Editor’s Note: India’s financial year 2023-24 ended as of March 31. This update will review the highlights of the Indian FY 2023-24.

India’s benchmark index, the Nifty 50 Index, represents the country’s top 50 blue-chip companies across various sectors. The index has notched several record highs this financial year from reaching 19,000 in June 2023 to surpassing 21,000 in December 20231. As for the 2024 calendar year, Nifty crossed the 22,000 mark in January and recorded a new record high of 22,525 in March.2

Overall, the Nifty’s strong performance can be attributed to robust retail participation and Foreign Portfolio Investor (FPI) inflows due to buoyant economic growth, healthy macro-economic indicators like fiscal deficit, Goods and Service Tax Collection etc, robust corporate earnings and political stability.

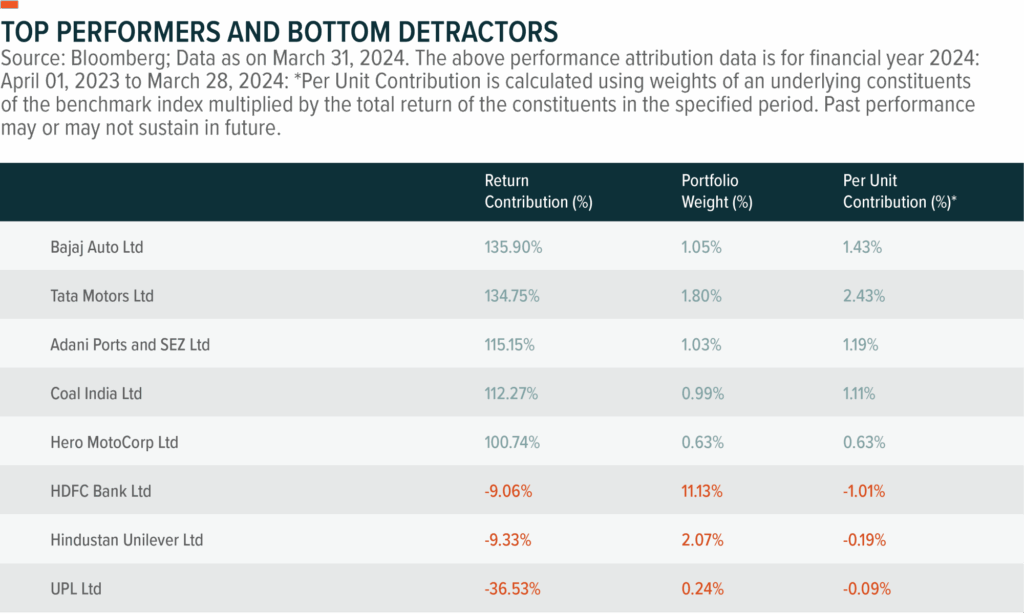

Throughout this bullish run, the Nifty 50 Index generated a staggering return of 30.08%. 47 out of 50 blue-chip companies in the Nifty 50 Index surged by over 25% with five delivering more than 100% returns in FY 2023-243. Notably, three of these high-performing stocks belong to the auto sector, which benefitted from strong sales and decreased raw material costs, bolstering their gross margins.

Top Five Performers of the Nifty 50 index for FY24.

Bajaj Auto Ltd: Bajaj Auto emerged as Nifty 50’s best-performing large-cap of FY24 with a remarkable return of 135.90%. Investors lapped up shares of the two-wheeler company on the back of a premiumisation trend in the 350+cc two-wheeler sector4. The company’s sizeable Rs.4,000 crore stock buyback also lifted sentiment for the stock.5

Tata Motors Ltd: Tata Motors was the second best-performing stock of FY24. Investors favoured the company based on strong prospects for its luxury arm, Jaguar and Land Rover, as well as its growing presence in the electric vehicle space.6

Coal India Ltd: The country’s general increase in power demand and growing electrification has sent the coal miner’s stock higher over the last several months.

