Some history

The last significant change to the rules concerning preservation of benefits in superannuation occurred on 1 July 1999.

The 1 July 1999 changes basically directed that what were then referred to as deductible contributions, such as self-employed contributions and voluntary employer contributions (i.e. salary sacrifice contributions), and what are now considered to be non-concessional contributions, would be treated as preserved benefits.

Prior to 1 July 1999, most of the preserved benefits were derived from mandated contributions (i.e. superannuation guarantee contributions) only.

The current situation

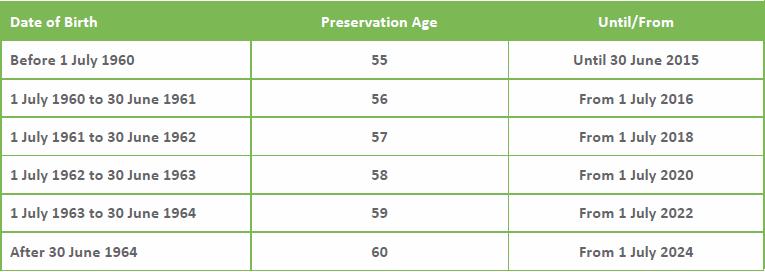

That amending legislation also introduced a timeframe for an increase in the preservation age which, in 1999, seemed so far into the future as to not be of any concern.

However, we are now almost at that point in the future. The preservation age timeframe, based on the date of birth of a superannuation member, is set out in the schedule below.

What is the impact?

On 1 July 2015, the preservation age for new ‘entrants’ will effectively become 56 years of age.

Interestingly, no one will reach their preservation age in the year 1 July 2015 to 30 June 2016 (i.e. 1 July 1960 plus 56 years equals 1 July 2016).

That same situation will then apply every second year until 1 July 2024 (subject to there being no legislative changes in the meantime).

Why the extra focus?

Until 30 June 2015, advisers basically need to continue to ensure a client has reached 55 years of age, after which they may access their superannuation by:

– meeting a full condition of release as a result of having permanently retired from employment; or

– commence a transition to retirement income stream.

From 1 July 2015, that will change since not all 55-year-olds will have reached their preservation age.

In other words, those turning 55 after 1 July 2015 will need to wait until 1 July 2016 before reaching their preservation age, and so on, for the years set out in the table above.

For advisers, therefore, consideration of the ages of clients takes on greater meaning post-1 July 2015.

How can it go wrong?

Consider, for a moment, the situation where an adviser recommends to an individual that they commence a transition to retirement income stream once they turn 55 years of age on 1 August 2015.

The advice would have been sound if the individual had turned 55 on or before 30 June 2015 but, by forgetting the impact of the change, the adviser may have inadvertently caused the fund to breach both superannuation and taxation legislation, resulting in potentially significant penalties for early access to superannuation.

What else will change?

The age increase relates only to the timing of preservation and access to superannuation after reaching preservation age.

The age of 55 has also been applied to other actions relevant to superannuation – for instance the capital gains tax small business concessions whereby an individual:

– may be eligible for the CGT small business 15-year exemption if they have retired after reaching age 55, and they may utilise the CGT cap amount to contribute the proceeds to superannuation; or

– may be entitled to claim the small business retirement exemption and, if aged less than 55, must roll the amount of capital gain disregarded into superannuation (and may do so if aged 55 or more).

The age of 55 has not changed for those entitlements; the only change is to the age at which preservation of superannuation benefits can be lifted, through the meeting of specific conditions of release.

Does that apply to someone who is already 55?

No. If an individual is already aged 55 at 1 July 2015, but has neither met a full condition of release nor commenced a transition to retirement income stream, their preservation age will remain 55, regardless of when they eventually access their superannuation.

Conclusion

Advisers and trustees now have another aspect to consider when advising clients in the age range of 55 to 60, in respect to their ability to access their superannuation.

Care needs to be taken to ensure they are not incorrect in their advice.

Michael Harkin, national manager for training and advice, Topdocs