With a new financial year having now started there is no better time to start thinking about strategies to maximise exempt current pension income (ECPI) than right now. For SMSFs who intend on claiming ECPI, there are two methods available: the unsegregated method and the segregated method. For trustees who have elected to use the segregated method by clearly setting aside assets to support their retirement phase income streams, they will receive 100 per cent tax exemption on the income received from these segregated assets. However, for SMSFs that have not elected to segregate their assets, having an understanding of how the actuary’s percentage is calculated as well as how and when deemed segregation applies can allow trustees to implement strategies to maximise their ECPI.

Unsegregated assets method

An SMSF is required to use the unsegregated method for the purpose of claiming ECPI where assets are supporting both retirement phase income streams and non-retirement phase accounts. To calculate ECPI under this method, an actuarial certificate is required. A certified actuary will calculate a tax-exempt percentage that will apply to the SMSF’s ordinary and statutory income received during the unsegregated periods in a given financial year. As specified under section 295.390 of the Income Tax Assessment Act 1997, the formula the actuary uses is:

Average value of current pension liabilities

Average value of superannuation liabilities

In practice, it is essentially the daily weighted average value of the balance of the unsegregated retirement phase income streams divided by the daily weighted average value of the unsegregated total fund balance. The actuary will take into consideration the opening balances as well as timing and amounts of any pension commencements, pension rollbacks, contributions, external transfers in, non-retirement phase withdrawals and retirement phase withdrawals. As the actuary’s percentage is calculated on a daily weighted average, the timing and weighting of a transaction will have a bearing on the actuary’s percentage. Transactions that have a larger weighting with respect to the unsegregated total fund balance or occur earlier in the financial year will be more material to the actuary’s percentage compared to transactions that occur later in the year or are of a lesser amount.

What increases the actuarial percentage?

Opening retirement phase account balances, pension commencements and non-retirement phase account withdrawals can all increase the actuary’s percentage. The larger the opening retirement phase account compared to the opening non-retirement phase accounts, the higher the actuary’s percentage will be (assuming no pension commencements or rollbacks occur). Retirement phase income streams that commenced earlier in the year rather than later can also potentially increase the actuary’s percentage. Furthermore, if an SMSF intends on withdrawing a lump sum from their non-retirement phase account during the financial year, withdrawing it earlier in the year rather than later can also increase the actuary’s percentage.

What decreases the actuarial percentage?

Transactions that either decrease the numerator or increase the denominator in the actuary’s formula will effectively decrease the actuary’s tax-exempt percentage. Opening non-retirement phase account balances, pension rollbacks, contributions, external transfers in and retirement phase withdrawals can all decrease the actuary’s percentage. How much these transactions decrease the actuary’s percentage will depend on the timing and the weighting of the transaction.

In general, SMSFs that have an opening non-retirement phase account balance higher in value compared to the opening retirement phase income streams will result in a lower tax-exempt percentage (assuming no pension commencements or rollbacks). Contributions and external transfers in will increase the fund’s non-retirement phase liabilities; therefore, the earlier they occur in the financial year, the lower the tax-exempt percentage will be. Pension rollbacks and retirement phase withdrawals reduce the fund’s current pension liabilities, meaning they reduce the numerator in the actuary’s formula, resulting in a lower tax-exempt percentage. Therefore, the earlier the pension rollbacks and pension withdrawals occur in the financial year, the lower the tax-exempt percentage will be.

Deemed segregation

Where an SMSF is eligible to use the segregated method in a given financial year and there are periods during the year where the assets are solely supporting retirement phase income streams, those periods will be deemed segregated. Earnings received during these deemed segregated periods will be tax exempt under the segregated method. To understand how deemed segregation can be advantageous toward maximising ECPI, consider the following example:

