In the hunt for yield by SMSFs in the Australian share market we are immediately drawn to names like Telstra, the banks, Woolworths and, until recently, BHP. Listed investment companies offered by some of the best fund managers in the country can play a vital role in generating income alongside these stocks in an SMSF portfolio, and have the added benefit of providing diversity of investment within an SMSF.

One thing that we know for sure following the Brexit vote is that the vote will place downward pressure on interest rates in the short term, with most leading economists suggesting that interest rates have further to fall in Australia.

This will make the job of SMSF trustees to meet pension payment cash flow obligations all the more difficult, particularly if they are like many and have a reasonable allocation to cash and term deposits.

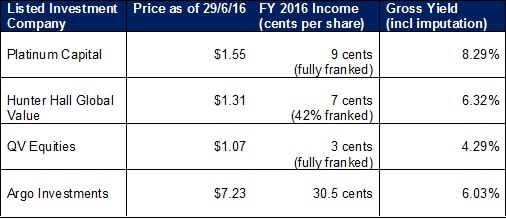

Let’s start by highlighting some of the dividend yields on offer from some of the listed investment companies that we follow (note that this is not an exhaustive list – merely an example).

Of course, investing purely for yield is cautioned against, and we would argue that an SMSF that already owns Telstra and the Banks, Woolworths and BHP is largely duplicating their existing holdings by investing in Argo. Our point here is to think about LICs that are complimentary to an existing SMSF portfolio. SMSFs need to understand how the LIC is invested in order to determine whether it has a place in their portfolio or is simply duplicating what they already own.

QV Equities, an LIC managed by the team at Investors Mutual, by contrast invest in Australian companies outside of the top 20 stocks (by market cap) and therefore may be suitable for SMSFs who already own banks, Telstra, etc, but are looking for a diversified investment in Australian companies.

Hunter Hall and Platinum of course are well-known brands in managing international equities.

Several microcap managers have also recently established listed investment companies that can assist SMSFs to obtain access to the returns on offer from small companies without taking excessive risks by investing directly. In this space we saw in June 2016 that the Glennon Small Companies fund has put itself in a position to pay a 5 cent annual fully franked dividend.

A listed investment company unlike an unlisted managed fund has the ability to smooth dividends in a ‘reserve account’, so that during periods of poor market returns the manager does not necessarily have to reduce the dividend. We view this as a distinct benefit of LICs for SMSF trustees while acknowledging liquidity, particularly during market stress as a major downside.

The first step in our view of selecting an LIC involves looking at the investment personnel and long term track record of the manager. This information can be accessed through a broker or financial adviser, company websites, or by reading the annual report.

We prefer investment management teams who have an ownership stake in the business as it provides good alignment of interests. A good long-term track record over varying investment conditions and stability of the team itself are other factors to consider.

We are also believers that there is benefit in investors meeting the investment manager to determine a greater level of understanding how the manager approaches investing to ensure that they are comfortable with the approach taken. Ethical considerations come to mind here. This, of course, can be achieved not only by attending face to face shareholder meetings, but most fund managers run YouTube channels these days which can achieve a similar result.

We finish on some other tips when thinking about investing in the listed investment company market:

- Always consider the net asset backing of the LIC – we encourage investors to look to purchase either at a discount to asset backing or at asset backing. Asset backing is regularly advised to the ASX by the fund managers.

- Be prepared to sell an LIC if its price trades at a significant premium to its asset backing.

- Be mindful of the liquidity of trading – and ensure the SMSF has liquidity elsewhere to meet cash flow obligations.

- Talent of the fund manager is paramount to success in the LIC market – this is where we encourage investors to dedicate most of their research time.

Mark Draper, financial adviser, GEM Capital Financial Advice