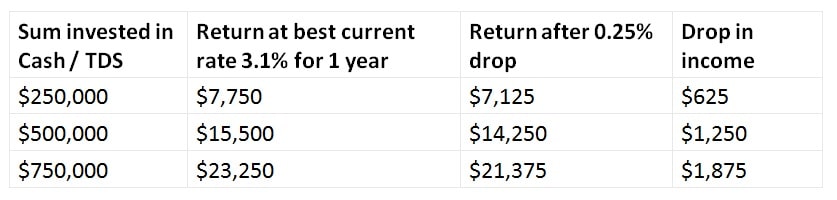

With some of the banks already planning to pass on the cut in full to mortgage clients, it won’t be long before they also cut their term deposit and cash rates. Here’s what self-funded Australian retirees can expect:

So that equates to a drop of 8.06 per cent in income for those conservative investors who stick to cash and fixed interest-based investments.

Not more than a year ago you could still get 5 per cent on a Term Deposit so the drop in income over the last two years has been more like 43 per cent. Could a normal family suffer that loss of income?

Meanwhile, Centrelink will not review deeming rates until September 20 and there is no certainty they will react to the drop in interest rates. If they don’t, then the next review is not until March 2016.

The government claims that by leaving the clean energy supplement in place, and a few other tax measures, that they have made up the difference for you and a real ‘she’ll be right’ attitude from ministers on huge salary packages.

Tell them ‘they’re dreaming’ and it’s your reality!

Some tips for those affected:

– Forget about loyalty and shop around for the best deal

– Consider taking on some additional risk but drip feed slowly in to any investment

– Don’t chase yield blindly as you may lose your capital

– Get some advice to ensure you are maximising your entitlements. See a Centrelink Financial Information Service Officer

Liam Shorte, principal wealth adviser, Verante Financial Planning