Did you know that psychologically investors are much more impacted by a loss as opposed to a gain?

Research has found “the aggravation that one experiences in losing a sum of money appears to be greater than the pleasure associated with gaining the same amount” (Kahneman & Tversky, 1979).

If your client’s aim is to generate an income to pay their future bills, why have them worry about unnecessary risk?

There is no need to invest in hybrids or shares if you would like to achieve higher returns than deposits. Corporate bonds – which include senior secured debt, senior debt and subordinated debt are the subsequent steps up the risk/ return spectrum. It’s just that few investors know about the securities or how to invest.

What is the risk?

Investment grade bonds are statistically, a very low risk way to invest. According to international credit rating agency, S&P Global Ratings, the historical probability of an investment grade bond issuer failing to make an interest or capital payment is less than 1% – just 0.92%. That is low risk. To learn more see ‘Quantifying the risk of bonds with S&P credit ratings’.

There is a very active global bond market and bond prices fluctuate providing opportunities to buy and sell. But roughly half of FIIG’s investors choose to buy and hold, making investment very simple.

Your clients never have to make the decision to sell unlike many other investments.

So, if your clients do nothing for the term of the bond and the company continues to operate your clients receive predictable interest and capital at maturity. For this reason, bonds complement other higher risk and more volatile investments that your clients might hold in their portfolio and are a straight-forward investment for less financially literate or as gifts for children and grandchildren.

Sample investment grade portfolio

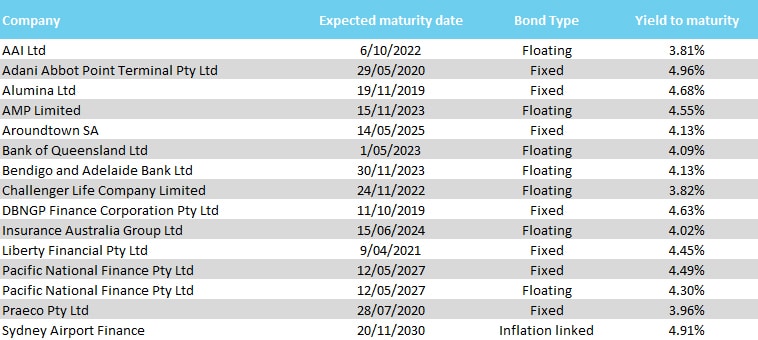

The 15 bonds below are all investment grade and there is a mix of fixed and floating rated bonds and an inflation linked bond, increasing diversification.

Note: The inflation linked bond assumes inflation at 2.5%pa. As at 11 February 2019 a five year term deposit rate from a major bank was 2.75%pa.

To learn more and view FIIG’s latest sample portfolios, including a balanced and high yield approach, please click here.