CFDs and SMSFs: What You Need to Know

CFDs are used by many trustees for SMSF investment. But there are some things to bear in mind before adding CFDs to an SMSF investment strategy.

Disclaimer: This post contains only general information and does not offer financial or investment advice of any sort.

An SMSF can use a number of different investment instruments and strategies to accumulate money ahead of retirement. One possible strategy involves CFD trading, potentially profiting from both upwards and downwards movements in financial markets.

However, CFDs always feature an element of risk, and there are restrictions. Before you incorporate CFDs into your own SMSF strategy, there are some things to consider.

What is CFD Trading?

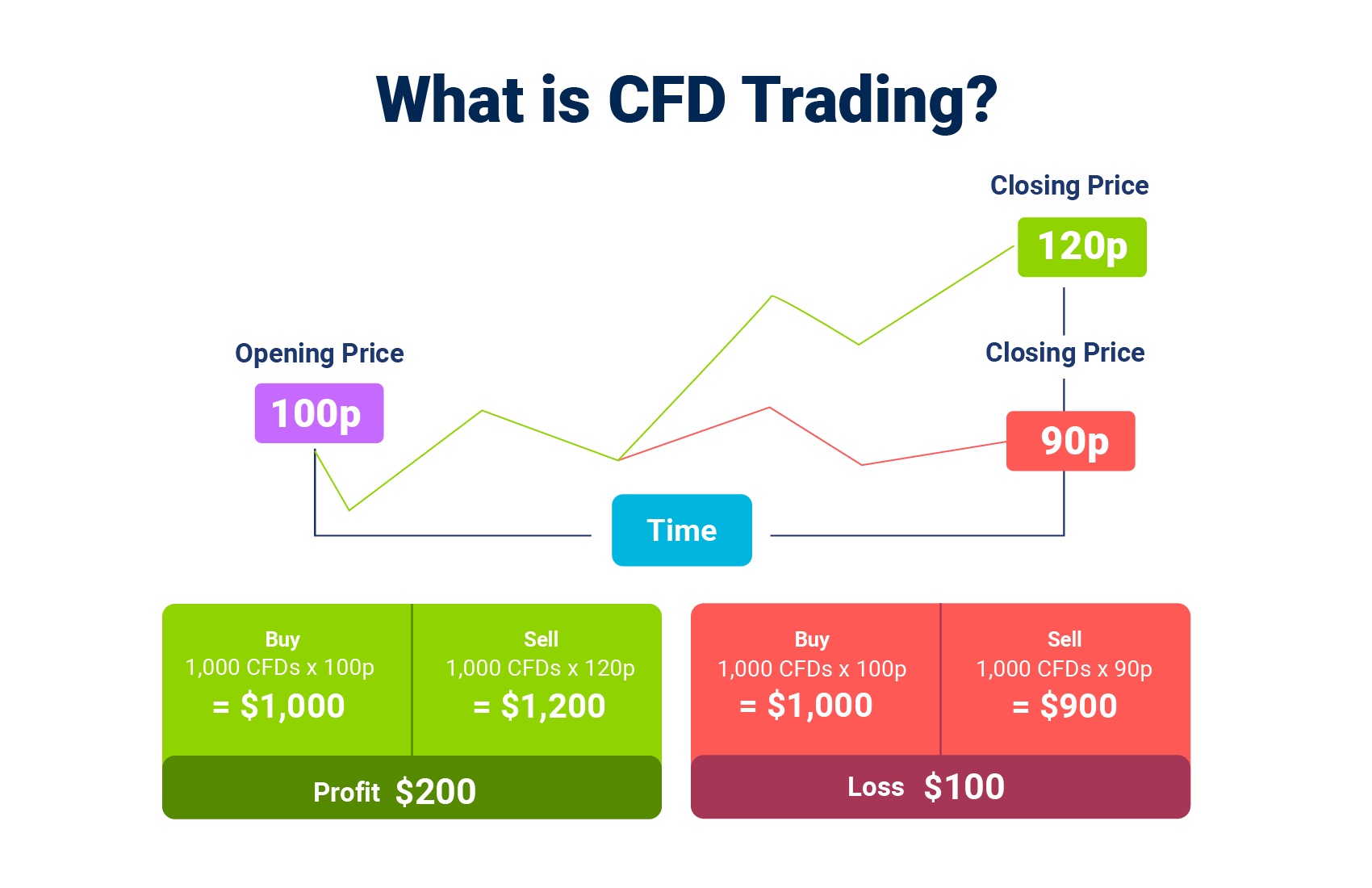

CFD trading refers to contract for difference trading. This is a way to speculate on financial markets without ever actually owning any underlying assets.

To trade a CFD, you’d first choose an instrument. Forex pairs, stocks and indices are common CFD instruments. Then you decide whether you think its value will increase or decrease, and open your position accordingly.

If your prediction was right, you will make a profit. If you made the wrong prediction, you will incur a loss.

CompareForexBrokers founder Justin Grossbard explains more:

“CFDs always carry an element of risk, so I understand why some SMSF trustees are a little hesitant to use them,” Justin said.

“However, with the right approach to risk management, CFD trading can be profitable. Many SMSF trustees do use CFDs as part of their strategy, but it’s best to proceed with caution.”

CFDs as Part of an SMSF

CFDs as Part of an SMSF

If SMSF trustees are considering a CFD investment, there are a few things to consider.

SMSF Trustees Can Invest in CFDs

The trustee of an SMSF may be able to invest in CFDs. Neither the Superannuation Industry Supervision Act 1993 (SISA) nor the Superannuation Industry Supervision Regulation 1994 (SISR) forbid this. However, this doesn’t mean SMSF trustees can always invest in CFDs.

SMSF CFDs Must Not Contravene SISA and SISR

There are ways in which SMSF CFD investments can contravene SISA and SISR. One example is if the trustee deposits funds with the CFD provider to pay margins on CFD trades. This may be considered “giving a charge over, or in relation to, an asset of the fund”. SISR prohibits this.

