Since the ATO released its PCG 2016/5, much has been written about the ATO’s requirements for a related-party LRBA to be considered to be within a safe harbour.

But what does that mean, in a practical sense, for the trustee of an SMSF that may have loan terms not fully meeting the PCG 2016/5 guidelines?

Of course, the trustee may choose to ignore the safe harbour provisions and argue that the terms of the related-party loan are on a commercial footing, possibly providing benchmarking data to support that argument.

Alternatively, the trustee may utilise one of the three rectifying options set out in PCG 2016/5, two of which are:

Option 2: refinance the loan with a commercial lender; or

Option 3: sell the asset.

In reality, however, many trustees will wish to take the first rectifying option, which is to ensure that their SMSF is operating within the safe harbour guidelines. So, the question is: how do advisers help them get there?

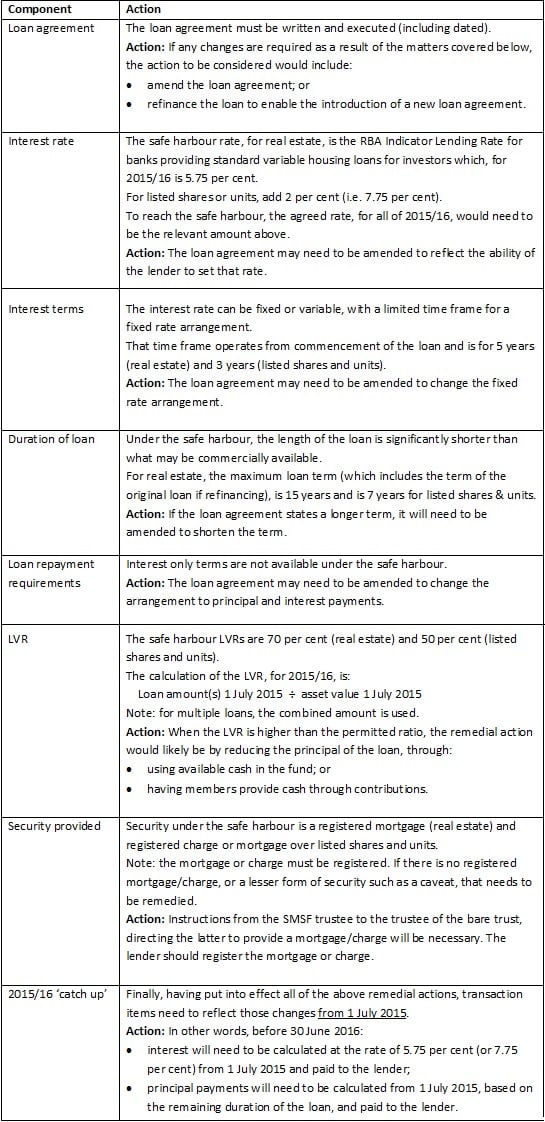

The first step will be to assist trustee clients assess the components of their borrowing arrangement and determine which, if any, need ‘fixing’. The aspects to consider include the:

• loan agreement;

• interest rate;

• interest terms;

• duration of loan;

• loan repayment requirements;

• loan to value ratio (LVR);

• security provided; and

• 2015/16 ‘catch up’.

With the details of the components, the next step is to consider each in isolation and determine what action, if any, needs to be taken, as detailed in the following table:

If all of the above matters are completed before 30 June, trustees can be satisfied that the non-arm’s length provisions of the income tax legislation will not apply to their fund, in regards to their related-party borrowing arrangements.

Unfortunately, we do not have any safe harbour provisions for investments that are not either real estate or listed shares and units, so the suggested course of action for advisers with client SMSFs with other investments is that they benchmark, as closely as possible, the terms of the related-party loan with a loan commercially available.

Michael Harkin, national manager for training and advice, Topdocs