The digital currency bitcoin operates as a decentralised peer-to-peer payment system. It enables online payments to be transferred directly without an intermediary. Imagine there is an Excel spreadsheet containing all the transactions that have ever been conducted in the digital currency. Imagine too, that this spreadsheet is duplicated across a network of millions of computers that are updated in real time. No matter how many changes are made, by how many users, everyone has an identical up-to-date version of this spreadsheet. This is the essence of the technology behind bitcoin, a mass-distributed, single and identical public ledger called the blockchain.

The beauty of blockchain technology lies in the fact that transactions are incorruptible and irreversible. The transactions are grouped and added to the public ledger in blocks. These blocks cannot be controlled by any single entity and there is no single point within the block vulnerable to failure. The verdict from around the world is that this technology is here to stay with multiple future applications possible.

Bitcoin is designed to be pseudonymous. The creator of bitcoin itself is pseudonymous – created as it was by the mysterious Satoshi Nakamoto. His or her identity has remained unknown since bitcoin first emerged in 2008.

Transacting bitcoin

In order to purchase bitcoin, you need to have a “bitcoin wallet”. A wallet is a software program (there are many providers of such software). Once the necessary software has been downloaded, you have, in essence, opened a “bank account” with a zero balance.

A wallet stores and manages your “public key” and “private key”. The public key is for receiving money and the private key for spending money. The public key and the private key are mathematically related. A private key can be transformed mathematically into a public key, but this function can only to performed in one direction. It is impossible to reverse the calculation, therefore it is safe to reveal the public key. An address is a hashed version of the public key, which basically means a bitcoin address would look something like this:

1EHNa6Q4Jz2uvNExL497mE43ikXhwF6kZm

Sometimes the terms public key and addresses are used interchangeably. In practice, a bitcoin address as it appears above is used to receive bitcoin. Each time bitcoin is received, a new address is created by the wallet.

It’s crucial that the private keys remains confidential. Anyone having access to a private key has complete control over the stored bitcoin. Anyone having access to a wallet also has access to all the private keys in it. A wallet may have the function to export private keys. It is important that both the wallet and the private key are kept secure.

The wallet also keeps track of the transactions made, with time stamps on each transaction.

Challenges for SMSF compliance

One compliance challenge for investing bitcoin in an SMSF is that the wallet does not have the SMSF title on it. A wallet does not have any title on it. While title and ownership are fundamental concepts for SMSF compliance, bitcoin is pseudonymous by design.

An online wallet can potentially show the trustee’s name. However, it is not recommended to have private keys stored online, especially when the investment is significant. Blockchain technology itself is robust, but private keys and passwords are still vulnerable in traditional ways.

In theory and in reality, one can have multiple wallets. Each time a transaction occurs, there is a new address to it. It can be messy to create an audit trail.

Compliance traps

(1) Reg 4.09A Separation of assets

Investments in an SMSF must be clearly identifiable as being owned by the SMSF and clearly separate from assets held by the trustees in their personal capacity.

It is critical that an individual’s wallet is separate from a wallet dedicated to the SMSF. Otherwise it is an immediate breach of the separation of assets.

(2) S66 Acquisition from related party

Bitcoin can not be used as an in specie contribution and the SMSF can’t purchase bitcoin from its members as it is neither a listed security nor a commercial property. It must be purchased with cash in the fund from an unrelated party.

(3) Reg 4.09 Investment strategy

The trustee must formulate and give effect to the investment strategy. Bitcoin is no doubt highly volatile based on historical pricing; the decision to invest in bitcoin needs to be reflected on in the fund investment strategy.

Another consideration is that bitcoin may not fall into any existing asset class in the investment strategy. Bitcoin is not cash, it doesn’t have a physical form, therefore is not classified as a collectable, and it is technically a right. It is recommended that cryptocurrency is added as a separate asset class.

(4) Trust deed

I would imagine an existing normal trust deed would not specifically allow or disallow investing in bitcoin. It is prudent to check the fund trust deed, and hopefully the definition is not too narrow.

