Key takeouts:

- Three quarters of older Australians face an uncertain future and need access to affordable financial advice.

- A move to more principles-based regulation will encourage innovation in financial services.

- The key to disseminating quality personal advice to the masses in the short-to-medium term lies in greater use of technology to automate processes and drive efficiencies, supported by accommodative public policy and reform.

- The next few years will see advancements in advice tech and the emergence of new advice models.

Australia’s pension funding shortfall is a mammoth, looming crisis.

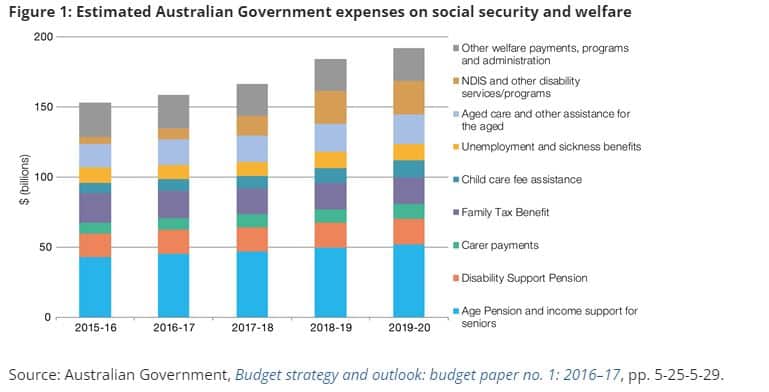

By 2025/26, it is estimated that government expenditure on the Age Pension, which only provides for a modest retirement lifestyle, will jump to $72 billion per annum. (1)

Graph: Australian government expenses on the Age Pension and social security 2015-2020

This gap is due to a combination of inadequate and uncertain income in retirement, leaving three quarters of older Australians facing a bleak future. (2)

According to the Aegon Retirement Readiness Index, which examines and quantifies the retirement awareness and savings of 15 countries on a scale of 0-10, Australians are straddling the border of medium-to-low readiness, with a score of 6. (3)

We lag countries including the United States, Brazil and China.

Furthermore, after decades of being celebrated as one of the best retirement systems in the world, Australia dropped to sixth place in the 2022 Mercer and the CFA Institute Global Pension Index, let down by a score of just 70.2 for adequacy and 77.2 for sustainability, despite a high score of 86.8 for integrity. (4)

The report cited a lop-sided focus on accumulation and called for greater attention on retirement income, in light of Australia’s ageing population.

The answer to this $72+ billion problem is simple but definitely not easy.

Australians need access to affordable personal financial advice.

Will the Treasury proposals provide a solution?

Pleasingly, this is the focus of the government’s Quality of Advice Review. As stated by Treasury, “the purpose of these reforms is to simplify the regulatory framework to better enable the provision of high quality, accessible and affordable financial advice”.

Bell Direct is broadly supportive of Treasury’s proposals to date.

We agree with Treasury’s observation that the compliance burden on advice businesses has driven the cost of financial advice beyond the reach of the average Australian.

This is glaringly apparent when comparing the cost of engaging other professionals.

The starting price to see a doctor in Australia is around $90 for a 10 minute consultation; $150 for a specialist. Similarly, accountants charge around $175 per hour to prepare a tax return. By comparison, the minimum upfront cost to engage a financial planner is around $3,500 – $5,000, due largely to the complex rules and regulations that govern the provision of personal advice.

Annual ongoing fees of circa 1-2% are on top of that.

Over 20-25 years, that’s around $100,000.

Under the current regulatory regime, it is uncommercial and risky for advisers to provide one-off scoped advice.

The Quality of Advice Review is proposing a more principles-based approach to regulation. This will also encourage innovation and the development of alternative advice models, particularly digital advice.

Can existing adviser models reach the 90%?

Given the small number of Australians who currently receive professional advice, it is clear that existing advice models, which focus on holistic face-to-face advice and an ongoing relationship, don’t suit everyone.

This comprehensive approach has also limited advisers to around 133 clients. (6)

With just over 15,000 financial advisers on ASIC’s Financial Adviser Register (FAR), as at August 30, 2022 (7), simple maths suggests less than 2 million Australians (roughly 10% of Australia’s adult population) receive professional advice.

The industry must find a way to reach the remaining 90%. Part of the solution is to boost adviser numbers but that isn’t a short-term prospect.

It will take years, if not decades, for a new generation of professional advisers to emerge.

In the UK, the Financial Conduct Authority’s Retail Distribution Review (RDR) reforms, which introduced higher education and training standards, and ended almost all product commissions, effectively stalled growth in adviser numbers.

In 2012, when RDR came into effect, there were 35,000 financial advisers in the UK. Today, FCA data shows there are 36,674. (8)

If the UK experience is any indication, it may take a decade for adviser numbers here to creep up.

Significantly longer again to achieve the growth necessary to meet demand.

