Breaching the separation of assets rules

Under the new SISR Regulation 4.09A, where a trustee may have breached Regulation 4.09A they will have also breeched sections 31 and therefore 34 of the SISA. This can have significant tax consequences for the fund.

Prior to 1 July 2013, where a material breach of the separation of assets rules was noted it was required to be reported to the ATO under paragraph 52(2)(d) (later 52(2)(g)) of the Superannuation Industry (Supervision) Act 1993 (SISA).

From the following financial year, there was no longer any option; all breaches had to be reported under regulation 4.09A, which has a major impact for all SMSFs.

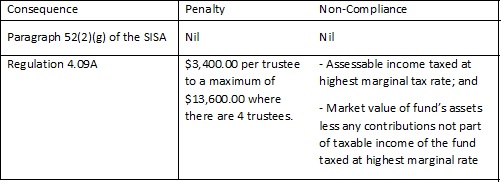

Under section 52, the ATO has no formal power to impose penalties. However, through moving this to the newer SISR Regulation 4.09A, the ATO now has this ability as outlined below.

Section 34 of the SISA states that the operating standards must be complied with at all times. Where they have not been complied with, the trustees are taken to have committed an offence under the SISA.

The term ‘Operating Standard’ is defined in subsection 31(1) of the SISA as being prescribed by the regulations in the SISR.

SISR sub-regulation 4.09A(1) states that:

“For subsection 31(1) of the Act, the standard stated in sub-regulation (2) applies to the operation of regulated superannuation funds.”

Similarly SISR sub-regulation 4.09A(2) asserts:

“A trustee of a regulated superannuation fund that is a self-managed superannuation fund must keep the money and other assets of the fund separate from any money and assets, respectively:

a) that are held by the trustee personally; or

b) that are money or assets, as the case may be, of a standard employer-sponsor, or an associate of a standard employer-sponsor, of the fund.”

So the question is: what does this mean for the trustee(s) of a self-managed super fund?

As a trustee may have breached Regulation 4.09A of the SISR they will also have breached sections 31 and therefore 34 of the SISA.

The issue would now fall under the new penalty regime and therefore under section 166 of the SISA whereby each trustee could be liable to an administrative fine of 20 penalty units or $3,400. Where a fund had four individual trustees this would result in a penalty of $13,600.

The larger problem could come under section 42 of the SISA, also known as the test of compliance.

Where a fund has committed an offence, the ATO will have to consider whether to make a fund non-complying.

ATO Practice Statement Law Administration 2006/19 – Self managed superannuation funds – notice of non-compliance states at paragraph 24:

“For the purpose of determining whether an SMSF is a complying superannuation fund, a contravention of a regulatory provision under the SISA is to be ignored unless the contravention is:

• an offence under the SISA provisions, or

• a contravention of a civil penalty provision, or

• a contravention of a regulatory provision listed in paragraph 38A(ab).”

Making a fund non-complying can have a significant financial impact on the SMSF because:

• for every year that the fund remains non-complying, its assessable income is taxed at the highest marginal tax rate; and

• in the year that it becomes non-complying, it includes in its assessable income an amount equal to the market value of the fund’s total assets less any contributions the fund has received that are not part of the taxable income of the fund.

Tax implications of non-compliance

The tax rate that applies to non-complying funds is set out in section 26(2) of the Income Tax Rates Act 1986 as follows:

“The rate of tax payable by a trustee of a non-complying superannuation fund in respect of the taxable income of the fund is 45 per cent”.

This, however, has been increased to 47 per cent, temporarily, due to the Budget Levy of 2 per cent being added by the Income Tax Rates Amendment (Temporary Budget Repair Levy) Bill 2014.

The consequences of this change can be summarised as follows:

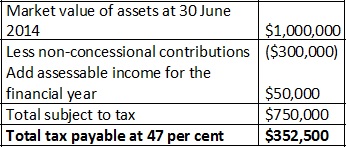

Consider the following case study: In the financial year ending 30 June 2015, Mike makes a $300,000 non-concessional contribution to a brand new SMSF. By 30 June 2014, the market value of the SMSF, through income and concessional contributions, has grown to $1 million. After completing an audit of the fund, the Commissioner of the ATO issues a notice of non-compliance for the financial year ending 30 June 2015.

The amount owing to the ATO can be summarised as follows:

Examples of breaches of the separation of assets requirement include:

1. Assets such as bank accounts, shares or property held:

(a) in the names of the member(s) with no mention of the fund; or

(b) held in the name of the former trustee(s) of the fund.

2. Assets purchased by the fund but not transferred to the fund.

Of course, in each case the Commissioner must take into account the circumstances of each breach and must consider:

• the taxation consequences if the fund was to be treated as a non-complying superannuation fund;

• the seriousness of the contravention(s) ; and

• all other relevant circumstances.

For specific examples, please refer to ATO Practice Statement Law Administration 2006/19 – Self managed superannuation funds: notice of non-compliance

Other regulations that are subject to the Operating Standards include, but not limited to:

• SISR Regulation 4.07D – Permitted types of insurance;

• SISR Regulation 4.07E – Self-insurance;

• SISR Regulation 4.09 – Investment strategy;

• SISR Regulation 4.10 – Investment by non-complying superannuation funds;

• SISR Regulation 5.08 – How minimum benefits are to be treated;

• SISR Regulation 6.17 – Restriction on payment of benefits;

• SISR Regulation 6.17A – Payment of benefit on or after death of member;

• SISR Regulation 7.03 – Restriction on accepting contributions;

• SISR Regulation 11.07AA – Disclosure of certain information;

• SISR Regulation 13.12 – Assignments of superannuation interests;

• SISR Regulation 11.07A – Disclosure on change of status;

• SISR Regulation 13.13 – Charges over a member’s benefits;

• SISR Regulation 13.14 – Charges over assets of funds; and

• SISR Regulation 13.16 – Accrued benefits – restriction on alteration.

As always, you should take the time to review your investments and adapt your investment strategy to suit your requirements.

Heath Griffiths, director, Quay SMSF Audits