While fully franked dividends may be nice to have, they are not an investment solution on their own.

We are not dismissive of the value of franked dividends, but it’s important to remember that it is the total return that matters and that an obsession in pursuing fully franked dividends is not necessarily going to lead to good outcomes.

Fully franked dividends are paid by companies who have paid tax in Australia on their Australian earnings, and the imputation system ensures that there is no double taxation as the tax paid by companies is attributed or imputed to investors. By extension this results in those companies with overseas earnings not normally paying fully franked dividends.

To highlight the actual value of a fully franked dividend in a SMSF trustee’s pocket we take a look at the 20-year average return from the ASX 300 Accumulation Index. The return to 30 June 2017 was 8.17 per cent per annum. This is an index return and does not include the value of franking.

For the sake of simplicity, let’s assume that the return consisted of a 4 per cent per annum dividend (fully franked) and 4.17 per cent per annum of capital appreciation. Also for simplicity, we are considering a SMSF in pension phase with zero tax on earnings.

The 4 per cent fully franked income will receive imputation credits back to the SMSF worth 1.71 per cent per annum. This means that the total after tax return to an SMSF with a zero tax rate would be 9.88 per cent per annum. In other words, the imputation credit from a 4 per cent fully franked dividend increases the total return by 1.71 per cent per annum. While this is significant, the value of the imputation credit slips into insignificance if other aspects of the investment falter — just ask Telstra shareholders.

SMSF trustees who only seek fully franked dividends deny themselves of the opportunity to invest in some of Australia’s best companies who derive income from offshore. CSL, Sonic Healthcare and Macquarie Bank come to mind.

They also limit their opportunity set to domestically facing businesses including banks, telecommunication providers and retailers, all of which are facing challenging headwinds.

SMSF practitioners should instead encourage clients to focus on the company’s earnings and the sustainability of those earnings, ahead of whether the dividend is fully franked or not. We would argue that it is better to invest in a company with a growing earnings stream with lower dividend, than it is to invest into a company with flat or falling earnings with a higher dividend, subject of course to investing at a sensible entry point. A growing earnings stream can also lead to future higher dividends.

