Bill Shorten announced that if Labor wins the next federal election cash refunds from imputation credits will be abolished from 1 July 2019.

While it is being touted as a loophole enjoyed by the wealthy, this proposal hurts self-funded retirees in SMSFs the most – retail superfunds still qualify to offset their tax using imputation credits as their net tax position is positive – not due to a member by member allocation but because pooled overall, they have a positive tax position. So, the policy is a tax on the use of a particular structure, an SMSF.

Mark Lawry, partner of Suntax, stated, “This proposed change will negatively impact retirees and pensioners and will lead to gross inequity in the treatment for Australian share investors. My retired clients will be at least a million dollars worse off each year (overall), which is a large sum for a suburban practice. This change is not targeted at only the top end of town, it is a direct attack on ordinary mum and dad retirees.”

SMSFs in pension phase will no longer receive a refund for excess imputation credits. If you roll out of your SMSF into a retail or industry fund your franking credits are safe. If you leave it in an SMSF you are going to lose them as you are using a “tax loophole” enjoyed by the wealthy.

If this becomes a reality what would it mean?

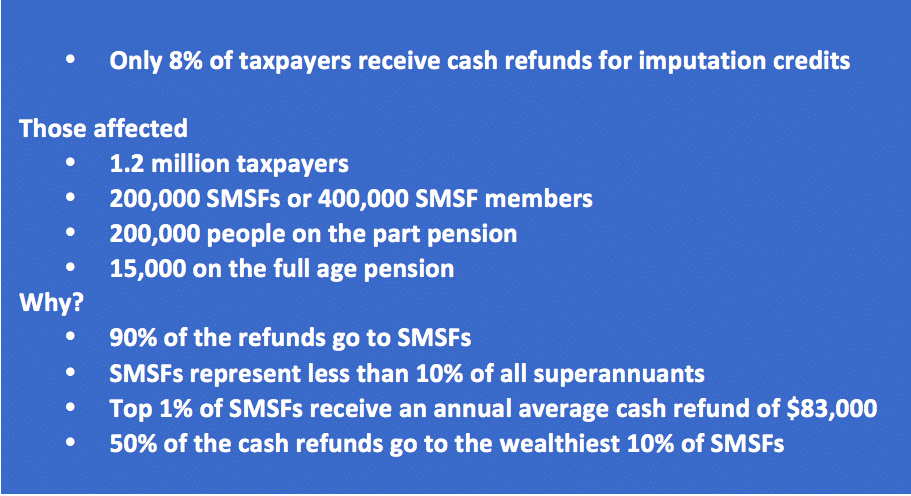

Ninety per cent of the imputation credit refunds go to SMSFs and 200,000 SMSFs would be detrimentally affected by this change, which is approximately one-third of SMSFs.

SMSFs in retirement phase traditionally have a low risk profile and invest in blue chip Aussie companies that pay fully franked dividends – the refund on the imputation credits makes these investments an attractive proposition when otherwise the ROI would not necessarily fit with their investment strategy.

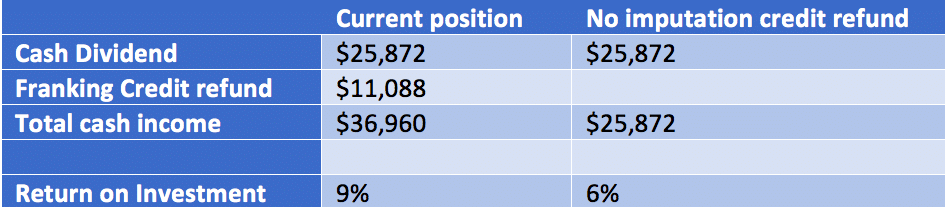

Let’s look at an average member in an SMSF in pension phase:

- Member balance $616,000

- Cash and term deposits 30 per cent

- Australian shares 70 per cent – blue chip focus – estimated 6 per cent yield fully franked.

This is a significant reduction in the retirement income of self-funded retirees and another blow. They will have to use their capital faster and will qualify for a part pension sooner.

Interest rates are low, the housing market is soft and removing imputation credit refunds is the perfect storm for the self-funded retiree.

What are their alternatives?

Post retirement you don’t want to take out an LRBA and the property market is down – Perth in particular, Sydney and Melbourne are muted. Bank interest rates are low. Heading into retirement phase you are looking for income streams not debt and not necessarily capital appreciation. Blue chip Aussie companies fulfilled that profile.

It will certainly push more SMSF members across to retail or industry superannuation funds where even though their performance may be lower the franking credit will offset that.

$59 billion revenue over the next decade

Detailed estimates have not been released by Labor, however this premise relies on Australian companies still being profitable and still paying fully franked dividends. There is no guarantee of this since we have such a high corporate tax rate.

