Australian investors are demanding stable income from their fixed income investments and with standard term deposit rates declining, many investors are hunting for solutions that complement their current mix of income investments that do not place their capital at unnecessary risk.

For investors seeking certainty their capital will be preserved safely, provide mitigation of investment risk whilst delivering a predictable income stream, term deposits have typically been the popular choice. Yet while they form an essential part of every investor’s portfolio, their current low interest rates make their yield a little unappealing.

Bonds provide another popular defensive asset class offering a similar proposition –income from coupons paid at agreed intervals and repayment of face value at maturity. There are generally several types of bonds available, however two distinctive types – fixed rate and floating rate – each deliveringa slightly different yield outcome based on market conditions.

Let’s compare the two?

Hunting for higher returns

Yield can be defined as the expected return on an investment. For term deposits this is the interest rate, which is fixed for a specified term.

Bonds are issued by companies or governments to raise capital –investors effectively ‘lend’ money to them and in return they promise to pay regular interest (a ‘coupon’). Once the bond matures they must return the face value to the investor.

This means the yield can be measured as the interest rate paid to the investor. Yet as bonds can also be traded on a secondary market, i.e. Australian Stock Exchange (ASX) or over the counter via a fixed interest broker (non-ASX), their capital prices can fluctuate providing an investor with the potential for additional yield through capital gains or capital loss if sold prior to the bond maturing.

Bonds therefore may be slightly riskier than term deposits, tending to offer higher interest returns. However, there are much wider variations on yield between government and corporate bonds reflected in the perceived higher risk of a corporate bond investment. As well as gaining potentially higher returns, bonds may provide longer-term income certainty dependant on market conditions and bond type.

Assurance of Capital

Term deposits are protected by the government guarantee on amounts up to $250,000 with any one Approved Deposit-taking Institution (ADI) and as such are the safest investment you can make.

Depending on the bond type, they can be classed as senior secured or unsecured, or subordinated debt, which places them high up in a bank/ corporate capital structure. Simply this ensures bond investors are prioritised over equity or hybrid investors if the issuer becomes insolvent.

As a result, there is a strong degree of certainty investors will receive the bond face value back at the maturity date. If a bond issue carries a higher risk of running into financial difficulties, investors should expect a higher “coupon” or “rate of return”.

When comparing hybrids with bonds, risk and payment rank need to be taken into account. This is why many investors place hybrids into the equities bucket, as hybrids can convert into equity if APRA believes a bank is underperforming.

Liquidity

Once invested in a term deposit,capital is locked away for a fixed period. If the investor wants to access funds early there’s usually a 31day notice period, maybe a fee payable and loss of interest – however the capital is never placed at risk.

Bonds are liquid and, similar to equities, are bought and sold at the market price. When interest rates are low or falling, a fixed coupon bond value may increase on the secondary market – with the cost of trading lower.Conversely if interest rates are rising, a fixed coupon bond value may decrease on the secondary market with the subsequent change to trading costs. Floating rate notes (FRN) which maintain a margin over a benchmark may provide a solution in times of interest rate volatility.

In general, newly issued bonds offer greater potential for price appreciation and better liquidity.

Diversification

Investors may view term deposit choice limited to ADI and interest rate. With bonds, investing is through a wider range of issuers– from local corporations to international conglomerates – resulting in a greater investment universe than ASX-listed debt securities.