It’s worth noting that this is just one example where CFD investments have been found to breach SISR. There may be other ways CFD investments can contravene the SISA and SISR.

SMSF CFDs Must Align with the Trust Deed

The Trust Deed is the document that describes the underlying rules of the SMSF. While the Trust Deed won’t usually specify any particular instruments or strategies, it may outline things like decision-making processes.

If a CFD strategy is started without going through the defined decision-making process, it might not align with the Trust Deed.Investment Strategy

The Investment Strategy is a document that outlines how the SMSF will be run. This is likely to include the investment types trustees can use. It may also outline any risk management measures they need to take.

If CFDs are not listed as available investment types, trustees cannot use them as part of the SMSF. The document would need to be amended to allow this to happen.

SMSF CFDs Should Be Offered Through an ASIC-Regulated Broker

SMSF CFDs Must Align with the

The Australian Securities and Investments Commission (ASIC) regulates CFD trading in Australia. While there are other reputable regulatory bodies around the world, only the ASIC can protect Australian traders.

With this in mind, SMSF trustees may want to consider only working with the top ASIC-regulated brokers. This offers more protection when trading CFDs.

Protecting the SMSF

While the aim is always to grow the SMSF, protecting the fund is also a priority. Regulators like the ASIC help you do this. The ASIC require that all Australian-licensed brokers provide negative balance protection.

With this measure, losses are limited to the broker account balance. So the SMSF will never end up owing money to the broker.

For Justin Grossbard, this is a big benefit:

“I really like the ASIC’s negative balance protection requirement,” Justin says.

“There’s always a risk of losing the money you put in, but this protection at least stops your brokerage balance going below zero. For trustees working with an SMSF, negative balance protection is a must.”

DISCLAIMER: This post only offers points to consider, and does not provide any financial or investment advice. Consult a licensed professional for advice relating to your own circumstances.