Introduced in the Treasury Laws Amendment (Fair and Sustainable Superannuation) Act 2016, the decision to use the unsegregated or segregated method for the purpose of claiming Exempt Current Pension Income (ECPI) will no longer be a choice for some SMSFs.

The effects of these changes are outlined in the newly added section 295.387 of the Income Tax Assessment Act 1997.

Beginning from 1 July 2017, an SMSF will be unable to use the segregated assets method for the purposes of claiming ECPI in a given financial year if all of the following circumstances are satisfied:

- At any time during the given financial year there is at least one superannuation interest supporting retirement phase within the SMSF

- Just prior to the start of the given financial year, a member within the SMSF has a Total Superannuation Balance that exceeds $1.6 million and they are also a recipient of a retirement phase income stream (whether it is inside or outside the SMSF), and

- At any stage during the financial year, the same member holds a superannuation interest (accumulation or retirement phase) within the SMSF.

If a fund falls into this category, then it will be required to use the unsegregated method for the purposes of claiming ECPI for the given financial year. The fund will need to obtain an actuarial certificate to determine the proportion of tax exempt income.

Example 1: An SMSF ineligible to use segregated method

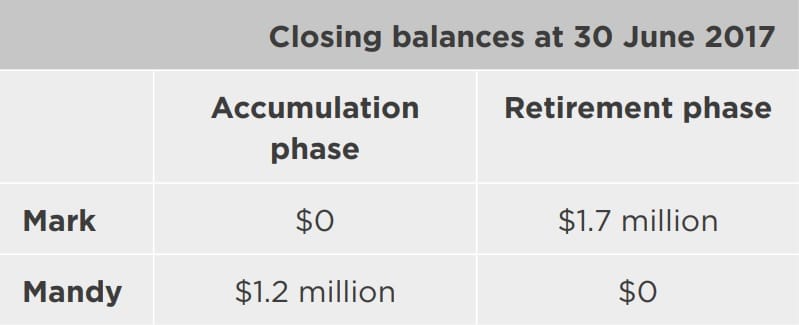

Mark and Mandy are the two sole members of Money Tree Super Fund. At 30 June 2017, Mark holds a superannuation interest valued at $1.7 million which supports an Account Based Pension (ABP) and continues to receive this pension into the 2018 financial year. Mandy holds an accumulation interest which is valued at $1.2 million and continues to be in full accumulation phase for the 2018 financial year.

Can the fund use the segregated method for the 2018 financial year? Let’s consider the facts:

- Mark holds a superannuation interest supporting retirement phase within the SMSF during the 2018 financial year

- Mark’s total superannuation balance exceeds $1.6 million and he is also a recipient of a retirement phase income stream just prior to the start of the 2018 financial year

- The member who has a total superannuation balance higher than $1.6 million (Mark) also holds a superannuation interest in the SMSF within the 2018 financial year

Outcome

The SMSF is ineligible to use the segregated method and must use the unsegregated method for the purposes of claiming ECPI for the 2018 financial year. An actuarial certificate will be required and must apply to the full year of income.

Example 2: An SMSF ineligible to use segregated method when there are superannuation funds outside the SMSF

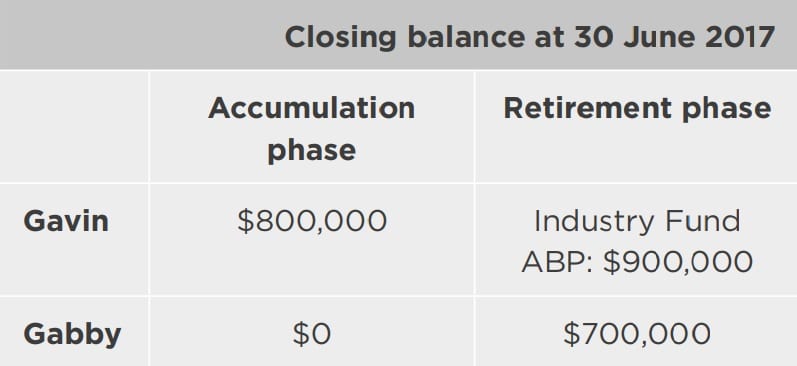

Gavin and Gabby are members of End of the Rainbow Super Fund. At 30 June 2017, Gavin has an accumulation interest valued at $800,000, whilst Gabby holds an ABP valued at $700,000. Outside the SMSF, Gavin is receiving an ABP from his Industry Super Fund which is valued at $900,000 on 30 June 2017. All superannuation interests continue to be held by the members into the 2018 financial year.

Can the SMSF use the segregated method? Let’s consider the facts:

- Gabby holds a superannuation interest supporting retirement phase within the SMSF in the 2018 financial year

- Just prior to the beginning of the 2018 financial year, Gavin’s Total Superannuation Balance exceeds $1.6 million and he is also a recipient of a retirement phase income stream

- The member who has a Total Superannuation Balance higher than $1.6 million (Gavin) also has a superannuation interest in the SMSF within the 2018 financial year

Outcome

The SMSF is ineligible to use the segregated method and must use the unsegregated method for the purposes of claiming ECPI for the 2018 financial year.

