The psychology of money to better serve clients – client behaviour stories from Behavioural Economist, Morgan Housel

Promoted by BT Financial Group

Grace Groner was orphaned as a child, never married or had children and never worked. But on her death in 2010 she left $7 million to charity.

Over her life, she squirrelled away her money, invested in the stock market and patiently allowed her assets to compound for more than 70 years.

Successful Wall Street executive Richard Fuscone had a very different background. Educated at Harvard University and the University of Chicago, he quickly became wildly successful and retired in his 40s to pursue personal and charitable interests.

But his assets were highly leveraged and the financial crisis of 2008 wiped him out. “The only source of liquidity is whatever my wife is able to sell in terms of personal furnishings,” he told a judge after filing for bankruptcy.

These stories demonstrate successful investing requires more than knowledge of financial markets. It involves insight into how people behave with money. Importantly, understanding behaviour is not about formulas or spreadsheets. It is innate, varies from person to person, is hard to measure and changes over time.

The nexus of behaviour and wealth

People’s view of the world is anchored to their life experiences. So there’s no one-size-fits-all investing approach, or even viewpoint.

Someone who grows up in an economy of high unemployment, high inflation and rough market conditions will approach life with a different view to someone who grew up in uninterrupted prosperity. They will view risk, goals, and the prospect of future growth through different lenses.

So better financial plans consider not only the client’s future, but also their past experiences. There’s less focus on what the market might do, and more emphasis on how clients react when the market moves. It’s an approach critical to maintaining long-term trust and helping clients adhere to their plan.

Rethinking skills that promote good investing results

The behavioural approach to building a financial plan requires a shift away from skills and intelligence in favour of good wealth-building behaviours. Grace Groner and Richard Fuscone’s examples show how this works.

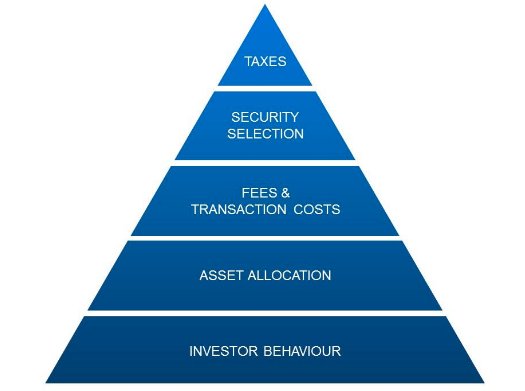

Every investor has a hierarchy of needs, which must each be met. Richard was able to meet the needs at the top of the pyramid, but failed to negotiate the blocks at the bottom of the structure. In contrast, Grace mastered the bottom blocks so well the top blocks were hardly necessary. This is a powerful lesson for advisers when working with clients.

Focusing on long-term mindsets, managing your relationship with greed and fear, understanding the historical frequency of market declines and planning with room for error are essential factors when building a financial plan – but they are also easy to discount.

Emotions can override any level of intelligence. As a result, little matters in investing until advisers and clients develop a firm grasp of the behavioural side of investing, and understand the psychology of money. That’s the best way to build a fruitful relationship between advisers and clients and long-term wealth over time.

Wall Street Journal columnist and Behavioural Economist, Morgan Housel uses history, psychology, and recent business trends to tell stories about how investors, economists, and business leaders go astray, and what they can do to overcome their own biases and pitfalls.

BTNext 2018 offers a unique opportunity to hear from Morgan Housel, “How Understanding Your Clients’ Behaviour Can Grow Your Business” at events taking part in Sydney, Melbourne, Brisbane, Adelaide and Perth between August 20th and 24th 2018. Register at www.bt.com.au/btnext