Adani Ports and Special Economic Zone Limited: After the meltdown at the end of the previous fiscal year following allegations of stock manipulation by American short-seller Hindenburg Research, shares of Adani conglomerate’s flagship ports company made a strong comeback in FY24. Adani Ports and Special Economic Zone was among the best Nifty performers delivering nearly 115.15% return on the back of the growing prospects for India’s ports sector and its strong standing in this space.

Hero MotoCorp Limited: Another auto stock making its way in the best-performing large-cap of FY24 with a return of 100.74%.7 The company recently announced a series of new vehicles, and investors have sent the stock higher on hopes of a recovery in rural demand and growing premiumisation in the sector.

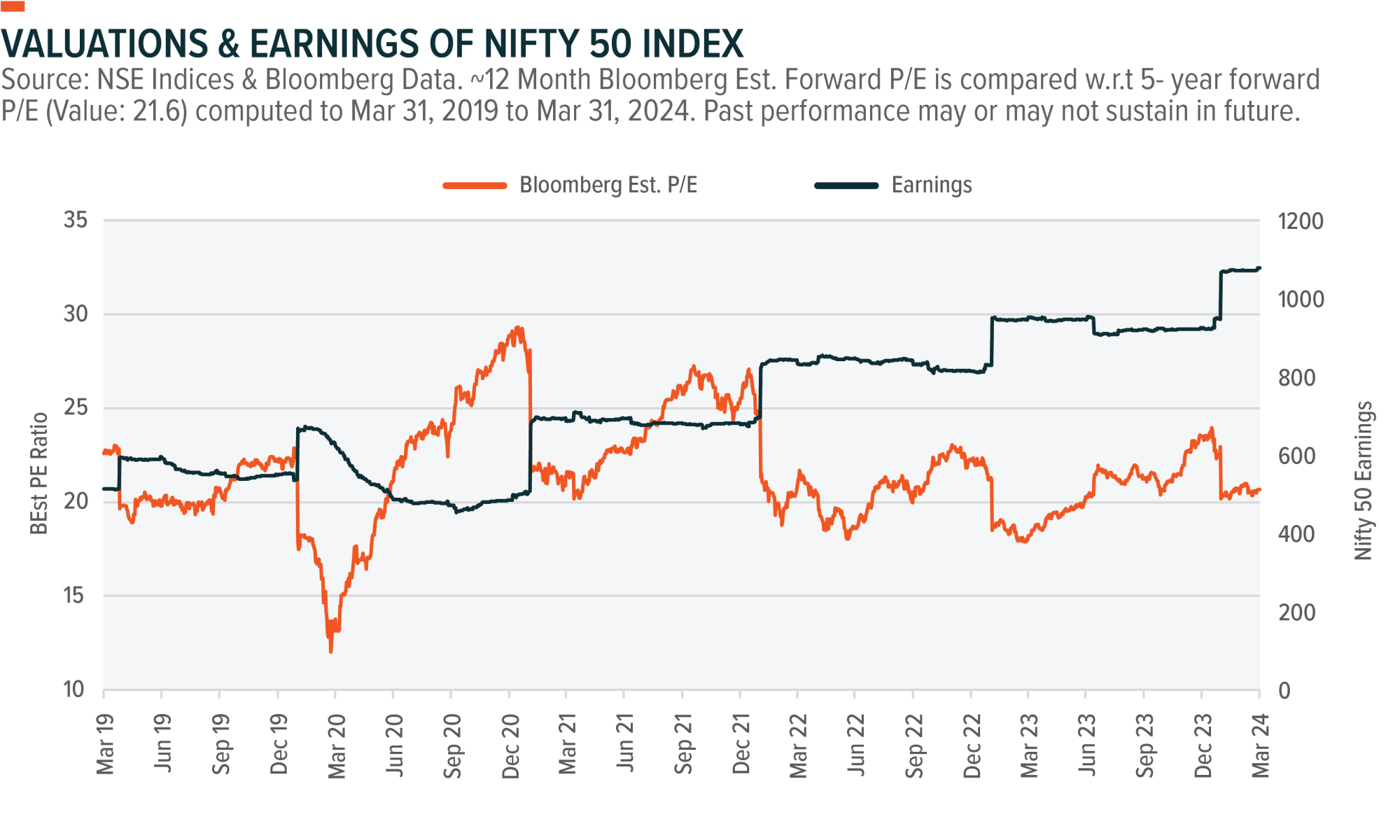

Valuations:

