Last month, social services minister Scott Morrison called upon pensioners to “use up” their super balances during their lifetimes rather than hanging on to it to provide a tax-effective inheritance to the next generation.

While the government has now indicated that it does not propose to make any change to increase pension drawdown rates for the time being, it is worth considering the general point he was making at the time.

To the extent that we have a shared understanding of the purpose of super (and I’d argue there’s work to be done on this!), there would probably be broad agreement that it’s not supposed to be an estate planning vehicle.

So are people who don’t spend their super during their lifetime being deliberately annoying or breaking the rules in some way?

Why do people end up still having so much in super when they die?

One reason is simple mathematics.

The minimum drawdown rates for account-based pensions are simply not designed to make super run out very quickly.

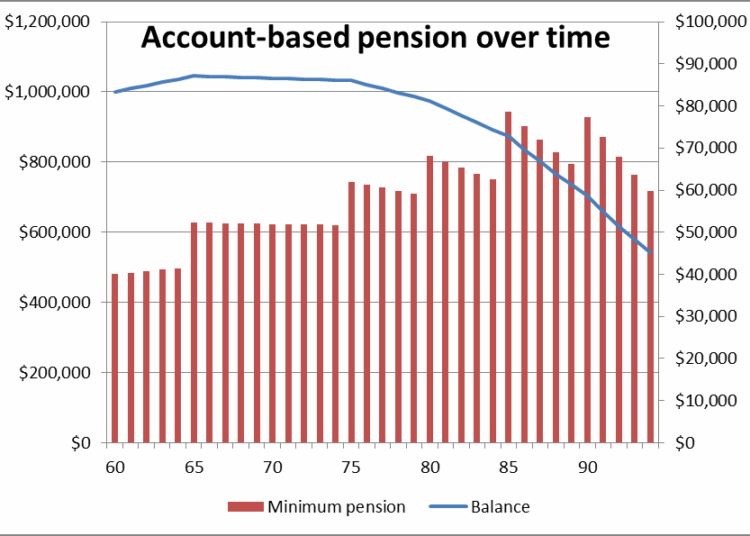

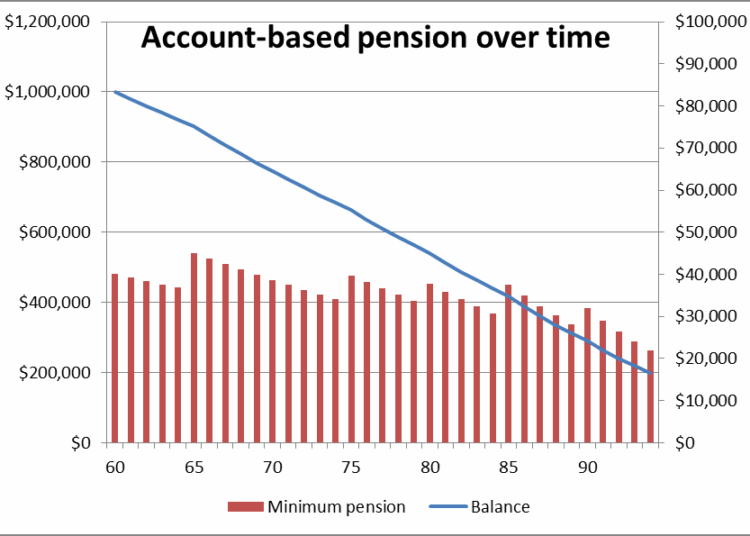

The graph below shows how the balance of an account-based pension would change over time (the blue line, graphed against the left hand axis) if the client started with $1 million, achieved investment earnings of 5 per cent per annum and always took the minimum pension possible (red bars, graphed against the right hand axis).

Despite following all the rules, the client would have more than $500,000 (50 per cent) of their original capital left some 30 years later.

Of course, $500,000 in 30 years’ time will be worth a lot less than $500,000 today! But even if we adjust the figures to allow for inflation, it will be over 20 years before the pensioner has used up more than 50 per cent of their capital.

