In FY21, Australia saw the greatest increase in newly established SMSFs since they first appeared in Australia in 1999. This burst of SMSF popularity has brought about a wave of Australians who are using the flexibility of an SMSF to indulge in purchasing unusual liquid assets within their Superannuation funds.

“We have audited funds that own pink diamonds, rare crystal animals and treasured artifacts including coins and stamps. It’s not just gold bullion or artwork anymore, these liquid assets are becoming more diverse every year” attests Naz Randeria, Managing Director of Reliance Auditing Services.

Amidst the eager anticipation of their niche investment yielding a favourable return come retirement, Naz encourages SMSFs to temper this with an understanding of compliance. The true cost of compliance, including storage and insurance, can sometimes dull the shine of anticipated profits over time.

Historically many SMSFs have used safety deposit boxes operated by the major banking institutions. In recent months, however, Bankwest was the latest in a line of Australian banks ceasing to offer safety deposit boxes, with the remaining big banks tipped to follow suit.

Customers with these boxes are now compelled to find a new storage solution for their SMSF-owned liquid assets and Naz urges using this opportunity to carefully consider that their next arrangement remains compliant AND secure.

“Many SMSFs are now forced to reconsider their storage options and the issue of compliance is often not top of mind,” Naz comments. “I encourage all of my clients to ensure their compliance does not lapse during this time, to avoid breaches and possible penalties. Maintain your insurance, do your research when selecting your next storage option, and absolutely don’t hold these assets in your home.”

The Australian market has seen an upswing in privately-run storage facilities, however without the same regulations as a bank, these solutions offer varying degrees of security and peace of mind so should be assessed on their individual merits – in line with your own comfort levels given the value of your asset.

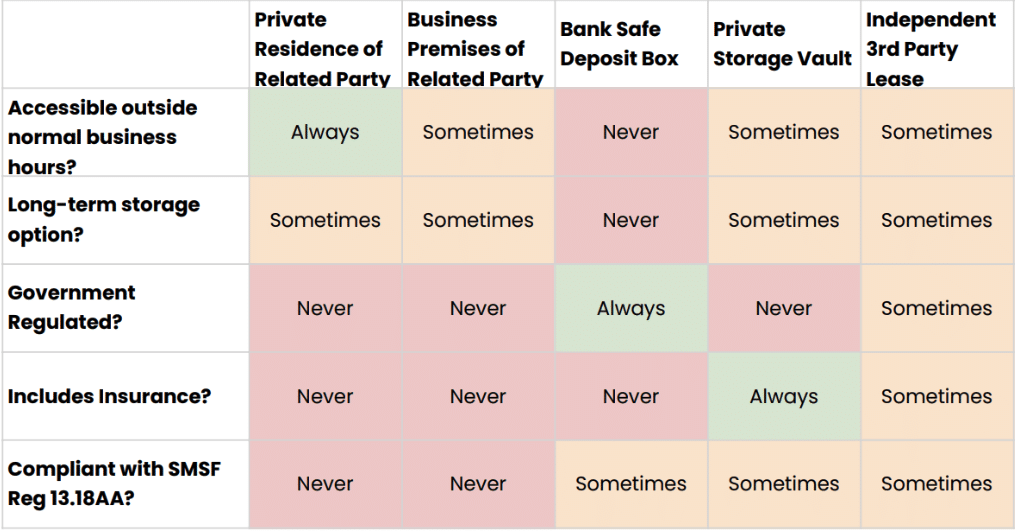

Reliance Auditing Services advise SMSF Trustees to consider the following four factors when choosing how to store these assets:

- Accessibility – Am I able to access the asset whenever I like?

- Longevity – Is my asset able to be stored for a long period? Or is it likely I’ll need to go through the inconvenience of re-homing again in the near future?

- Regulations – Do I have the peace of mind that this facility is subject to government regulations? If not, am I comfortable that the provider is legitimate, professional and able to uphold their promises in regards to the security of my asset?

- Compliance – Will this solution allow me to comply with my

“personal use” and insurance obligations under Superannuation Industry (Supervision) Reg 13.18AA?

These factors are summarised in the matrix below:

Trustees must exercise caution to ensure their SMSF-owned assets are compliant with all facets of the latest SIS regulations, not just those regarding storage.

By Naz Randeria, managing director, Reliance Auditing Services

“……funds that own pink diamonds, rare crystal animals and treasured artifacts including coins and stamps. It’s not just gold bullion or artwork…. ” how are these ‘liquid’ assets?