LRBAs and pensions: A risky balance

SMSF trustees are increasingly entering borrowing arrangements later in life and consequently failing to meet minimum pension requirements – the key to addressing these issues is implementing strategies as early as possible.

Since the introduction of the ability of SMSFs to borrow in order to purchase assets as part of a limited recourse borrowing arrangement (LRBA) under section 67A of the Superannuation Industry (Supervision) Act 1993, we have seen a proliferation of new SMSFs specifically to purchase residential investment properties.

Whether these investments have been made rightly or wrongly, there are significant issues facing advisers in assisting clients in implementing strategies for the impending retirement of members.

The issue was highlighted recently by Kasey MacFarlane, assistant commissioner, superannuation, in her speech to the CPA Australia SMSF conference. Among other things, she said that one of the issues they are seeing is the liquidity problems associated with real property exasperated for SMSFs in pension phase where the asset has been acquired under an LRBA. The issue surrounds the ability of the SMSF to meet the annual minimum pension payment requirements in order to be entitled to the applicable income tax exemptions under the eligible concession pension income (ECPI) provisions. The issues are not only important from the perspective of SMSFs but also for the individual member as they may be taken to have received a lump sum payment during the income year rather than the pension payment.

In this article, I seek to tease out some of the issues in relation to LRBAs and the payment or implementation of pension strategies when the sole asset is residential property. I will look at a brief case study to illustrate the question of liquidity and paying pensions.

Case study

In several of the SMSFs associated with LRBAs that we have seen, the member is at or approaching 50 years of age and has around $150,000 to $250,000 in super. Their ‘financial adviser’ has recommended they roll out of the current fund and establish an SMSF in order to purchase new residential real estate.

For the purpose of this case study, let’s make the following assumptions:

• Alan is 50 years old when he establishes an SMSF. He was born pre-1 July 1960. As such, his preservation age is 55.

• At that time, he had $250,000 in super.

• Alan is advised to roll that money into an SMSF and invest in a new residential property.

• The total cost of that property purchase is $500,000. Broken down as a $475,000 purchase price with stamp duty, legals and on-costs the remainder.

• Of the $475,000 purchase price, $40,000 is for fixtures and fittings; $235,000 for the building; and $200,000 for land. Assume an average depreciation rate of 20 per cent for fixtures and fittings and the 2.5 per cent per annum building allowance.

• Alan enters into an LRBA with a bank. The interest rate is 5.7 per cent per annum. For simplicity, I shall assume that it is interest-only, noting, however, that principal and interest may lead to greater cash outflows.

• Alan’s salary is $100,000 per year and he contributes $12,000, including SGC and salary sacrifice.

• Rental yield on the property is 3 per cent and costs associated with holding and maintaining the property, including rates, agent’s fees, repairs etc. are $3,500 per year. These are assumed to rise to $4,500 when Alan is 55 and to $5,000 when he is 60 years old.

• Each year, any additional cash flow is used to reduce the LRBA.

• Annual compliance costs and fund administration are $5,000.

• When Alan reaches age 55, the property is valued at $525,000 and when he is 60 its value is $575,000.

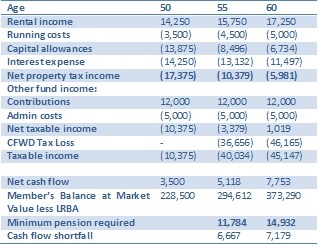

In accordance with the above assumptions, the following estimated cash flows arise. The cash flows are calculated at year one, when he was 50; when he is 55 and may wish to start a transition to retirement income stream (TTRIS); and when he is 60, looking to start a tax-free pension.

As can be seen from the above, should Alan wish to commence a TTRIS at age 55, there will be a funding shortfall of $6,667 per annum for his minimum pension payment. Further, the fund would have carried forward tax losses in the order of $40,034. Thus, the ability to pay a TTRIS is not possible. Even if it were, the potential that the carry forward tax losses are unutilised may mean that this strategy is not viable in any event.

Should Alan wish to switch on a tax-free pension from the age of 60, there is still a cash flow shortfall of $7,179 per annum. This makes it very difficult to move into pension phase, providing Alan with little option but to keep working for the foreseeable future. It is also worth noting that based on the above assumptions, this will be the first year that the fund generates taxable income in order to offset some of the tax losses carried forward. By the time Alan turns 60, the carried forward tax losses are around $45,000.

Possible strategies to get the SMSF into a position to pay pensions

There are a number of strategies to consider in improving the SMSF’s liquidity and net asset position in the lead-up to paying pensions. However, not all strategies will be successful and thus some SMSFs may have no alternative but to sell the underlying asset and unwind the LRBA in order to fund a pension.

This, in turn, calls into question the whole viability of the SMSF and may lead to its complete wind-up.

In general, strategies to consider may include:

• Increasing concessional contributions to the SMSF. In the example above, Alan is only contributing $12,000 whereas his concessional limit is $35,000. Thus, increasing his deductible superannuation contributions has the potential to save significant tax outside of super and soak up the tax losses generated within the SMSF that the property investment and LRBA are generating.

Based upon the assumptions above, if Alan were to lift his contributions to $35,000 per annum, the net cash flow to the fund would be in the order of $30,000 positive at age 55. This would generate sufficient funds to pay an estimated minimum pension of $16,338. Further, at age 60, the LRBA would be completely paid out and the SMSF is generating a positive cash flow in the order of $39,000. Again, this would be sufficient to make a minimum pension payment calculated at just over $25,000.

However, Alan may have personal budgetary constraints that restrict him from contributing more to super. For example, he may have a significant mortgage on his home and/or be funding children’s education. Consequently, this may not be possible for all clients.

• Making non-concessional contributions in order to reduce the LRBA debt. Again, whilst this may improve the liquidity of the SMSF, the ability to make such contribution with after-tax money would generally be limited.

• Taking other members into the fund. An SMSF can have up to four members. Thus, if Alan has a spouse with a superannuation balance, they could consider rolling that balance into the SMSF. This may assist in improving the liquidity of the fund.

However, in a lot of circumstances the spouse may not wish to transfer out of their current fund. They may see it as a better performing asset or as a way of diversifying risk from the single asset in the SMSF.

Further, care needs to be taken if Alan is looking to take on other members such as his children. This may reduce one of the major benefits that SMSF has in Alan being in control of its investments. Further, should his children go off the rails or end up in a marital dispute, the SMSF may be restricted in its ability to make effective decisions.

• If all else fails, and the member needs to access the pension, the SMSF may be in a position where it is forced to sell the property. This will obviously incur transactional costs and possible penalties from the bank on the LRBA. Further, the ability to cash in the asset, its value and timing are all at the mercy of the market. Thus, this requires careful planning and implementation well before the pension is required.

Other options may be available; however, the overarching rule is that careful planning and implementation are required to ensure that the appropriate retirement strategy can be implemented.

Conclusion

The proliferation of SMSFs invested in single asset residential property investments funded via LRBAs means that most SMSF advisers will come across these arrangements at some stage. Consequently, putting strategies in place to better prepare the SMSF so it is able to pay pensions should be addressed as soon as possible.

The fact that the ATO has now highlighted this issue only adds to the urgency with which advisers should act.

Damien Butler, principal, Butler Chartered Accountants