So it’s not surprising that clients could have significant sums left in super when they die.

But there’s perhaps an even more important point that these figures don’t show.

Until 2007, it was compulsory to start drawing super at some point – generally at 65 or slightly later for those still working. Importantly, though, super had to come out some time (it was called ‘compulsory cashing’).

For some reason that requirement was quietly dropped as part of the 2007 changes to super. I have no idea why. It means that those with very substantial wealth can (and do) just leave their super accumulating indefinitely. They don’t start a pension because that would mean allowing some of their wealth to leave the most concessionally taxed environment available.

While starting a pension might lower the tax paid on investment income in the fund to nil per cent, even the ‘accumulation fund’ rate of 15 per cent is pretty good when the alternative is personal or company rates of tax.

The biggest issue they face is dying with a large taxable component – at which point there is a risk their children will face a 15 per cent (plus Medicare) tax on the capital they inherit. (And while 15 per cent on income doesn’t sound like much, 15 per cent on capital hurts.) But even that is manageable – many were able to organise their super well enough around 2007 to maximise their tax-free component so this 15 per cent tax on death has little impact. Others are just careful to make sure they withdraw large sums once they reached a very advanced age (in the extreme, just before death).

I’d suggest we review whether it is appropriate to have dropped compulsory cashing before we worry too much about adjusting account-based pension drawdown factors.

Meg Heffron, head of customer, Heffron SMSF Solutions

I also think that there is some confusion that retirees who live on less than the minimum drawdowns have to spend the extra money. Super was never mean to be a tax-advantaged structure for your entire life (assuming you lived that long), which is why the minimums start to jack up after a period of time.

Clients dont have to spend the money. All it is is shifting money from one account to another, from inside super to outside super. I tell clients they have options, they can spend it, they can simple save it and invest outside super, they can give it to the kids as an early inheritance or they can use it for causes or charities that are important to them.

There are some great comments below however, with respect, I think Senator Scott Morrison is drawing the wrong conclusion.

Retirees passing away with an existing superannuation balance can be seen as a success indicator for superannuation policy. It shows retirees are taking responsibility for funding their own retirement and reducing their need for pension payments. This is precisely what the government and superannuation policy claims to encourage not to increase to the number of people with nil superannuation balances and increased pension payments.

What superannuation policy makers could measure and comment on, is the number of retirees who pass away with a NIL superannuation balance. Any increase in these numbers indicates an increased need for government funded pension payments (and also indicates a failure of superannuation policy and/or a failure of retirement planning).

Nice to have a blog with everyone in violent agreement for a change.

When discussing asset allocation and risk I often put to clients, “as you are comfortably funded, do you wish to pursue a strategy where you die wealthier and your kids get more money or, we never have to have a conversation about cutting your pension and income as the market has hit you hard”.

I have completely lost count how many times I have posed that q, NEVER once has the client opted for the wealthier children.

Like many things regarding “common wisdom” esp in Canberra and the media, super as driving factor for estate planning is not one of them.

An issue yes, destroying the super system integrity – not even close.

I totally agree with comments from Wildcat and Greg

I am 71 and I will draw down my own hard saved Super that suits my own lifestye.

Should my chidren inherit the balance of my super and pay 15% tax, so be it

Rather that,than running down your Super to zero and then be dependent on your chidren for support.

Most of the todays politicians and Governments will be on the political scrap heap long before my Super runs out !

Scott Morrison’s contention that super is being exploited for estate planning purposes doesn’t seem realistic in my experience. The primary concern for the majority of my retiree clients is their own retirement income, anything left for the kids is a nice bonus – what does it matter whether it is in their super fund or in a bank term deposit, there is no less tax to pay by paying a super death benefit (probably more assuming kids have reached adulthood and financial independence). Sure, a lucky few will have more capital than they could ever hope to spend and are getting a bit of a free kick with low tax in super, but that is far from the average punter.