It also relies on the fact that SMSFs in pension phase won’t make changes – like moving investments into a retail or industry fund or adding additional members to the fund who are in accumulation phase to use the imputation credits to offset contributions tax.

Will this change affect the ASX?

Initially the change is predicted to affect the share price of Australian companies – but it won’t only be share prices that are affected – what about IPOs and capital raisings?

Imputation credit refunds and the GST

The refund of excess imputation credits came about in 2000 – alongside the GST.

When GST came in – there was in uplift in government pensions, individuals received tax cuts, as did corporates and there was a reduction in other taxes – all to compensate for the extra costs associated with GST. Self-funded retirees did not receive any of the above but they did get the refund of excess imputation credits.

“Refundable imputation credits were part of the discussions behind-the-scenes back in the GST modelling and tax reform package in 2000 – in effect the only compensation self-funded retirees got for GST was refundable credits,” said Paul Drum, CPA Australia head of policy.

What do I suggest?

I think we all need to put pressure on Labor regarding this policy as it’s class warfare and unfairly targets SMSF members in pension phase. An alternative would be to put a cap on the amount of excess imputation credits you can receive a refund for rather than take money from mum and dad self-funded retirees that can least afford it.

Deanne Firth, director, Tactical Super

If any of you are interested and want the chance to front Shorten on this, he is appearing on the Chamber of commerce & Industry Qld CCQI Facebook forum at 4.30 pm today (Monday 16/4) at this link https://www.facebook.com/CCIQLD/photos/a.426304927407803.93384.179072152131083/1835478113157137/?type=3

Very good article clearly providing figures to aim to quantify the effect that Shorten has been so blase and skipped over whenever queried. This is a well aimed attack at those Labor consider not to be their constitutional voting base, and significantly betters Labor directly (talk about conflict of interest!). It is well publicized the relationship and substantial tens of millions of dollars that flows from Industry Super Australia to Unions and to Labor. Anything that lessens the appeal of SMSF by default enhances the attractiveness of other solutions, particularly ISA funds given their propensity to accumulation rather than pension members.

This is a crafted preemptive strike aimed now to take the Australian population largely unawares (let’s face it, most people are hardly aware of their super balance let alone any idea of structures or super taxation or what even this proposal is about, let alone any impact it may have on them now or in the future).

Aside from providing extra coffers via retained tax revenue for a potential Labor government to spend this assists both the Unions and ISA in retaining their revenue base. It is apparent the ISA have identified the commercial future age demographic issue they face, where baby boomers will be transitioning out of accumulation to pension, at which stage they traditionally seek further advice and a reasonable portion of the funds exit ISA.

[b]Whether you agree or not to the above, if you are a professional adviser in any capacity and concerned about this proposed tax restructure and for your SMSF client’s future retirement benefits, (or anyone with share investments for that matter), it is incumbent upon you as a minimum to advise your clients on the impact that this proposal may have, and preferably, assist your clients to write to all their local members with their concerns over the unfairness and detrimental implications this will have. A standard form letter from a professional association would be of benefit.[/b]

This proposal just doesn’t pass the fairness test. Labor are totally misguided here and look like they have ganged up with the industry funds and big banks to hammer the SMSF’s

It won”t affect the Pollies Defined Benefit schemes, will it?

If there is a complaint it is that super fund earnings are tax free in pension mode. In that case, limit the current pension income deduction to a tax free threshold per pensioner, don’t destroy the logical integrity of the imputation system. And please recognize that so far as “tax free” (tax paid?) pensions go, you need to get up to $50,000 per annum or thereabouts to get to a 15% average rate. Envy does not make for rational policy, especially when the larger funds will go offshore. Lawyers are, of course, happy to assist such clients restructure their affairs but as national strategy goes, the whole thing is appallingly silly.

I don’t read this to be subjected to Liberal Party propaganda, by all means present you arguments, but leave the political messages out of it, I may just use them to argue a labour government abolish SMSF

Please don’t show your ignorance in such a public forum, you’re only embarrassing yourself and our profession.

The idea of imputation credits was to ensure those taxpayers who invested in companies did NOT get taxed twice … once in the company at the corporate rate and then on dividends at the personal tax. So the franking credit was born. Now, comes the twist. Because Australia runs a multi-tiered tax system, the credits are most profitable to those investors whose marginal tax rate is LOWER than the corporate rate. A blind man could see that happenning. So, politicians created that problem – and now politicians wants to persecute taxpayers whose marginal rate of tax is lower than the corporate rate — their own members AND of course retired people in particular. Why not have a SINGLE FLAT income tax rate for corporates, individuals AND for GST purposes? One equilibrium rate would save BILLIONS in administration costs alone – get rid of surplus beaurocrats and it would not encourage popular tax schemes etc. Truly a clearing rate!