What’s worth $500bn and is paying no tax?

The SMSF segment as a whole appears to have paid zero net tax. But how was it done?

Recently, we looked at the small contribution superannuation is making to Commonwealth tax revenues, making it a target for future measures.

Data just out from the ATO adds a lot more colour to that picture, with detailed statistics released relating to individuals, companies, trusts and, of course, super.

Now we can tell that one of the reasons super is contributing so little to tax revenue is that it appears that SMSFs are paying no net tax – even taking taxable contributions into account – at least for the three years through to 2012.

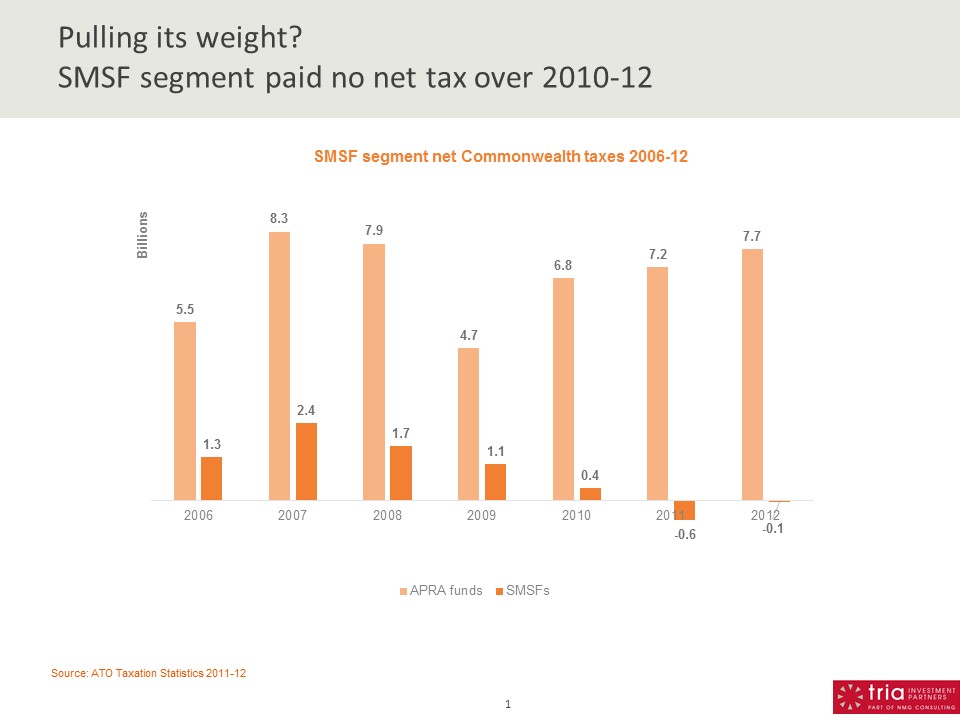

The chart shows the net tax collected from APRA-regulated funds and SMSFs over the past seven years – covering a cycle of boom, bust, and recovery.

The shape (if not the quantum) of APRA fund tax collections is pretty much what you would expect – rising into the top of the boom, falling sharply in the wake of the financial crisis, and steadily recovering since.

But it’s a different story for SMSFs. Tax collections from SMSFs also rose into the financial crisis and fell afterwards, but unlike APRA funds, they have not recovered. Instead, they have collapsed – indeed the SMSF segment received a net tax refund in 2011 and 2012.

Even at its peak, SMSFs made a much smaller tax contribution per dollar of assets under management than APRA funds. Take 2007: SMSF assets were ~40 per cent of APRA fund assets at that time, but paid only ~30 per cent of the taxes paid by APRA funds.

Jump forward to 2012. The SMSF segment as a whole appears to have paid zero net tax. How was it done?

- SMSFs had gross taxable income in 2012 (including taxable contributions) of $33 billlion

- Take away the $15 billion of taxable income that related to SMSF pension accounts – this is tax exempt. This also indicates that ~45 per cent of SMSF assets are in pension phase (more if the average return on pension accounts is lower than accumulation accounts)

- Fees, expenses, and other deductions came to $3 billion

- This left SMSFs with net taxable income of $15.6 billion – on which indicative tax at 15 per cent would have been ~$2.4 billion. Indeed, the ATO collected $1.2 billion in PAYG installments over the course of 2012

- Yet when the SMSF tax returns as a whole came in, not only did the ATO collect no more net tax beyond the PAYG instalments, it refunded more than the entire $1.2 billion it had collected during the year

- Enter the miracle of franking credits. SMSFs picked up just under $2.5 billion in franking credits over 2012, completely eliminating the segment’s tax bill, and in fact leaving a bit left over

A few points need to be made here.