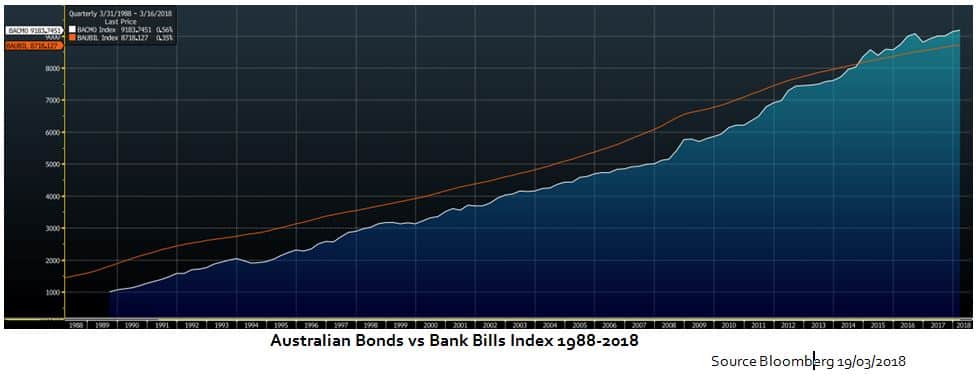

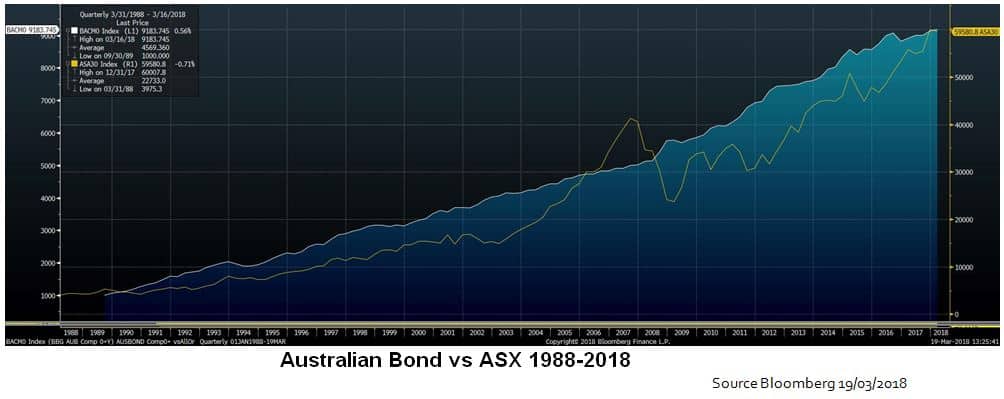

In general, when equities underperform, bonds outperform – basically when markets are unpredictable bonds appear more attractive to investors. In fact, corporate bonds and Australian equities often move in opposite directions. Therefore,investing in bonds may also assist to mitigate risks in an equities portfolio.

Further, of the two main bond types – fixed rate and floating rate – credit quality varies widely, so prospective bond investors should consider focusing on total portfolio risk through a diversified strategy and investors could potentially achieve higher overall returns.

However, following the GFC, ASIC has prevented disclosure of credit ratings to retail investors thereby reducing the knowledge of, and investment in bonds as an important slice in a diversified portfolio (1). Financial advisers are likely to have access to credit ratings, so can provide this added value to their clients with opportunities for investment.

While bonds are issued as fixed rate and floating-rate notes, some investors may choose to diversify their bond portfolio to include a mix of both. Also available are bonds where the floating rate coupon is based on variable interest linked to a benchmark or the Bank Bill Swap Rate (BBSW).The BBSW can be described at the short term money market benchmark interest rate and is available daily from the ASX. It provides reference interest rates for the pricing and revaluation of derivatives and securities such as floating rate notes.

Both bonds and term deposits provide control over the length of the term such that bond maturity dates or deposit terms can release capital at specified times to link to investment goals/ liabilities.

Accessibility

Bonds can sometimes be restrictive in that they can only be issued to wholesale investorsie those who satisfy specific financial criteria as certified by an Accountant.

A Strategy Consideration

Both term deposits and bonds offer a solution for investors searching for capital security and reliability of income. Investors with shorter time frames of less than 12 months, term deposits are a low maintenance, risk-free way for a fair return on investments. And whilst term deposits are available for terms up to 5 years, those with longer investing time horizons may also consider bonds within a diversified investment portfolio to offer higher yields and significantly lower volatility than equities.

(1) http://download.asic.gov.au/media/1338926/INFO99_CreditRatings.pdf