It’s the number one question on the minds of economists and the focal point of many financial professionals’ endeavours, who invest substantial resources in attempting to predict this metric.

To some, it makes sense why the interest rate timing discussion is on the edge of investor lips. Interest rates serve as a barometer, like the weather or a temperature gauge, providing insight into forthcoming economic conditions. Just as we eagerly await the nightly weather report to decide whether to wear a coat or carry an umbrella the next day, the anticipation of interest rate movements reflects our desire for clarity on financial climates ahead.

Yet, even when the forecast assures us of clear skies, how often are we caught off guard by unpredictable and unforecastable rain, necessitating a last-minute scramble for an umbrella?

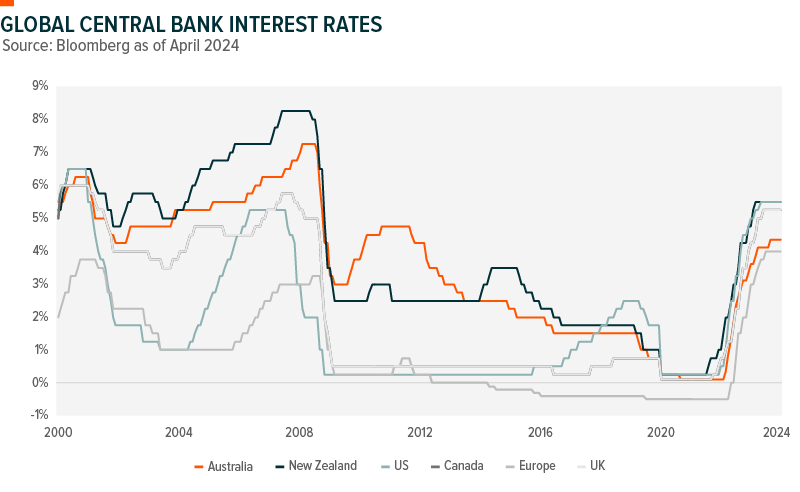

Amidst the peak of the Covid-19 pandemic, the Governor of the Reserve Bank of Australia (RBA) provided guidance to investors, indicating that the RBA wouldn’t raise interest rates until 2024 – a prediction. However, the reality that unfolded was a sharp and unexpected surge in interest rates, marking one of the swiftest rate rises witnessed in decades, alongside our developed nations.

Against a backdrop of a disinflationary environment and what appears to be a peak in interest rates, the dialogue since the start of 2023 has inevitably pivoted towards the anticipation of when interest rates might be cut – a prediction. More recently we’ve seen the market constantly push back their timing of interest rate cuts. Chances of rate cuts (both in Australia and abroad like the US) have decreased with some economists now predicting an interest rate rise instead.1

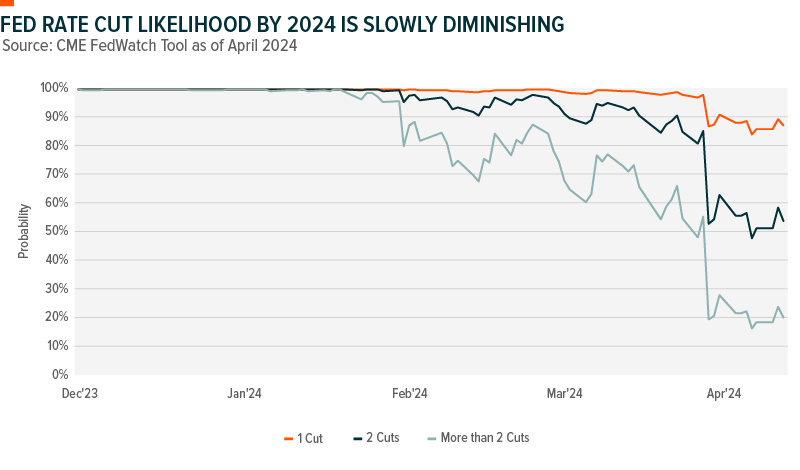

While the market maintains its anticipation of at least one rate cut by the US Federal Reserve before year-end (~90% probability), it’s essential to recognise that new data can swiftly alter these expectations. Predicting the future is a tricky business, even for experts who regularly update their forecasts. Every quarter, the Federal Reserve unveils a set of projections, highlighted by the “dot plot” indicating where policymakers anticipate interest rates heading. Just a short while ago, around mid-March, these dots indicated a consensus for three rate cuts in the year, despite a surprising uptick in inflation. However, circumstances have shifted significantly since then with hotter than estimated inflation data2, rendering those earlier projections somewhat questionable.

The focus on interest rate predictions has perhaps been overly prominent. Instead, investors would be better served by preparing for all possible scenarios – whether its interest rate holding steady, increasing or decreasing. This underscores the importance of maintaining a diversified portfolio comprising various asset classes as preparation tools, not prediction punts.