Example

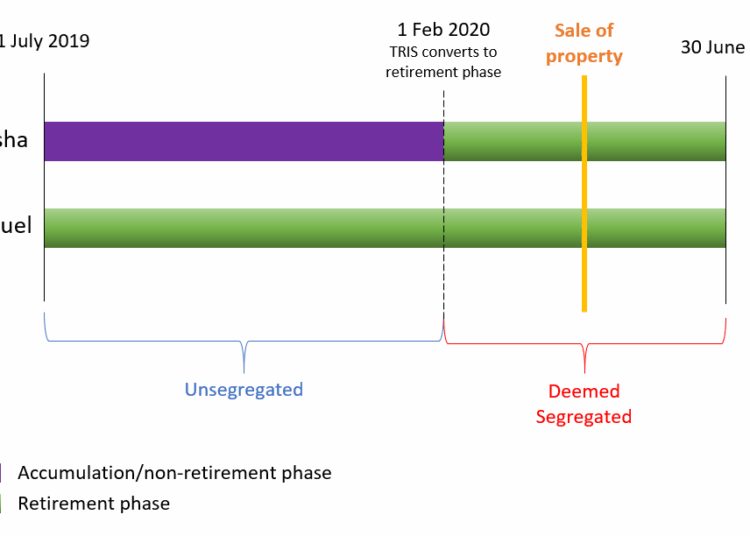

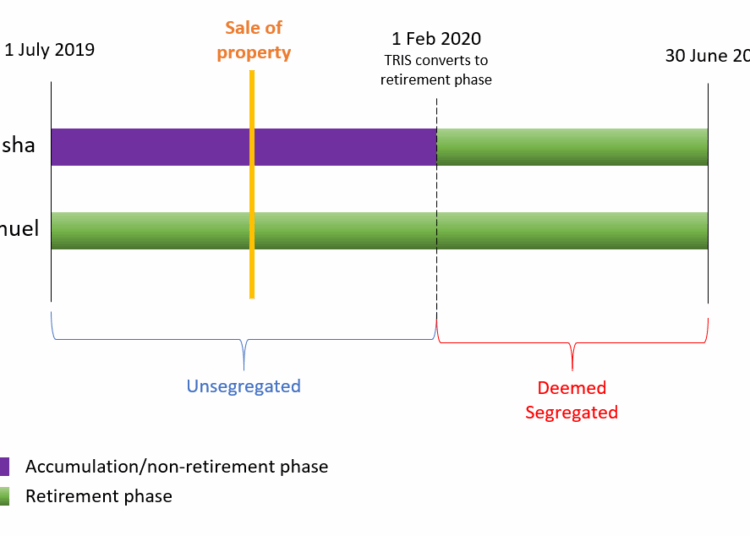

Samuel and Sasha are the two members of the Strategic Super Fund. At 1 July 2019, Samuel’s entire balance of $700,000 is solely supporting an account-based pension, while Sasha’s entire balance of $900,000 is solely supporting a transition to retirement income stream (TRIS) in non-retirement phase. The SMSF is eligible to use the segregated method for the 2020 financial year, and the trustees intend to sell an investment property held by the SMSF in the 2020 financial year.

On 1 February 2020, Sasha will turn 65 and her TRIS will automatically convert to a retirement phase income stream. As the SMSF is eligible to use the segregated method, the trustees identify that if they remain entirely in retirement phase for the period 1 February 2020 to 30 June 2020, then the fund will be deemed segregated for that period of time. Any ordinary or statuary income received during this period will be entirely tax-exempt under the segregated method. Consequently, if the sale of the investment property occurred during the deemed segregated period, then the capital gain realised would be entirely tax exempt.

Alternatively, if the trustees choose to sell the property during the unsegregated period, then the actuary’s percentage would apply. In this example, the actuary’s percentage would be 43.75 per cent, meaning only 43.75 per cent of the capital gain realised will be tax exempt.

It is important to note that if the trustees expected to receive a capital loss from the sale of their investment property, how the capital loss would be treated would be based on whether the sale of the asset occurred during the unsegregated or deemed segregated period. If the sale of the property occurred during the unsegregated period, then the capital loss can be offset against any assessable capital gain, or if it was a net capital loss, then it could be carried forward. Alternatively, if the sale of the property occurred during the deemed segregated period, then the capital loss could not be offset against any other capital gain nor could it be carried forward.

Conclusions

For SMSFs that intend on using the unsegregated method for the 2020 financial year, having an understanding of how the timing and weighting of specific transactions can influence the actuary’s percentage as well as how deemed segregation applies can allow trustees to identify opportunities to increase their ECPI.

Rebecca Oakes, SMSF technical manager, Act2 Solutions