Adviser fee focus creating conflict with best interests duty

Commissioner Hayne’s narrow interpretation of what advice fees can be charged to super funds is creating difficulties for SMSF advisers in meeting the best interests duty, says a technical expert.

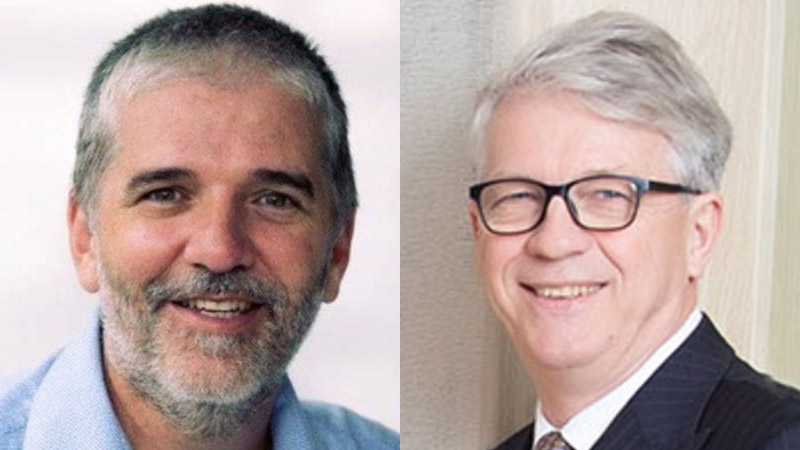

Back in the early 2000s, Colonial First State executive manager Craig Day said APRA released Superannuation Circular NO. III.A.4, which confirmed that financial advice fees can be charged to a member’s interest in their superannuation fund, but only where the subject matter advice relates to that member’s interest in that particular fund.

In a FirstTech podcast, Mr Day said the circular explains that the subject matter of advice also needs to be linked back to the core and ancillary purposes and that link must be reasonable, direct and transparent.

“Now in terms of fee deductions for advice on non-super savings, [APRA] is quite clear that is prohibited. So, non-super products or any advice in relation to non-super products or asset allocation, advice around health insurance or any general tax advice, you could not charge the fund for that,” he said.

“We then had the Hayne royal commission and the commissioner also came up with an opinion around fee deductions from member accounts. ”

Commissioner Hayne came to the view that the use of super money to pay for broad financial advice was not consistent with the sole purpose test, Mr Day explained.

“What he said was that it was not consistent with the sole purpose test for a trustee to apply the funds held by the trustee in paying fees charged by an adviser to consider or reconsider how best the member may order or make their financial affairs generally or best make provision for post-retirement income,” he said.

“He goes on to to say that fees for advice about actual or intended superannuation investments will comply with the sole purpose test in relation to consolidation of superannuation accounts, selection of super funds or products or asset allocation within a fund.”

Mr Day said that this very narrow approach to what advice fees can be charged to a superannuation fund, in some cases, can leave advisers in a situation where they can’t satisfy the best interests duty.

While it may be clear with certain types of advice such as rollover of benefits to a new super fund, advice on contributions to super, the commencement of pensions or insurance held in super, it is obvious that the fund can be charged for that advice, he said.

“However, typically a client doesn’t come to an adviser with just those particular issues; they’re seeking advice in relation to their full financial circumstances and sometimes you can get questions around debt reduction strategies and cash-flow advice,” he said.

“Now you might look at that on face value and say, well, no that’s not to do with a member’s interest in a superannuation fund, but what if that debt reduction and cash-flow advice allows for a contribution strategy to allow the client to achieve their retirement objective of retiring at age 65 with a certain level of income?”

Mr Day said there are problems with best interests here, because if the adviser provides advice to a client in relation to an appropriate level of life and TPD insurance to hold within superannuation, they will also need to consider the client’s non-superannuation assets and liabilities.

“Now, obviously, that is going to take time and effort on behalf of the adviser to get the complete picture of the client’s circumstances which can then lead to advice about the level of insurance that they should have. If we take a very narrow approach to the advice fees that can be charged to a superannuation fund, we almost leave an adviser in a position where they can’t satisfy best interests.”

Speaking in the same podcast, Coleman Greig principal lawyer Peter Bobbin agreed that advisers may take a very narrow view in terms of the advice, out of fear of how it will be treated from a superannuation perspective and whether the advice is properly attributed to superannuation.

“This means that they may have to take such a narrow or biased view that they’re actually ignoring the client more generally, and that is a breach of the best interests duty,” he cautioned.

Mr Bobbin said the position taken by commissioner Hayne is somewhat narrow given that retirement advice requires an understanding of everything about the client.

“Given the dominance of superannuation, it’s actually almost impossible to give advice in a retirement nature that doesn’t address superannuation as well as other aspects of the individual, and will therefore mean that the advice that’s being given will not only deal with superannuation issues, but of necessity must also deal with other issues associated with the individuals,” he explained.

Mr Day said the advice industry may have more guidance on this once APRA and ASIC complete their review of sole purpose test in regard to adviser fees.

“Some of the submissions to the royal commission took the view that the sole purpose test, as it’s currently written, is quite ambiguous and so APRA and ASIC have agreed to undertake a review, and to look at providing clear principles on how you should apply sole purpose test in the context of adviser service fees and examples of breaches that may require action.”

Miranda Brownlee

Miranda Brownlee is the deputy editor of SMSF Adviser, which is the leading source of news, strategy and educational content for professionals working in the SMSF sector.

Since joining the team in 2014, Miranda has been responsible for breaking some of the biggest superannuation stories in Australia, and has reported extensively on technical strategy and legislative updates.

Miranda also has broad business and financial services reporting experience, having written for titles including Investor Daily, ifa and Accountants Daily.