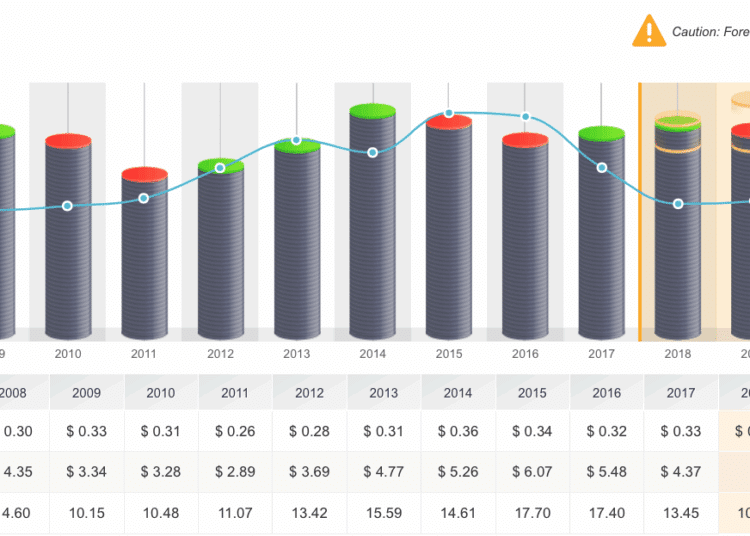

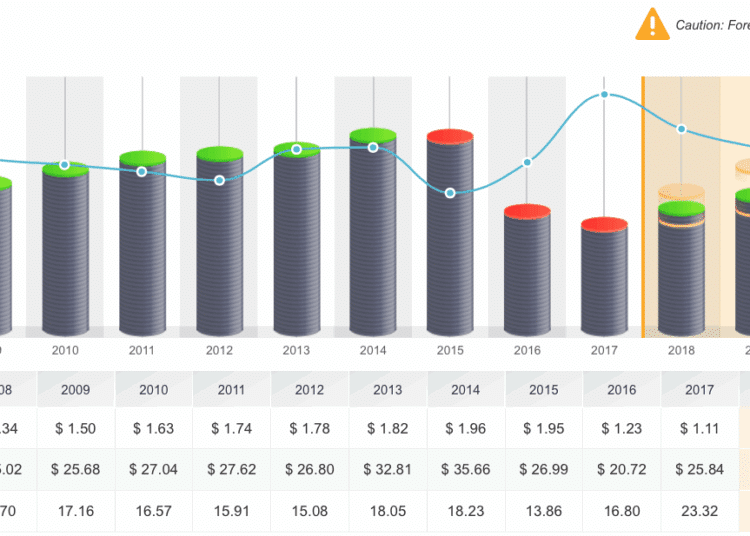

Below we show earnings charts from fully franked dividend payers, Woolworths and Telstra, which show a flat earnings profile over the last 10 years, and the share price reflects this.

Telstra

Source: Skaffold

Woolworths

Source: Skaffold

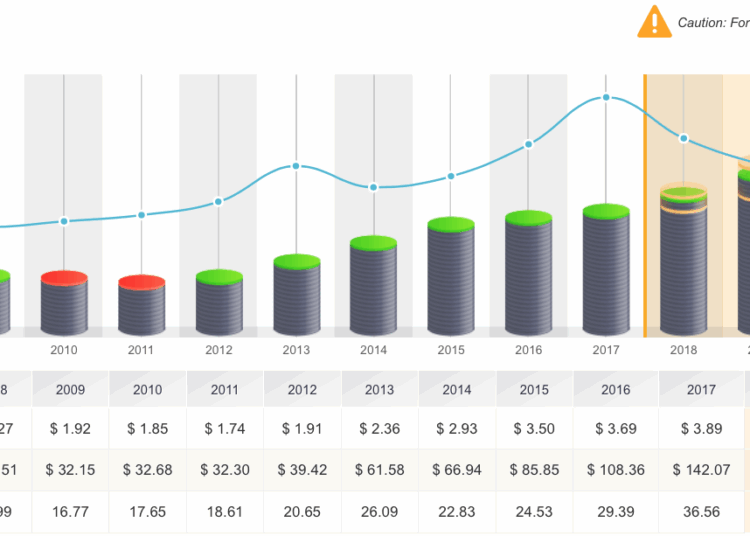

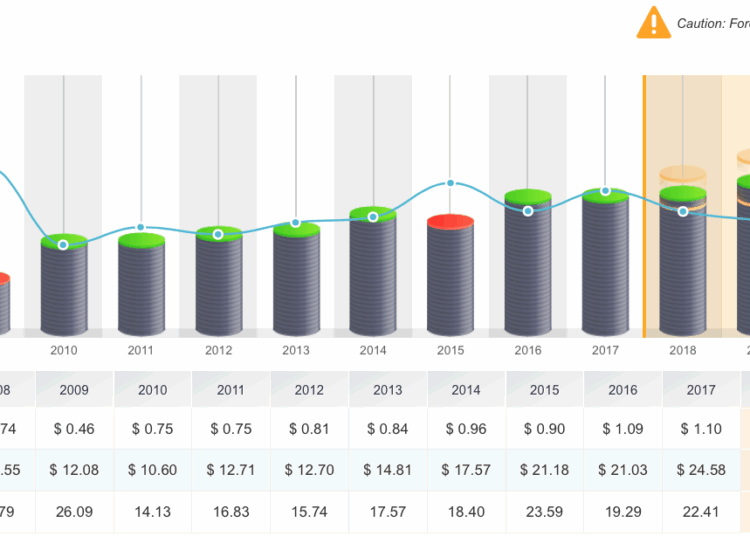

On the flipside we provide earnings charts for two companies that pay partially franked dividends due to their offshore earnings, CSL and Sonic Healthcare.

CSL

Source: Skaffold

Sonic Healthcare

Source: Skaffold

SMSF Trustees should consider some of the following aspects of a company rather than simply focusing on a fully franked dividend:

- Earnings history and forecasts

- What is the company’s competitive advantage?

- How is company management regarded by the investment community?

- Gearing levels

- Does the industry that the company operates in face a headwind or a tailwind?

By Mark Draper, adviser, GEM Capital Financial Advice