For individuals receiving transition to retirement pensions where they have not yet retired for superannuation purposes or attained age 65, it is also necessary to ensure that total pension payments do not exceed the 10 per cent ceiling applying to transition to retirement pensions.

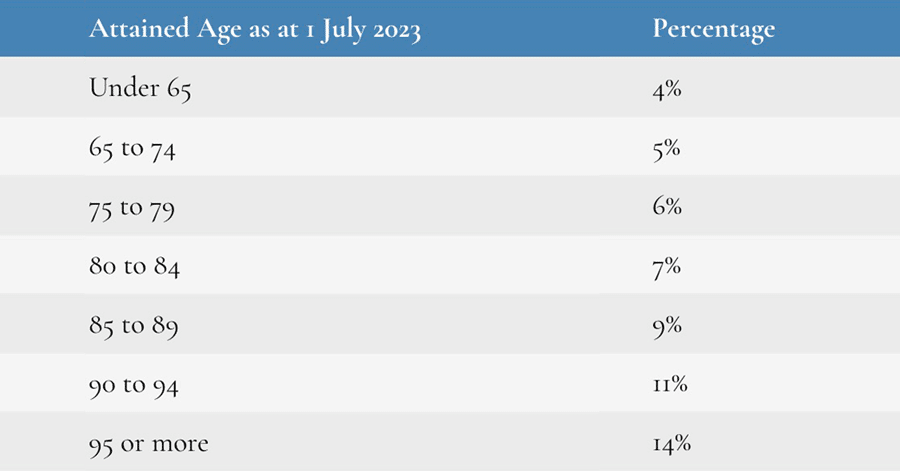

The minimum pension requirement is satisfied, if the total pension payments received by the individual during the 2023–24 financial year equals or exceeds a calculated minimum based upon a percentage of the pension balance at 1 July 2023, where the percentage is related to the attained age of the individual as at 1 July 2023.

The percentage factors are listed below:

Example

If your pension account balance was $200,000 as at 1 July 2023 and your attained age was then 76, the specified percentage is 6 per cent. Consequently, in respect of the 2023–24 financial year, you must receive at least $12,000 in pension payments. It does not matter whether there is only one payment or many payments; it does not matter whether the payments are fortnightly, monthly or quarterly, every 6 months or only once a year. It does not matter even if there is only one payment made on 25 June 2024.

What matters is that in respect of the 2023–24 financial year, at least $12,000 has been taken as a pension.

What to do? Check that sufficient pensions have been or will be made by 30 June 2024. If not make additional pension payments to satisfy the minimum pension requirement.