Once an SMSF has acquired property, either at auction, by private treaty or from a related party on an arm’s length basis, the next issue is whether it can be leased and to whom.

Leasing property

In all cases, the trustee of a superannuation fund must be able to establish, if questioned by third parties such as the fund auditor or the regulator, that any lease meets the requirements of the superannuation legislation (the SIS Act). To meet the requirements of the legislation, the ownership of property needs to satisfy the fund’s investment strategy, asset allocation and the other investment standards. These include the borrowing standards, in-house assets test and making sure the acquisition is conducted on an arm’s length basis.

Leasing commercial property

If a fund owns property which is used for commercial purposes (i.e. business real property) then it can be leased by anyone provided the lease is made on an arm’s length basis. This means that commercial property can be leased to related parties.

The fund trustees need to ensure that the lease agreement is properly documented, and the terms of the lease are consistent with bona fide arm’s length leases. This would include:

- The amount of rent

- When the rent is payable

- Which expenses are to be paid by the lessee or lessor

- Other rights and obligations.

Leasing residential property

Where residential property is concerned, as a rule, it must be leased to non-related parties on an arm’s length basis. This means the terms of the lease are similar or identical to other leases of residential property available in the marketplace and the lease is documented. Any lease agreement should have terms and conditions that are suited to the client’s situation.

Leasing residential property to related parties

Under the SIS legislation, residential property cannot be leased to related parties for even a short time unless the fund is able to satisfy the in-house assets rule.

The in-house assets rule restricts the proportion of the fund which can be:

- invested in

- lent to, or

- leased to

a related party to no more than 5 per cent of the market value of the fund’s assets.

In some rare cases it is possible that a superannuation fund may be able to rent residential property to related parties (such as fund members or their relatives) but in most cases the value of the residential property would exceed 5 per cent of the market value of the fund’s assets.

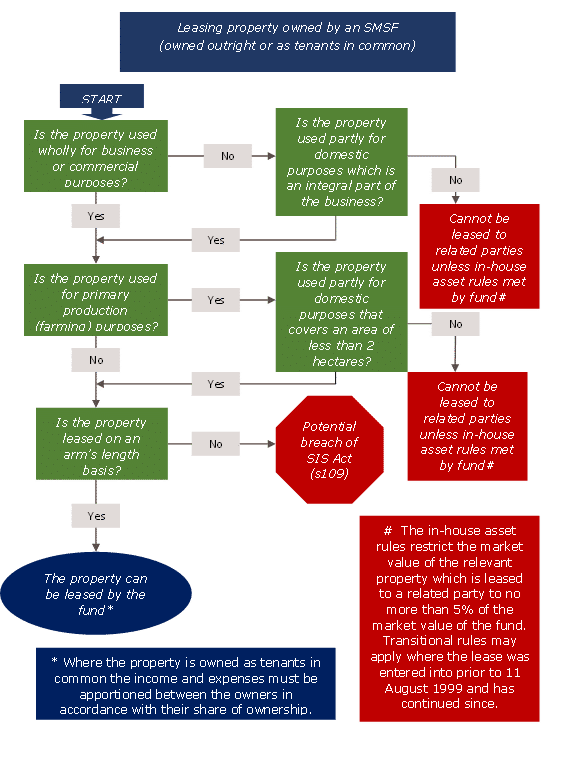

The flow chart at the end of the article may assist you to determine whether a property investment of a superannuation fund can be leased.

Case study 1: Lease of property by a related party

The Kyriazis Superannuation Fund wishes to lease part of a commercial property to a fund member, Bonnie. The property is divided into two separate areas – one area will be leased by the member’s business and the other area is used in the business of an arm’s length party.

It is possible for Bonnie to lease the property as it satisfies the definition of business real property. The lease must be permitted by the fund’s investment strategy and asset allocation. The fund will also need to show that any documents relating to the lease of the property were made on an arm’s length basis.

Case study 2: Lease of a farm to a related party

Con wishes to lease a farming property from his SMSF. The farm is suitable for grazing cattle and has a residence on a one-hectare block.

The property satisfies the definition of business real property as it is a primary production property with an area set aside for residential purposes of no more than two hectares.

Con can lease the farm from the SMSF. As in case study 1, the lease must be permitted by the fund’s investment strategy and asset allocation. The fund will also need to show that the terms of the lease and the documents relating to the property are on an arm’s length basis.

Case study 3: Lease of residential property to a non-related party

The Blue Superannuation Fund has purchased a residential property which is owned as tenants in common with the fund members and is leased to unrelated third parties.

The property can be leased to unrelated third parties providing it is made on an arm’s length basis and is consistent with the fund’s investment strategy. As the property is owned as tenants in common, any income and expenses relating to the property will be split proportionately between the owners.

Case study 4: Proposed lease of residential property by related parties

Max and Sophie’s SMSF recently purchased a residential property at auction. The property is in a convenient location near the beach.

They lease the property out on a short-term basis through a local real estate agent. Every now and then when the property is vacant, they will have a short holiday in it and will not pay rent to the superannuation fund as they consider one day it will be their own.

Under the SIS legislation there appears to be several problems. If the asset is residential property and is used by the members at any time during the year, the value of the property will be included in the measurement of the fund’s in-house assets. This applies irrespective of the length of time the property has been used. If the fund’s value of in-house assets exceeds 5 per cent of the market value of all the fund’s assets, then there is a breach of the rules.