Audit bitcoin in SMSF

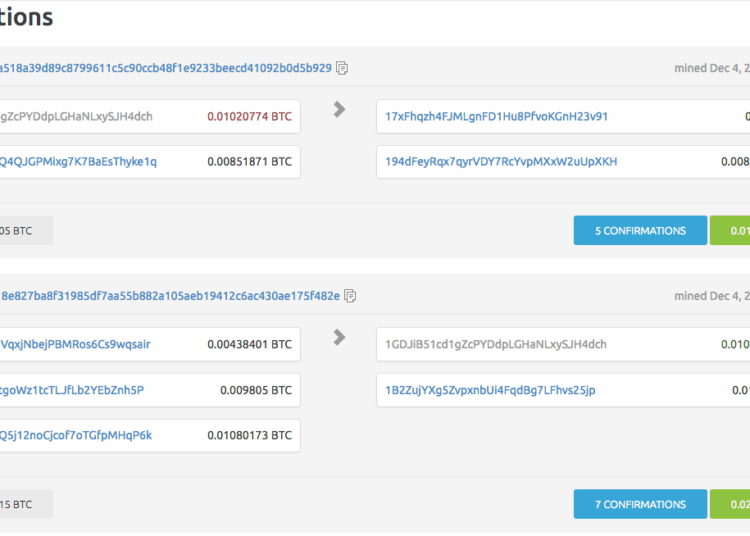

The good news for auditors is that we can have access to this single public ledger. Websites such as https://blockexplorer.com allow input of an address or transaction ID to get detailed data of that transaction. Third party verification for auditors is possible. We can obtain a transaction list generated by the SMSF wallet in Excel and verify the holding.

For example, if we input the following address to search:

1GDJiB51cd1gZcPYDdpLGHaNLxySJH4dch

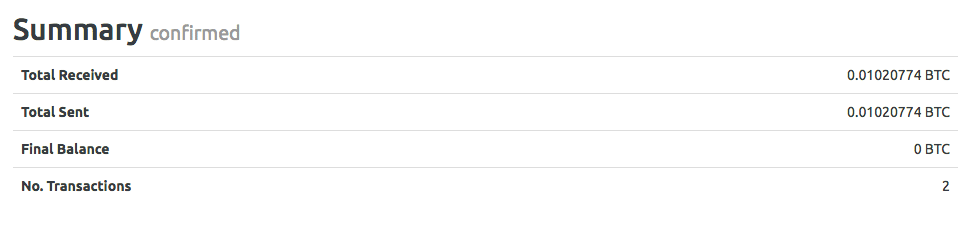

We discover this address has received 0.01020774 Bitcoin and that it is all spent. We can also see when it was purchased and when it was sold. The green ‘U’ in brackets on the right means the holding is not sold, the red ‘S’ means the holding is sold. Even if a holding is partially sold, it will still show a red ‘S’. Once a holding is partially sold, the remaining amount will be under a new address.

The trustees need to provide an acknowledgement of trust over the bitcoin if the SMSF is not on title. The trustees will also need to sign a declaration that they can still recover the asset and that their private keys and passwords are safe. They should also declare that the wallet they use is secure. Of all the types of wallets available, online wallets are the least secure.

When the holding is immaterial, the above evidence plus a screenshot of a wallet balance and transactions should be sufficient.

When the holding is significant, we need to verify ownership. That is, the super fund owns the address and has not merely copied it from elsewhere. Message signing is one method of proving control of a particular address.

The mechanism of message signing is similar to the mechanism of how private keys and public keys work. Some wallets have a message signing function. If a wallet doesn’t have such a function, it will be quite a hassle to achieve the same function by oneself.

Auditors can use the following site to verify a message: tools.bitcoin.com/verify-message

The ATO’s view

TD 2014/25 is the most comprehensive ATO interpretation on bitcoin. Based on the levels of use and acceptance of bitcoin within the community in 2014, the commissioner concluded that “it is far short of what may be regarded as sufficient or necessary to satisfy the test in [Moss v Hancock], nor is it a generally accepted medium of exchange as per Travelex”. Accordingly, bitcoin does not satisfy the ordinary definition of money.

In the legislative context, paragraph 32 states “Parliament intended to use the term ‘currency’ in the same sense that currency is used in the Currency Act – namely a currency legally recognised and adopted under the laws of a country…”. Therefore, bitcoin is neither Australian currency nor foreign currency. It is not currency.

In TD 2014/26 it is considered that “the bundle of rights ascribed to a person with access to the bitcoin under the bitcoin software and by the community of bitcoin users” amounts to a property within the meaning of paragraph 108-5(1)(a). Bitcoin is a CGT asset.