An actuarial certificate will be required and must apply to the full year of income.

Example 3: An SMSF eligible to use the segregated method

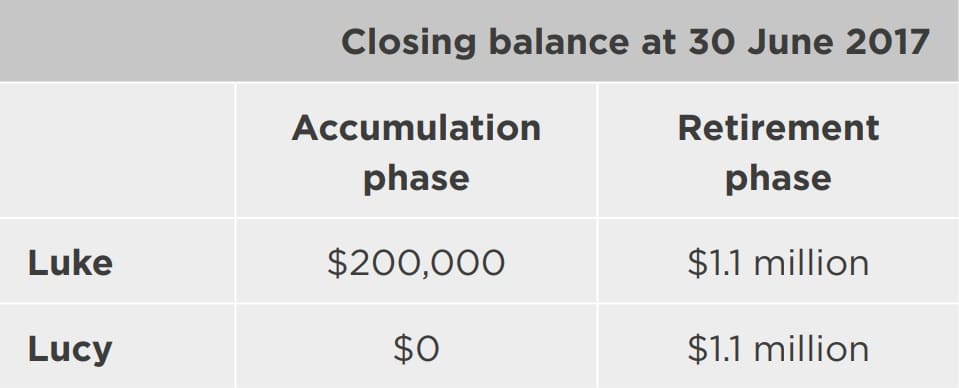

Luke and Lucy are members of the Lucky Superannuation Fund. Both members hold an ABP valued at $1.1 million each on 30 June 2017. Luke also holds an accumulation interest valued at $200,000 on 30 June 2017.

Can the SMSF use the segregated method? Let’s consider the facts:

- Luke and Lucy both hold a superannuation interest within the SMSF that is supporting retirement phase in the 2018 financial year

- Neither member has total superannuation balance that exceeds $1.6 million

Outcome

The fund is eligible to use the segregated assets method for the purposes of claiming ECPI for the 2018 financial year so long as the assets supporting retirement phase have been clearly set aside and can be clearly identified from the accumulation assets.

NOTE: If the assets supporting retirement phase are not clearly identifiable from the accumulation assets, and the fund moves into 100 per cent retirement phase during the 2018 financial year, the ‘deemed segregation’ method must be used for the period the fund is solely supporting pension phase.

Example 4: An SMSF in full pension and ineligible to use segregated method

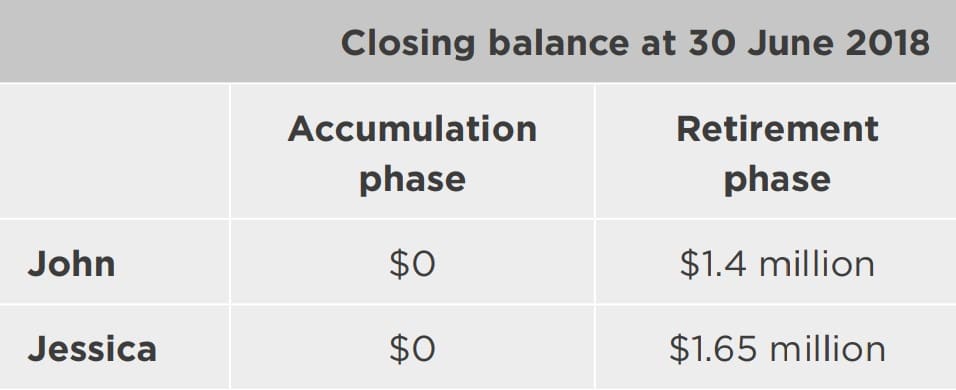

John and Jessica are members of the Lazy Days Super Fund. Both members hold an ABP valued at $1.4 million and $1.65 million on 30 June 2018, respectively. Jessica originally commenced her ABP on 1 July 2017 with $1.5 million; however, by 30 June 2018 the pension had grown to $1.65 million due to earnings. John and Jessica continue to receive their ABPs into the 2019 financial year and remain entirely in retirement phase.

Can the SMSF use the segregated method? Let’s consider the facts:

- John and Jessica both have a superannuation interest supporting retirement phase within the SMSF in the 2019 financial year.

- Jessica has a total superannuation balance exceeding $1.6 million and is receiving a retirement phase income stream just prior to the start of the 2019 financial year.

- The member who has a total superannuation balance higher than $1.6 million (Jessica) also holds a superannuation interest within the fund during the 2019 financial year.

Outcome

The Fund is ineligible to use the segregated method and must use the unsegregated method for the purposes of claiming ECPI for the 2019 financial year.

An actuarial certificate will be required and apply to the full year of income. As all the superannuation liabilities are supporting pension liabilities, the actuary’s tax exempt percentage will be 100 per cent tax exempt.

Conclusion

An SMSF that is intending on using the segregated assets method for the purposes of claiming ECPI will need to ensure that their SMSF is eligible to use this method just prior to the beginning of the given financial year. Such oversights may result in unfavourable tax implications being imposed on the fund.

Rebecca Oakes, SMSF technical manager, Act2 Solutions

Good article – Example 1 – will Mark receive an excess transfer balance determination for the $100,000 that is in retirement phase and in excess of the $1.6m cap as at 30 June 2017?