Even then, that won’t solve the fundamental problem that personal advice, as we know it, is too expensive.

How technology is part of the solution for advisers

The key to disseminating quality personal advice to the masses in the short-to-medium term lies in greater use of technology to automate processes and drive efficiencies, supported by accommodative public policy and reform.

It must be easier for advisers to provide limited advice such as educational material. It should also be easier for advisers to provide scoped advice, for example, investment only advice.

There must be the ability for personal advice to be transactional.

In the industry’s bid to rid itself of its product-selling roots and transition to a bona-fide profession, it abandoned the concept of transactional advice.

Historically, there were too many advisers collecting commissions and fees on large, inactive client books but with product commissions all but gone and stronger consumer protections in place, there is no reason why advisers can’t help hundreds, if not thousands, of clients.

Relationships and transactions are not mutually exclusive.

Doctors, particularly GPs, would argue they have a relationship with their patients, based on brief interactions and transactions over many years.

It can be the same with financial advice. The system should enable advisers to meet people where they are at.

They should be able to confidently answer questions like: How much life insurance do I need? Should I contribute extra to superannuation? What investments should I consider?

Over time, as trust is developed, that relationship grows.

Give them what they want

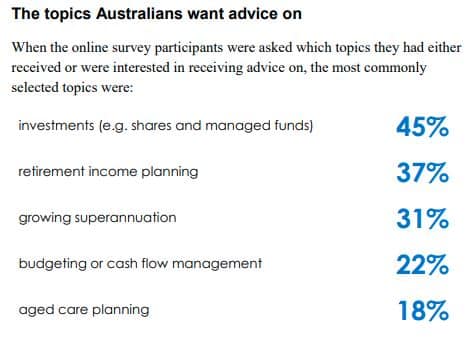

The number one topic Australians want advice on is investments, according to ASIC Report 627: Financial Advice – What consumers really think. (9)

But it’s not easy to give investment-only advice.

Before a recommendation can be made, clients must complete a comprehensive fact find questionnaire, and establish and prioritise their financial and non-financial goals in order for an adviser to conduct a needs analysis, scope their total advice needs, and research various products and strategies.

If a client chooses to limit the scope of advice, an adviser must explain the potential risks and consequences of receiving limited advice.

That process is lengthy and expensive.

The industry needs to embrace advice tech that can help advisers get up to speed on their clients and meet their ‘Know your client’ obligations quicker and cheaper. This will help facilitate the efficient provision of transactional advice.

Not only can technology support the delivery of traditional face-to-face advice by automating and streamlining parts of the advice process such as client engagement, gathering client information and producing advice documents, it can also support new digital advice solutions that cater to the self-directed market.

In the UK, automated advice solutions have played a key role in reducing the cost of advice and developing new ways to engage customers. (10)

According to the 2016 Financial Advice Market Review (FAMR), average advice fees in the UK (covering both advice and investment costs) are approximately 0.8% for automated investment advice, compared to 1.9% for holistic advice.

In transforming the advice process, technology has the power to increase business productivity, deliver scale and accelerate growth. It has the potential to create more profitable, valuable advice businesses.

Over the long term, this will see more people choose a career in the advice profession.

If the industry hopes to close the pension funding gap, help more people achieve a comfortable retirement and attract new entrants, it must embrace technology and find new ways to deliver scalable advice.

How many clients can you serve?

Ultimately, advisers need to serve more than 133 clients.

They need the capability to help hundreds, if not thousands, of clients every year. This is not a plea for the return of the olden days of recurring revenue and fees for no service. The industry has grown up since then.

Advice is a young profession with strict codes and standards. The next few years will see advancements in advice tech and the emergence of new advice models. These developments will underpin growth in the sector and benefit all players.

Rethink the way you deliver investment performance.

Desktop Broker is a financially stable trading platform for financial advisers. Our experienced adviser support team can help you save time on investment selection, portfolio construction and compliance.

We can move your advice practice to solid ground. Simply organise a time to talk to us about what your business needs by clicking here.

References:

- https://www.aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Library/pubs/BriefingBook45p/WelfareCost

- https://householdcapital.com.au/retirement-savings/retiree-savings-shortfall/

- https://www.aegon.com/research/our-research-approach/

- https://www.mercer.com/our-thinking/global-pension-index.html

- https://www.aihw.gov.au/reports/australias-welfare/age-pension

- https://www.moneymanagement.com.au/news/financial-planning/average-advice-practice-generating-11m-revenue

- https://asic.gov.au/about-asic/news-centre/news-items/asic-releases-july-and-august-2022-financial-adviser-exam-results

- https://www.moneymanagement.com.au/features/expert-analysis/what-australia-can-learn-financial-advice-reform-uk

- https://download.asic.gov.au/media/5243978/rep627-published-26-august-2019.pdf

- https://www.fca.org.uk/publication/corporate/evaluation-of-the-impact-of-the-rdr-and-famr.pdf