The introduction of the transfer balance cap measures led to significant activity for SMSF advisers and their clients in the lead up to 1 July 2017.

With the pre-1 July 2017 planning and compliance activities now in the rearview mirror, advisers should take time to properly appraise their clients’ succession planning issues. This is particularly significant in the context of the transfer balance cap measures and their impact on reversionary income streams.

Reversionary and non-reversionary income streams

A distinction is made under the taxation laws between non-reversionary death benefit income streams and reversionary death benefit income streams.

A non-reversionary death benefit income stream is a new superannuation income stream created and paid to a dependant beneficiary or beneficiaries following the death of the member. The Commissioner of Taxation takes the view that such an income stream arises broadly where the fund trustee exercises a discretion to determine to whom the death benefit is paid, the form that it will be paid, or the value of the death benefit.

This contrasts with reversionary death benefit income streams, which automatically revert to specified beneficiaries, because the governing rules or the pension rules under which the pension is provided expressly provide for such reversion.

Importance of the distinction

The difference in the transfer balance cap treatment between non-reversionary and reversionary death benefit income streams is significant. In particular:

- if the income stream is a non-reversionary death benefit income stream, the credit to a recipient beneficiary’s transfer balance account will occur on the “starting day”. The “starting day” is the day the beneficiary starts to be the recipient of the income stream. The value of the credit will be the value on the starting day of the superannuation interest that supports the superannuation income stream (which may include post-death earnings); whereas

- if the income stream is reversionary, the credit will arise in the reversionary beneficiary’s transfer balance account 12 months after the death of the primary beneficiary (being the “starting day”). The value of the credit will be the value of the interest supporting the income stream on the date of the primary beneficiary’s death.

In the latter case, post-death earnings on the deceased member’s account balance will automatically accrue to the pension interest without giving rise to additional credits to the recipient’s transfer balance account.

Further, a reversionary income stream will not cease on the death of a primary beneficiary and therefore the recipient will inherit the tax-free and taxable components of the income stream. In contrast, a non-reversionary death benefit income stream is created from a deceased member’s accumulation balance and may therefore have reset tax-free and taxable components.

Planning choices for reversionary pensions

Careful planning is required for members with transfer balance accounts at or close to $1.6 million. Where a member expects that the payment of a death benefit income stream will cause the recipient to exceed their transfer balance cap, the member should consider making the income stream reversionary so that the recipient has 12 months from the date of the member’s death to make important commercial and tax decisions regarding their superannuation affairs. These decisions include:

- Whether to internally or externally commute the recipient’s existing pension (if any) to comply with the recipient’s transfer balance cap;

- How to maximise the use of the recipient’s transfer balance cap; and

- How to deal with assets such as real property, that is, whether property should be converted to cash (bearing in mind potential capital gains tax and stamp duty costs).

It should be noted in this regard that it is not possible to internally commute a deceased member’s reversionary pension in a fund such that the interest supporting that pension forms part of the recipient’s accumulation account balance.

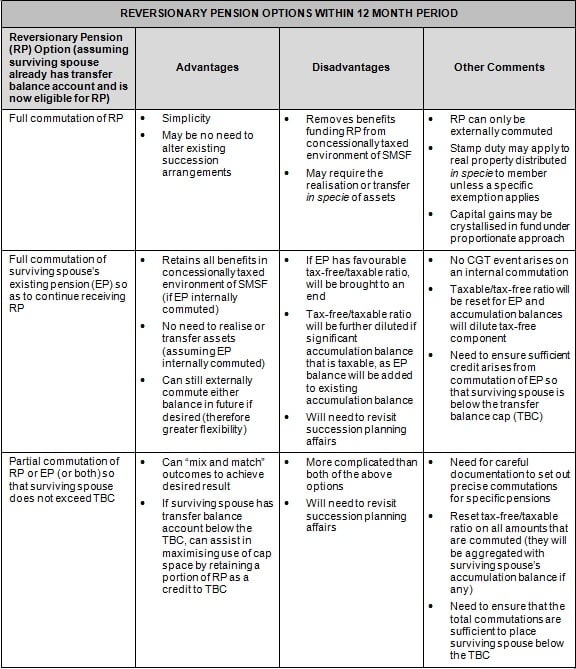

A summary of the potential options that may be available to a reversionary beneficiary is set out in the table below.

It may be seen that there are a number of potential trade-offs and issues to consider in evaluating the options available in dealing with reversionary pensions under the transfer balance cap regime. Careful planning is required in order to ensure that members are able to maximise outcomes.

By Peter Slegers, partner and Daniel Marateo, lawyer, superannuation group, Cowell Clarke

Can a surviving spouse who receives a reversionary pension in a smsf and does not wish to continue with the smsf, roll the pension over to a retail/industry fund. I can only find comments relating to death benefit pensions in this scenario and not reversionary pensions.

While tax and commercial considerations are important we must also acknowledge that having that 12 months to allow the survivor to deal with grief and sometimes having to take control at their own financial situation for the first time without a spouse to run things past, makes the reversionary option the most client client friendly option too. I just sat with a recent widow last week and she made it clear that she was overwhelmed and would need us to “take it easy on her and walk her through her options slowly in a few months time” as she just could not focus at present. I know tax and succession planning are crucial but if they have not done it before death, then the months after a loss are not the time to be developing complex strategies. We must get used to exit planning right from the start of an SMSF and not dance around the subjects of death or disability.