According to SuperCentral, there are a number of steps that superannuation members receiving pensions need to take ahead of the end of the 2022–23 financial year.

First, the firm said, members need to ensure that the minimum amount has been paid on or before 30 June 2023 (pro-rated if the pension commenced part way through the current financial year).

Payment, it explained, means a credit to the personal bank account of the member receiving the pension which has a date of transaction being 30 June 2023 or earlier.

“While there is an administrative concession provided by the ATO for inadvertent underpayment of the required pension amount, it is far better to avoid having to rely on this concession,” SuperCentral said.

Regarding the underpayment, SuperCentral explained it must be inadvertent and must not exceed 1/12th of the normal pension payment – if the pension was being paid monthly, then inadvertently paying the June payment in July will be disregarded.

Finally, it noted, the concession is not an informal grant of a right to be tardy in pension payments and can, generally, only be used once.

“If the concession is used a second time the ATO will have to approve the use of the concession.”

SuperCentral clarified the consequence of the failure to satisfy the minimum payment rule is that the superannuation account supporting the pension will be treated as not being in retirement phase, thereby incurring more tax for the superannuation fund.

“This adverse taxation consequence only applies to pensions in retirement phase: it does not apply to transition to retirement pensions in the period before the member retires or attains age 65,” the firm said.

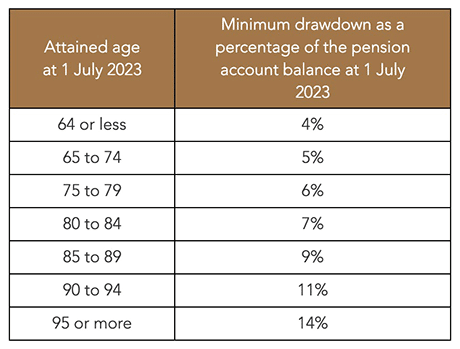

Once payments are sorted, SuperConcepts reminded that unlike the current financial year, the minimum pension amounts for 2023–24 will be determined using the normal drawdown rates: 4 per cent if under age 65 at 1 July 2023, 5 per cent if aged 65 but less than 74 at 1 July 2023, and so on.

Moreover, it added, that the minimum amount which must be paid in respect of each pension in the 2023–24 financial year is determined by two factors: the attained age at 1 July 2023, and the pension account balance as at 1 July 2023.