog’s breakfast. For now, let’s look at the current state of play and try to make sense of it.

Initial education requirements (RG105 and RG146)

If you want to apply for a limited licence, you will need to select at least one (preferably more) people to become responsible managers for the licence. These responsible managers will need to provide ASIC with proof they have met the minimum training requirements, detailed in Regulatory Guide 105 (RG105) in their capacity as a responsible manager.

The responsible managers will then need to ensure Regulatory Guide 146 (RG146) training requirements have been met by anyone who will be authorised and providing advice under the licence – including themselves – and be able to provide proof to ASIC, should the firm be audited.

If you are intending to become an authorised representative, you only need to focus on RG146. That said, RG146 requirements are a licensee responsibility and can vary depending on who you choose to be licensed with, and what you want to be licensed for. The licensee may also require you to complete additional training over and above RG146. This is entirely their choice but is often done to ensure they only authorise advisers who have met higher education requirements than the minimum.

One of the most important aspects of RG146 for accountants is that the requirements are broken into a number of different specialist knowledge areas and not all courses address all knowledge areas. The most common specialist knowledge areas accountants will need compliance in are:

• Superannuation

• SMSFs

• Financial planning

• Life insurance

• Securities

• Managed investments

• Margin lending

The challenge, therefore, is to determine in which specialist knowledge area of RG146 you need to be compliant.

Responsible managers

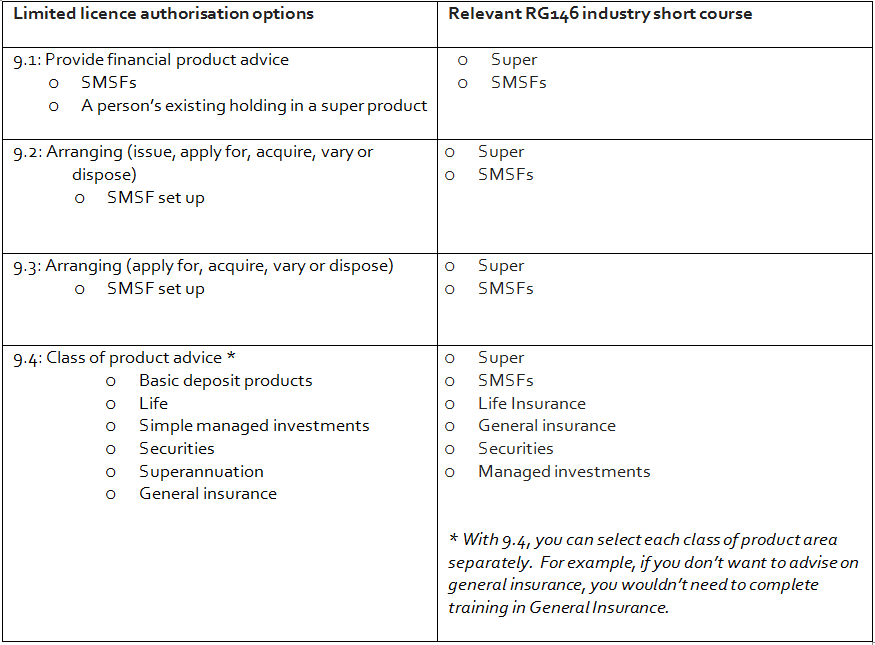

When applying for a Limited Licence, there are several authorisation options you can choose from. There are also a number of alternatives for meeting the initial training requirements. The most popular choice for accountants is Option 3 – which requires the person to hold a university degree in a relevant discipline and complete a relevant short industry course (ie, RG146).

Below is our understanding of the minimum RG146 training being sought by ASIC to meet the ‘relevant industry short course’ component for Option 3.

Advisers

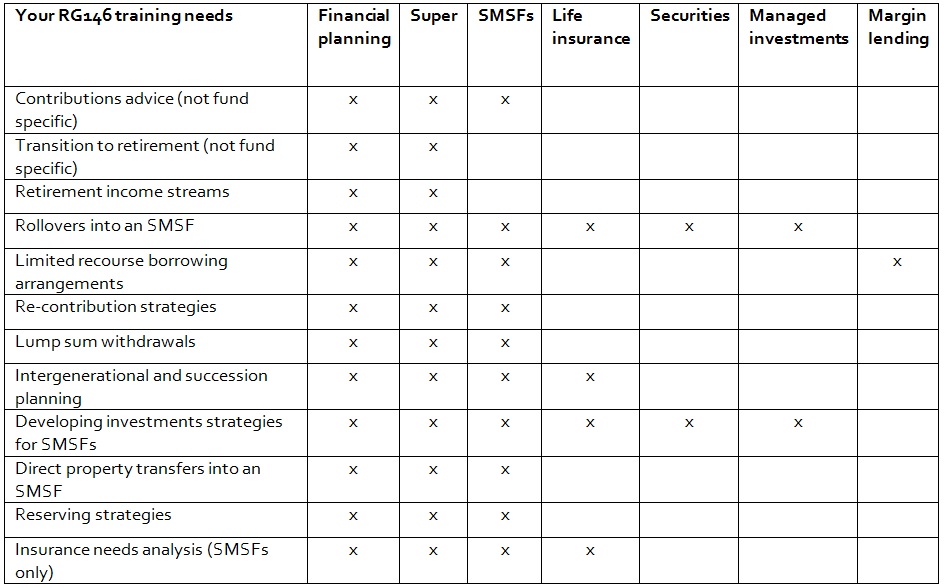

RG146 requires you to be appropriately trained in the areas in which you are providing advice. As there are many authorisations available, as well as different interpretations of what ‘appropriately trained’ means, there is no precise answer regarding an accountant’s initial education requirements.

However, after talking to a number of industry stakeholders including licensees, associations and industry consultants, we have compiled the following table outlining what is typically required. This also represents what Licensing for Accountants would recommend as a minimum for anyone providing advice in these respective areas.

Selecting a training provider

As mentioned above, there is no single course or training provider to meet everyone’s needs. Accountants should consider the following factors in making their selection:

• In which precise areas do you wish to give advice?

• Do you want to only meet the bare minimum requirements, comply with industry standards, or obtain a formal qualification?

• What is your preferred method of learning (distance or face to face)?

• If you've completed some training, are you just looking to fill in some training gaps?

• How much are you prepared to pay?

• Does the training provider have a good reputation and are they experienced in providing RG146-related education?

The answers to these questions should at least help get you started on navigating the licensing education maze.

Kath Bowler, chief executive, Licensing for Accountants