Similar to Andrew, as an experienced financial planner I would like to see my clients have the opportunity to plan financially for a longer than statistically average life, half of them will achieve it. Minimum ABPs should be reduced for older people, rather than forcing them to draw more and more of their capital. If they have flexibility to manage their money sensibly (rather than being encouraged to spend it faster) and provide a reasonable income over a long life, they may have less reliance on state pensions in those later years and a reasonable chance of maintaining a lifestyle better than just the subsistence level of existence afforded by the Age Pension. Meg, I really dont see any advantage to re-introducing compulsory cashing and can only see this adding to the widespread concern about meddling with super rules.

Some really spot on comments here – in my view, SMSF trustees live longer than the “norm” (wasn’t there an article on that recently?), err on the side of caution when it comes to making sure they have enough for good and while they do often want to pass an inheritance to their children, that’s not necessarily the strongest driver for the rate at which they draw down their super. They’re just smart and will do whatever makes the most sense for them and their family.

Greg you are not incorrect but there is more. If you are a couple in your in your sixties you have a 1 in two or three chance of one of you hitting your mid nineties. So now we are out to 30 plus years.

Add to that improved medicine, pharmacy, lifestyle and collapsing smoking rates the ‘long’ side tail risk grows even more.

We have been planning to 100 for the youngest for every client for over 10 years for this reason.

Other than longevity risk, if this colossal mountain of global debt ever gets repaid, rather than defaulted, the sleeping bear of inflation will return at some point in this time as well.

If it does better hope you have dry powder ‘excess capital’ to help protect your clients as well.

Never listen to a politician, they are short termist idiots.

Good points Andrew noting age also makes you risk-aware.

Retiring at age 60, life expectancy gives me another 27 years to live. If I do live that long, the history of the previous 27 years (GFC, Tech crash and 87 crash) suggest my financial planning should allow for several share market crashes in my lifetime. If I am lucky and live past the median point, I should allow for “more”.

How do I mitigate risk – make sure I have some financial reserves available when things “go wrong”. In short, don’t spend your entire super balance.

Nice article Meg.

I can also add some other ideas based on my 20 year career as a financial planner. I found that many clients are inherently smart about risk. Perhaps because retirees are by definition “older ” they have life experiences that taught them to never think everything will work out well, that health will eventually cost you , that you can’t trust others to look after you etc etc . Such risk aversion , coupled with their low risk capacity supports them being frugal . It’s not tax planning ! it’s concern about their last days and when they are going to have them.

We all know life expectancy tables are statistically correct but likely irrelevant to an individual so it’s sensible for people not tospeculate on a defined death but to provide for a hoped life….right up to the end.

Knowing when we will die and knowing future investment returns would make spending super balances easy.

Not knowing these, there are many issues

– while the projections shows an average retiree having their starting balance at age of approx 75 years, the very nature of an average is that approximately HALF of retirees will then have a balance significantly less than they started with.

– many SMSF’s are run by couple and to have a high confidence of funds lasting until the death of the last remaining member, you need to have funds last until an age approaching high 90’s and you need to worry that your returns may be less than average.

– there is no allowance for risks such as legislative, lifestyle, medical risks which may consume pension capital.

I.e.projections of average returns for average lifetimes, ignoring couples and ignoring risk events are optimistic for many and likely to have a poor match with what many retirees will experience.

They also want them to last as long as they live and they are living longer. My Father was very upset when told that his allocated pension fund will run out by the time he hits 90 years (currently 88years. My reminding him that they are designed to run out did not help either. The new “Simple Account Based Pensions:” seem to last longer than the old allocated pensions – good or bad??

What do you expect with Politicians chopping and changing the rules every 5 minutes! The only alternative it to take out large life policies with level premiums to repay the funds foregone, I don’t see any politician spending all there super in retirement or their spouses. They need to lead by example if they have the guts but I won

t be holding my breath.