- This is an overall segment view. Plenty of SMSFs will be paying tax alongside the many that are not

- There will probably be some recovery of SMSF segment tax revenues as investment markets experience positive returns (although there are still a lot of unrealised losses to soak up)

- The issue illustrates last week’s point – that the evolution of the super system towards the pension phase results in substantial erosion of tax revenues. It has already gone a long way in the SMSF segment

That SMSFs have been paying no net tax as a segment does not necessarily indicate tax avoidance, although it will do nothing to quell the concerns of Treasury and others about some of the motivations in the segment. The data supports anecdotal evidence that a commonly marketed benefit of SMSFs is their ability to eliminate tax.

But regardless of the legalities, in an environment where government is looking for more tax revenue contribution from everyone, to have a super segment of one million of the highest account balance members collectively paying little or no tax is simply not a good look. Especially when mum and dad members in APRA funds are still making a significant contribution. It’s hard to imagine that disparity being allowed to continue for long.

Andrew Baker is managing partner at Tria Investment Partners.

James makes an interesting point. The reason Treasury claims (falsely) Australia's tax to GDP ratio is low compared to European OECD countries is that it ignores this point. Super guarantee levy, workers comp do in Australia what social security taxes do in Europe.

James makes an interesting point. The reason Treasury claims (falsely) Australia's tax to GDP ratio is low compared to European OECD countries is that it ignores this point. Super guarantee levy, workers comp do in Australia what social security taxes do in Europe.

But super here would be doing that job of replacing the age pension better if it were required to be paid as life annuities and there was a $1 for $1 income test against age pensions.0 I Hope Mr Bakers ears are burning. He obviously didn't do much thinking before writing down his wrong headed thoughts. THE REASON GOVERNMENT MADE IT EASY FOR SMSF's IS BECAUSE SMSF's ARE DOING THE JOB TRADITIONLY DONE BY GOVERNMENT0

I Hope Mr Bakers ears are burning. He obviously didn't do much thinking before writing down his wrong headed thoughts. THE REASON GOVERNMENT MADE IT EASY FOR SMSF's IS BECAUSE SMSF's ARE DOING THE JOB TRADITIONLY DONE BY GOVERNMENT0 The 2 articles that I have seen from Andrew Baker have suggested to me that he is anti SMSFs. Nor does he think clearly when he makes his assertions

The 2 articles that I have seen from Andrew Baker have suggested to me that he is anti SMSFs. Nor does he think clearly when he makes his assertions

Firstly, all superfunds (excluding those in full pension mode)pay tax.

The only reason a superfund gets a tax refund while it supports a TTR pension or is accumulation mode is if the 30% franking credits reduce the tax payable. The tax rate is 15%.

So the effect is that the tax for an accumulation fund is 15% but the franking credits reduce that to zero and the excess of the frankings credits creates a refund.

If a person who had a low taxable income it is possible that that person would receive a full 30% refund. That is 100% more than a superfund.

By extension would Mr Baker suggest that all low income earners or people who do not earn a salary are cheating the taxman if they received a full refund of franking credits?

Apra funds have all the same tax benefits of SMSFs.0 Dear Ralph

Dear Ralph

Investing in an overseas entity does not mean that entity cannot invest back one way or another in Australia. That is what economists refer to as the round-tripping of financial capital. A lot of it is driven by sovereign risk fears: eg Latin Americans putting money in Miami and borrowing it back for local businesses. The point I am making is that silly sovereign risk policies by a Federal Government can produce similar responses. Certainly, it is not easy to navigate all the tax and legal issues but we are talking here about large SMSFs run by sophisticated wealthy families. Non-SMSF investment vehicles are available to them, both onshore and offshore if they wish, and they can invest locally or globally. In fact, anyone with one or two million or more to invest can probably find a suitable vehicle these days.0 One point governments forget. If they attack super funds billions will be heading offshore. There are legal alternative investments in other countries. If they attack a valuable pool of domestic investors who nursed Australian companies through the GFC they will simply expose Australia to more stress next time. But ... You can't tell them.

One point governments forget. If they attack super funds billions will be heading offshore. There are legal alternative investments in other countries. If they attack a valuable pool of domestic investors who nursed Australian companies through the GFC they will simply expose Australia to more stress next time. But ... You can't tell them.

