By offering your clients an in-house comprehensive compliance service, you give them peace of mind that if any further work needs to be done during the year you are able to meet any compliance needs such as reviews or audits. The firm will be in a position to meet that need at no additional cost (subject to agreed thresholds).

The idea of offering a prepaid compliance service to your clients is not completely new. Many accounting practices are doing just that. Now, with the help of the smart fully automated Apxium Protect Audit Safe service you can easily and effortlessly offer the new service, knowing it is a much better outcome for both your clients and your firm.

Many accounting practices have told us that they find the annual audit insurance offer process onerous and unnecessarily cumbersome. Additionally they have shown interest in finding new solutions that would offer their clients a better outcome and a more comprehensive compliance service.

You no longer need to share your client relationships and income with a third party, or endure their administratively time consuming claims process. With Audit Safe you keep all your client relationships and the claims process is entirely run by your firm. The client is still protected, gets a service fee deduction and receives a much better service offering to boot!

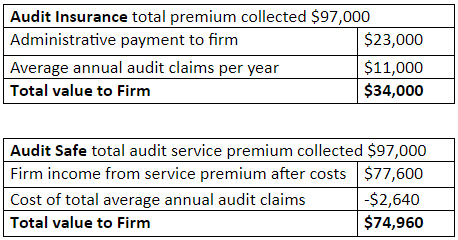

By way of comparison let’s look at the experience of an actual firm and compare the two financial outcomes (insurance vs Audit Safe).

This firm just made an additional $40,960 while their clients get a better service, level of certainty and cover!

The mathematics of the proposition are simple. There is a large amount of value accruing to a third party via insurance premiums paid by YOUR clients.

Apxium Protect Audit Safe is the solution you need to both offer better service to your clients, significantly lower your administrative burden and substantially increase the benefit to your firm.

Apxium are experts at data integrating with accounting systems, as evidenced by their suite of products that are delivering substantial financial and operational savings while significantly improving your firm’s debtor days.

Audit Safe is fully automated, will integrate with your underlying accounting system and pre-populate your cloud dashboard with all your clients, your client groups, and SMSF’s. Additionally Audit Safe will pre populate the amount of cover and client pricing; this is easily edited by your administration team.

There is no paperwork no manual invoicing and if any clients happened to get audited, which we know is quite a rare occurrence, then there’s no claims process. They are your clients and therefore you can manage their experience.

Via Audit Safe you will grow your income stream while your clients will get a higher level of care because you are now the one offering them the comprehensive compliance service.

The implementation of Audit Safe couldn’t be simpler, Apxium will integrate with your underlying invoicing system build out your dashboard and presented to you in order for you to finalize your offer to your clients once this is done we will manage everything from there.

Contact us today and learn how accountants are disrupting audit insurance while at the same time offering a significantly better service to their clients and improving the bottom line of their business.

Click here to learn more, watch our video or sign up for a demonstration!