The Tax Office said it is now aware of a number of schemes that may be used to artificially create or inflate an entitlement to the cash-flow boost, and has warned that it will pursue action against businesses and tax agents that engage in such arrangements.

Those who claim that former employees are still working for them, or who resurrect dormant entities, to wrongfully claim the cash-flow boost have also been identified as key fraudulent schemes.

The list of schemes comes after the ATO and the Tax Practitioners Board warned of “firm and swift action” against tax agents who were caught attempting to defraud the government’s stimulus package.

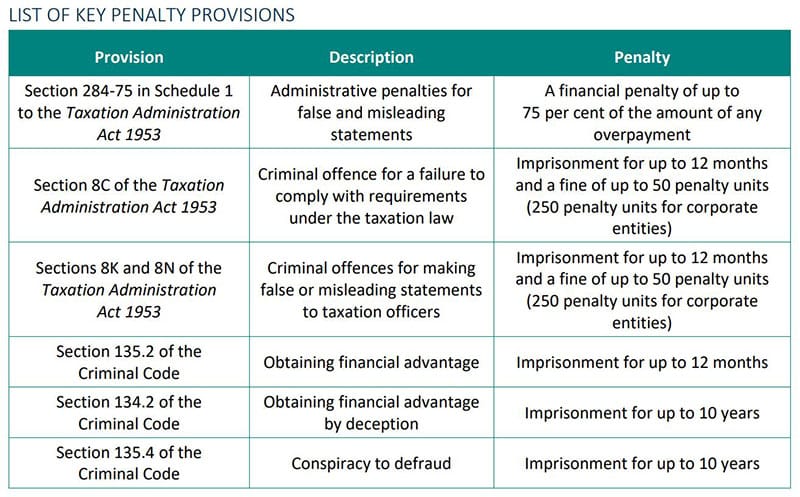

The ATO has now warned that it may pursue unscrupulous agents under promoter penalty laws, with civil penalties of up to 5,000 penalty units for individuals, 25,000 penalty units for bodies corporate, and impositions of up to twice the amount of consideration received or receivable.

Integrity measures built into the JobKeeper legislation will also give power to the Commissioner of Taxation to make determinations around schemes that are carried out for the sole or dominant purpose of obtaining or increasing the $1,500 per fortnight JobKeeper payment.

Glad that the ATO is receiving these warnings. As people who are in the front line, we know too well that the possibility is endless for individuals awaiting such opportunities.

Withdrawal of super is my main concern. We have already heard stories about some wanting to withdraw money, leave in their account and pay for example, deposit for an investment property.