I doubt that a lot of money will move off shore. Most SMSF trustees will only invest locally or have a very small exposure. If they did invest offshore they will lose the benefit of franking credits which account for a lot of the net "no tax payable" situation. Given that Australian shares are some of the highest yielding with refundable credits, why would you swap into a zero tax credit share and risk currency exchange losses as well?0 Very simply, the rules are the same for all members of all superannuation funds. Certain individuals choose SMSFs because they are most likely older (and in pension phase) and possibly more capable than the fund managers of looking after their retirement savings. With the proposed fall in the company tax rate all SMSFs will receive a lesser benefit of future franking credits (a substantial government saving I suspect)but I haven't seen reported yet. Those Funds in pension phase will have a 2% (roughly) reduction in franking credit refunds. I wonder how much the accumulated franking credit balances of ASX listed companies restated from 30% to 28.50% works out to be?0

Very simply, the rules are the same for all members of all superannuation funds. Certain individuals choose SMSFs because they are most likely older (and in pension phase) and possibly more capable than the fund managers of looking after their retirement savings. With the proposed fall in the company tax rate all SMSFs will receive a lesser benefit of future franking credits (a substantial government saving I suspect)but I haven't seen reported yet. Those Funds in pension phase will have a 2% (roughly) reduction in franking credit refunds. I wonder how much the accumulated franking credit balances of ASX listed companies restated from 30% to 28.50% works out to be?0 It is obvious Mr Baker has a vested interest in twisting the facts to suit his message. He obviously has not looked beyond his own biased opinion. Mr Baker's proposals would reduce my capacity to fund my own retirement and possible longevity.0

It is obvious Mr Baker has a vested interest in twisting the facts to suit his message. He obviously has not looked beyond his own biased opinion. Mr Baker's proposals would reduce my capacity to fund my own retirement and possible longevity.0 More anti SMSF propaganda from Mr Baker that I see has been picked up again in today's press. This is a broader super issue so why attack SMSFs? Again a case of any media is good media except ultimately it means zero credibility. Assume Mr Baker is being paid by the big end of town so this line of attack makes perfect sense when outflows to SMSF are the number one issue.0

More anti SMSF propaganda from Mr Baker that I see has been picked up again in today's press. This is a broader super issue so why attack SMSFs? Again a case of any media is good media except ultimately it means zero credibility. Assume Mr Baker is being paid by the big end of town so this line of attack makes perfect sense when outflows to SMSF are the number one issue.0 One point governments forget. If they attack super funds billions will be heading offshore. There are legal alternative investments in other countries. If they attack a valuable pool of domestic investors who nursed Australian companies through the GFC they will simply expose Australia to more stress next time. But ... You can't tell them.0

One point governments forget. If they attack super funds billions will be heading offshore. There are legal alternative investments in other countries. If they attack a valuable pool of domestic investors who nursed Australian companies through the GFC they will simply expose Australia to more stress next time. But ... You can't tell them.0 APRA and SMSF both operate under the same tax rules - so nothing is happening in one segment that cannot happen in the other. This chart just goes to show why so many people want to operate their own SMSF. Because the APRA funds are full of accumulators while SMSfs have more pensioners. In the APRA funds that I have seen clients in they do not appear to be receiving the full tax beneifts that are going through the APRA funds so opt for a fund that they can manage and benefit from the full tax advantages on offer. I have yet to see a study that shows the effects on APRA funds of their income smoothing (known as reserving ) strategies where they take the members current year income and keep it for a bad year to smooth out their returns & hence look better. Where the member that losses that income may never get the advantage of it. This is not as prevelannt in SMSF where the members can use reserving strategies but often dont wanting to get all the income for the year allocated to them0

APRA and SMSF both operate under the same tax rules - so nothing is happening in one segment that cannot happen in the other. This chart just goes to show why so many people want to operate their own SMSF. Because the APRA funds are full of accumulators while SMSfs have more pensioners. In the APRA funds that I have seen clients in they do not appear to be receiving the full tax beneifts that are going through the APRA funds so opt for a fund that they can manage and benefit from the full tax advantages on offer. I have yet to see a study that shows the effects on APRA funds of their income smoothing (known as reserving ) strategies where they take the members current year income and keep it for a bad year to smooth out their returns & hence look better. Where the member that losses that income may never get the advantage of it. This is not as prevelannt in SMSF where the members can use reserving strategies but often dont wanting to get all the income for the year allocated to them0