As of March 31, 2024, the Nifty 50 index trades at a forward-looking PE ratio of 20.7x, which represents a slight discount of ~3% compared to its 5-year average of 21.6x.

Forecasts are not guaranteed, and undue reliance should not be placed on them. This information is based on views held by Global X as of 17/04/2024.

Past performance is not a reliable indicator of future performance.

Diversification does not ensure a profit nor guarantee against a loss. Brokerage commissions will reduce returns. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results.

1Bloomberg. Data as on March 31, 2024.

2Ibid

3Bloomberg. Data as on March 31, 2024.

4Bloomberg; Data as on March 31, 2024; Financial Year Performance Period is considered for all stocks: Apr 1., 2023 – Mar 28, 2024

5(January 8, 2024). Bajaj Auto board approves Rs 4000-crore share buyback at Rs 10,000 each.

6Bloomberg; Data as on March 31, 2024; Financial Year Performance Period is considered for all stocks: Apr 1., 2023 – Mar 28, 2024

7Ibid

Disclaimer

This document is issued by Global X Management (AUS) Limited (“Global X”) (Australian Financial Services Licence Number 466778, ACN 150 433 828) and Global X is solely responsible for its issue. This document may not be reproduced, distributed or published by any recipient for any purpose. Under no circumstances is this document to be used or considered as an offer to sell, or a solicitation of an offer to buy, any securities, investments or other financial instruments. Offers of interests in any retail product will only be made in, or accompanied by, a Product Disclosure Statement (PDS) which is available at www.globalxetfs.com.au. In respect of each retail product, Global X has prepared a target market determination (TMD) which describes the type of customers who the relevant retail product is likely to be appropriate for. The TMD also specifies distribution conditions and restrictions that will help ensure the relevant product is likely to reach customers in the target market. Each TMD is available at www.globalxetfs.com.au.

The information provided in this document is general in nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information in this document, you should consider the appropriateness of the information having regard to your objectives, financial situation or needs and consider seeking independent financial, legal, tax and other relevant advice having regard to your particular circumstances. Any investment decision should only be made after obtaining and considering the relevant PDS and TMD.

This document has been prepared by Global X from sources which Global X believes to be correct. However, none of Global X, the group of companies which Mirae Asset Global Investments Co., Ltd is the parent or their related entities, nor any of their respective directors, employees or agents make any representation or warranty as to, or assume any responsibility for the accuracy or completeness of, or any errors or omissions in, any information or statement of opinion contained in this document or in any accompanying, previous or subsequent material or presentation. To the maximum extent permitted by law, Global X and each of those persons disclaim all any responsibility or liability for any loss or damage which may be suffered by any person relying upon any information contained in, or any omissions from, this document.

Investments in any product issued by Global X are subject to investment risk, including possible delays in repayment and loss of income and principal invested. None of Global X, the group of companies of which Mirae Asset Global Investments Co., Ltd is the parent, or their related entities, nor any respective directors, employees or agents guarantees the performance of any products issued by Global X or the repayment of capital or any particular rate of return therefrom.

The value or return of an investment will fluctuate and an investor may lose some or all of their investment. All fees and costs are inclusive of GST and net of any applicable input tax credits and reduced input tax credits, and are shown without any other adjustment in relation to any tax deduction available to Global X. Past performance is not a reliable indicator of future performance.