The main fundamental benefit of SMSF loans is that they allow a borrower to invest directly in residential or commercial property using funds accumulated in their Super.

There are also some lucrative tax advantages: interest and borrowing expenses are generally tax deductible, which greatly reduces the Superannuation tax payable within the fund.

Investing in commercial property using your SMSF

Commercial property isn’t as strictly regulated as residential property, which makes it an attractive addition to your SMSF investment strategy.

Commercial property within SMSFs can be owner occupied (unlike residential SMSF). This is known as ‘business real property’ meaning land and buildings used wholly and exclusively by your business. If your SMSF owns your business real property, your business then pays rent direct to your SMSF. However, this must be at the market rate (usually assessed and issued by the lender’s valuer).

Owning the commercial business freehold/premises within the SMSF creates great advantages & incentives, such as the ability for SMSF trustees to make ‘in specie’ contributions. Meaning, that a member can transfer their existing ownership (whether held in personal name or trust structure) of an asset to their SMSF.

If your business premises (freehold) are held within an SMSF, they are subject to asset protection, which means the asset is protected against future claims or liabilities that could result from operating your business. In essence, if the trading business ceases trading due to insolvency, bankruptcy or other enforceable measures, the commercial property cannot be claimed upon.

Refinancing your existing SMSF Loan

Refinancing your SMSF loan – similar to refinancing any other loan – also allows significant opportunities with reducing your applicable interest rate and accessing product terms which can be up to 30 years. No cash out is allowed, though which means the lending must be dollar for dollar e.g, $500,000 SMSF loan, refinanced to another institution results in maximum new borrowings of $500,000. When it comes to refinancing, many lenders have strict requirements so reach out to your broker if you’re keen to sense check your existing rate.

Check your rate with SMSFr8

Get an idea of what your SMSF loan rate could be using SMSFr8. Answer a few simple questions about your scenario and receive an obligation-free estimate on the sharpest rate for either commercial or residential property.

SMSFr8 can help you start the SMSF loan journey or be a sounding board for your existing SMSF rate.

How Blue Crane Capital can help you secure an SMSF loan

At Blue Crane Capital, with our wider team experience in commercial banking, we understand commercial property finance better than anyone.

Whether owner occupied or investment, for purchase and refinance in SMSF, we have been recognised as the industry leaders in arranging SMSF property loans for the past five years.

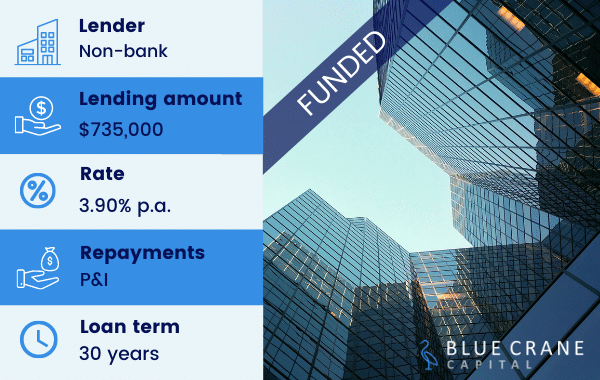

We recently helped a client of ours purchase a commercial investment property within their SMSF. They had approximately $750,000 accumulated cash and liquid assets within their superannuation. We were able to help them get a loan for $735,000 through a non-bank lender with an interest rate of 3.90% p.a.

If you’re interested in learning more about using your SMSF as an investment vehicle, reach out to the Blue Crane team today.