If there is a single statistic that has provoked debate from within the ATO’s annual SMSF statistical release in December, it is probably SMSF borrowings and any link with increased residential real estate activity and prices.

When you have identities such as Paul Howes writing on the topic in The Australian Financial Review, you know it has filtered into the financial mainstream.

The debate revolves around how quickly SMSF borrowing is rising, whether this matters in the scheme of things, and its impact on residential property markets, both in terms of price levels and helping to lock out first home buyers. Stories abound in weekend real estate sections of young home buyers being outbid by SMSF investors.

Stories are not data of course. So let’s look at the data. Our view of it says that SMSF borrowing appears to be growing very, very fast – faster than even the critics think.

That said, looking at the data is easier said than done. ATO disclosure of SMSF borrowing data is still evolving. In fact, the December 2013 report (for the June 2012 year) was the first year in which a specific line was disclosed for SMSF borrowings ($6.3 billion).

A separate figure is disclosed for limited recourse borrowing arrangements (LRBAs), which appear to be a subset of total borrowings at $2.3 billion. In previous years, this was described as “Derivatives and instalment warrants”. An LRBA is essentially a type of warrant arrangement.

There are three important limitations to note:

– We don’t have an ATO total borrowing number for prior years;

– Total borrowing understates the true borrowing figure since some SMSFs borrow by investing in a geared unit trust (this may not show up as a borrowing of the SMSF); and

– The data is now out of date by 18 months

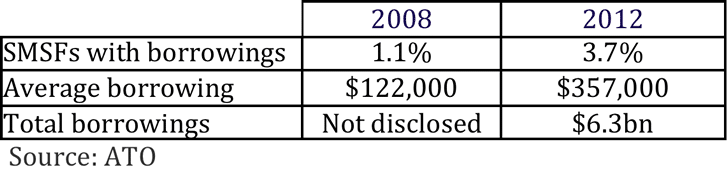

Much of the analysis of the issue to date actually relies on commentary provided by the ATO rather than on the numbers. Here are the main numbers published by the ATO:

It should be pointed out that there is a confusing reference by the ATO to increased borrowings over the five years to 2012, but the ATO then refers to 2008 and 2012 data points, reflected in the table above, which is of course a four-year period.

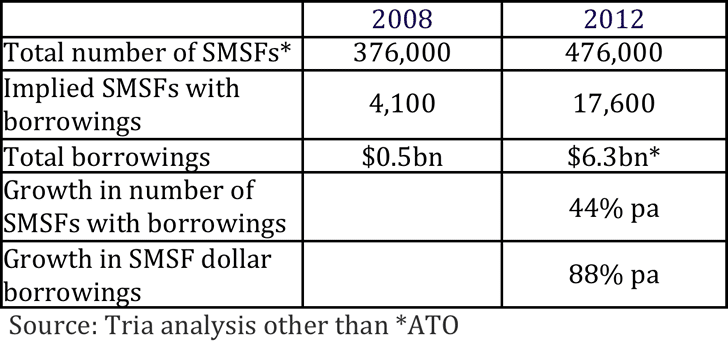

Assuming the ATO actually means the 2007/2008 year as the base, and given we know the number of SMSFs in existence, we can back-solve:

Now that is pretty interesting.

Most of the analysis to date has looked at the increase in borrowing incidence from 1.1% to 3.7%, and concluded that SMSF borrowing has roughly tripled over the period. This is wrong – the numbers are far higher:

– The number of SMSFs with borrowing has more than quadrupled (a growth rate of 44% pa); and

– The dollar amount of SMSF borrowings has risen by a factor greater than 12 (a growth rate of 88% pa)

Note that if the period is actually five years rather than four years, that doesn’t change the view much – the growth rate of the dollar amount of SMSF borrowings comes down to 66% pa, but it is still huge.

An important implication is that with an 18-month lag, these growth rates imply that SMSF borrowings could now easily be over $10 billion, especially given that residential real estate markets didn’t really get moving until after June 2012.

So we can say with some confidence that SMSF borrowing appears to be growing very quickly. Sustained growth rates of 50-100 per cent pa is a boom in anyone’s language, even with a low base. It also suggests that given the size of the segment, we need better and more timely SMSF data – relying on data 18 months old when events are moving quickly is really not good enough.

As for whether SMSFs are complicit in fueling the residential property boom, that’s a whole new argument.

Andrew Baker is managing partner at Tria Investment Partners.

[quote name=”KCA”]Stephen bit of a pedantic technical point but you can get a 80% LVR from quite a few banks on a residential LRBA now[/quote]

Interesting 🙂

Best Ive seen in Adelaide is an LVR of 60% for commercial and 70% for residential. Most LRBAs I see are for commercial as residential (in little old Adelaide) just doesn’t justify the effort required to set it up.

The OLD story ‘1.1% has increased nearly 4 times to 3.7%. Therefore the world is falling in ‘ That makes much more interesting copy than ‘borrowings in SMSf’s now just over 1% of total assets held’

Stephen bit of a pedantic technical point but you can get a 80% LVR from quite a few banks on a residential LRBA now

Stephen I think CA and TT will do both stories. The difference between SMSF and new home buyers is SMSFs have enemies and LRBAs will be seen as a non essential investment option whilst we have to have houses for new home buyers although increasing their LVRs may not be a bad thing as I think housing prices would adjust down to compensate for higher LVRs

New home buyers can borrow up 95% of the value of a new home…..so after the next property downturn who do you think the ACA/TTs of this world are going to be talking to. It surely wont be smsf trustees with lrba’s with 60% leverage 🙂

KCA …. New home buyers can leverage up to 95% of the value of their home with the banks. So I suspect that by the time ACA/TT is finished with all the first home buyers after the next property downturn that Smsfs with LRBAs (who can only leverage up to 60%). aren’t really going to register with ACA/TT …don’t you think 🙂

We need to have one eye on what happens in the first property downturn. There will be LRBA’s inevitavbly set up in the last 6 months of the preceding boom and there will be tears on Current Affair/Today Tonight when the banks call in the personal guarantees. We need to legislate the LVRs on LRBAs to make properties highly likely to be postively geared to stop the tears or real danger the Govt of the day especially if Labor which is Industry fund friendly will take lazy way out and ban LRBAs altogether.

So the 550 billion dollar smsf sector “could” have 10 billion dollars in debt … and your point is what ?