Buying a property off-the-plan (OTP) typically refers to purchasing a property prior to construction starting – i.e. it only exists in plan form. For many, it is an attractive option when compared to buying an established dwelling as buyers often enjoy greater tax benefits, incentives and exemptions or concessions on stamp duty.

However, there are also inherent risks in purchasing OTP. The finished product may differ to the plans or the development may not go ahead at all. Moreover, the time between the OTP sale and the completion and settlement of the dwelling means that OTP buyers are essentially paying today’s prices for a product in tomorrow’s market. This makes sense when the property grows in value. But slowing price growth across all markets has seen sentiment shift. This in turn has given rise to greater settlement risk.

When property values fall, a property may be valued lower on completion than it was at time of purchase. This means that the purchaser requires a larger equity contribution than initially planned. The amount becomes greater if banks are lowering their loan-to-value ratios (LVR), meaning that buyers will need to contribute even more equity to settle their purchase. If the purchaser is unable to do so, then the property is not settled and will likely re-enter market, often at a lower price.

Our analysis has suggested that an established apartment has shown greater capital growth than an OTP apartment. Based on apartments initially sold since 1 January 2011 (and in Sydney since 1 January 2015 to capture the more recent weaker market) and that have since subsequently resold, resales of established apartments have consistently recorded stronger growth than the resale of an OTP apartment. It appears that an OTP apartment price has a premium priced in for being a new apartment compared to existing stock, as well as offering the tax benefits, incentives and exemptions that will not be as significant as for an established property. This in turn has translated into more limited upside in price growth for the first resale.

Table 1 shows that across the inner suburbs (within a 3-5 km radius) of Sydney, Melbourne and Brisbane, OTP apartment resales have realised consistently smaller gains than established apartment resales. In fact, the Melbourne market saw aggregate gains in OTP transactions since July 2011 lose an average 1.3% upon their subsequent resale. Resales of purchases in Sydney since 2015 have seen the highest gains of 18.2%, while its OTP market has still done relatively well, returning aggregate 9% gains on average. The gains seen in Sydney were driven by the more significant upturn in its market, which peaked in 2017. Meanwhile, growth upon resale of apartments in Brisbane has been muted.

Table 1: Total Aggregate Gain on Resales, First Sale After 1 Jan 2011 (2015 in Sydney), Inner City Areas

<Insert chart>

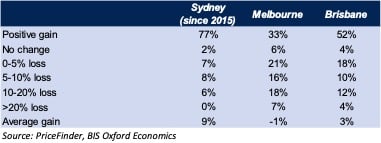

Table 2 shows the magnitude of losses made across OTP transactions in the past seven year period. Around two thirds of OTP transactions in Melbourne since 2011 have recorded zero or negative growth upon resale, while this figure was nearly half (48%) in Brisbane. Looking at more resales of more recent OTP sales in Sydney, around 23% of OTP purchases since 2015 in Sydney recorded zero gain or a loss. Despite the aggregate gain of 9% in Sydney resale prices, even in the prior three years, it appears many OTP buyers have recorded losses.

Notably, the number of losses on OTP purchasers of 10% or more is greatest in Inner Melbourne, at around one in four resales. This can be attributed to the high level inner city supply in Melbourne in recent years, as well as the stamp duty saving for investors available to OTP buyers in Victoria up to 2017. The high level of recent supply in inner Brisbane has also seen 16% of OTP sales record losses of 10% or more on resale. This compared with 6% of resales in Sydney recording 10%+ losses. With losses at 10% or more, this would mean an OTP buyer would have effectively lost the 10% deposit at point of purchase and will be required to come up with additional equity at settlement (particularly if banks are requiring lower LVRs as well).

Table 2: Percentage of OTP Sales Recording Gains and Losses, Inner City Areas

Comparing OTP purchases across apartment type, some segments have clearly done better than others. One bedroom apartments have typically performed weaker than two and three bedroom apartments in Melbourne and Brisbane. This could be due to the concentration of investor activity in the smaller, more affordable one bedroom apartment type while owner occupier demand is focussed in the three bedroom and to some extent, two bedroom stock. The exception has been Sydney, where average gains have been greater for one bedroom apartments. This may suggest that larger OTP apartments in Sydney are overpriced relative to smaller apartments. It may also be that the presence of legislation governing apartment design in Sydney (SEPP 65) has meant that apartments are equally attractive to owner occupiers and investors, and this has helped to support values for the smaller one bedroom apartments.

Table 3: OTP Aggregate Gains Upon Resale by Apartment Type, Inner City Areas

With apartment prices expected to fall further in 2019, the percentage of OTP apartment purchases recording a loss upon resale is expected to rise. In particular, the resale performance of one bedroom apartments in Melbourne and Brisbane compared to two and three bedroom apartments is a cause for concern for investors. Losses to purchasers reduce the attractiveness to subsequent investor buyers and will increase settlement risk, particularly in inner city pockets and in buildings where investors make up a large component of demand. If an increasing number of apartments do not settle, unsold stock will re-enter the market, often at a lower price, pushing prices further down. On a large enough scale, developers may also not be able to meet their finance commitments, resulting in more defaults and stock sold off quickly at a discount to cover debt.

Moreover, the possibility of changes to negative gearing policy upon a change of government at the next Federal election may have an additional negative impact upon OTP resales. The removal of negative gearing benefits from established dwellings and quarantining it to new dwellings will further reduce the value of established dwellings relative to new dwellings and is likely to exacerbate resale losses. Alternatively, it could be a drag on OTP prices, despite the negative gearing benefits that OTP purchases enjoy. As indicated above, OTP buyers already pay a premium over established dwellings, so the removal of negative gearing for the property once it is resold will necessitate a significantly wider premium that an OTP purchaser may be unwilling to pay.

Angie Zigomanis, associate director, residential property, BIS Oxford Economics

In my experience most OTP properties bought by SMSF Trustees are bought without planner advice and sometimes against planner advice. One solution for Trustees who may fail to settle because the bank pulls the plug and they don’t have any more equity to put in might be to fractionalise the propertyand share the investment with one or two other SMSFs. Might be a better solution to losing the deposit.

Hmmm, and what style of property do most planners, who provide, advocate or refer a property ‘solution’, direct their clients to? Yes, new and OFP. I’d suggest they are the real property spruikers putting ordinary Australians at risk. Shame. Moreover, are they being called out by their peers? Nah, nothing to see here.