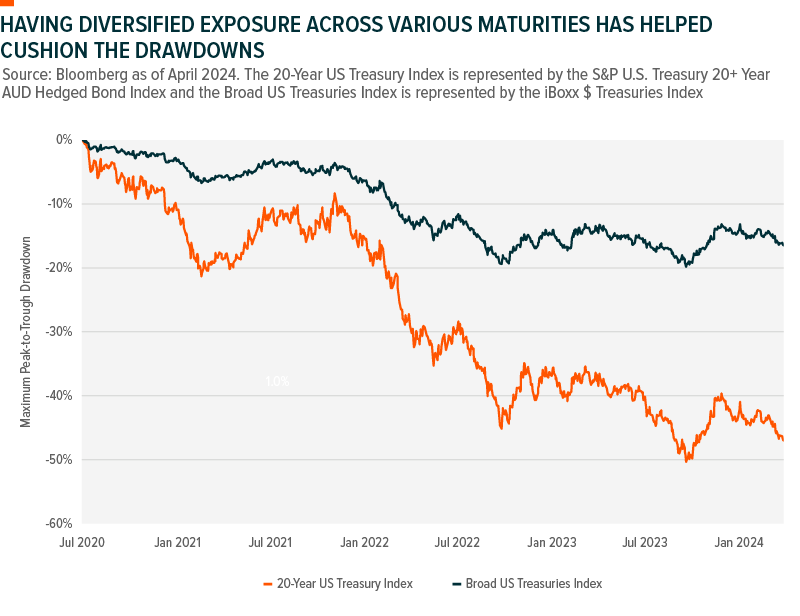

For example, investors who predicted that interest rates would stay lower for longer and took on too much duration risk in their fixed income portfolios saw heavy capital losses. Investors holding long duration bonds are still in a 40 to 50% drawdown since 2020. Investors who diversified across various maturity ranges and concentrated on the “belly” of the yield curve were cushioned from significant downturns.

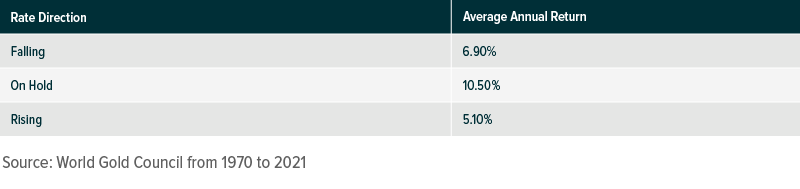

While higher interest rates can be a short-term headwind for asset classes like gold, due to the increased opportunity cost of holding the precious yellow metal, it does not always result in negative returns. Over the past 50 years, gold has shown its defensive ability to maintain positive returns in different interest rate environments.

The correlations of gold to the broader share market have remained low during different interest rate cycles. While correlations rose slightly during the interest rate hikes in 1994 and in 2004-2006, it has remained range bound and close to zero over the past 30 years.3 A pivotal characteristic of building an all-weather portfolio to handle all economic conditions is by owning a diversified set of uncorrelated asset classes, of which gold can be a key tenant.

While defensive assets like gold can act as the insurance policy, the growth drivers of portfolios should not be neglected. Instead of investors making sectoral bets based on the short-term interest rate environment, they can look to explore multi-decade investment opportunities like artificial intelligence and technology. While some interest-rate sensitive shares can fall during interest rate hikes due to their longer cash-flow duration profile, over the long-term the broader share market has been able to generate positive real returns that can outperform both cash and bonds. The annualised return on stocks outperformed bonds by 5.8% p.a. during easing cycles, and 3.9% p.a. during hiking cycles.4

Predicting interest rates is a challenging endeavor. It’s not just about deciphering interest rates themselves, but also about accurately forecasting a plethora of other economic indicators like economic growth, unemployment, exchange rates, inflation, consumer and business sentiment, and more. Given the unpredictable nature of life’s uncertainties, we seek out experts for their assurance, hoping for their unwavering confidence. Nonetheless, proficiency doesn’t guarantee flawless predictions. In fact, experts often miss the mark. As Warren Buffett once said, “forecasts create the illusion of apparent precision”.

Investors can benefit from tuning out the noise of economic predictions and forecasts about interest rates, and rather focus on the three areas they can control; 1) the costs they pay; 2) the level of investment risk they take; and 3) their own behaviour. Exchange traded funds (ETFs) offer cost-effective access to diverse investment categories such as shares, bonds, and gold, suitable for long-term holding.

When encountering predictions about the direction of interest rates, it’s wise to pause and consider that preparing portfolios to whether various market conditions might be the most prudent investment strategy.

Explore the Global X Range of Beyond Ordinary ETFs.

1Australian Financial Review (26 April 2024): RBA to lift cash rate to 5.1pc, says top forecaster.

2Reuters (27 April 2024): US inflation increases moderately; consumer spending boosts Q2 outlook.

3Source: Bloomberg based on rolling 3-Year Correlations of gold price to S&P 500 Index.

4UBS: Global Investment Return Yearbook 2024

Disclaimer

Global X Management (AUS) Limited (“Global X”) (Australian Financial Services Licence Number 466778, ACN 150 433 828) is the product issuer. Offers of interests in any retail product will only be made in, or accompanied by, a Product Disclosure Statement (PDS). In respect of each retail product, Global X has prepared a target market determination (TMD). Each PDS and TMD is available at www.globalxetfs.com.au. The information on this website is general in nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information, you should consider the appropriateness of the information having regard to your objectives, financial situation or needs and consider seeking independent financial, legal, tax and other relevant advice having regard to your particular circumstances. Any investment decision should only be made after obtaining and considering the relevant PDS and TMD. Investments in any product issued by Global X are subject to investment risk, including possible delays in repayment and loss of income and principal invested. The value or return of an investment will fluctuate and an investor may lose some or all of their investment. Past performance is not a reliable indicator of future performance. Forecasts are not guaranteed and undue reliance should not be placed on them. Diversification does not ensure a profit nor guarantee against a loss. Brokerage commissions will reduce returns. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is based on views held by Global X as at 29/04/2024.