Alternative approaches to retirement planning

The proposed super reforms will require SMSF practitioners to renew their focus on non-super portfolios and develop alternative retirement strategies for clients.

Freely contributing funds, within the relevant contribution caps, into superannuation to ultimately begin a tax-free super pension has been a safe and appropriate strategy for many SMSF clients. The 2016 federal budget announcements potentially change all that, and as an SMSF adviser, you may already have turned your mind to alternative strategies.

Single individuals over age 65 can receive more than $32,000 per annum of taxable income in their personal name before paying any tax. Based on our long-term return projection assumptions, almost $1 million can be held in a personal name without paying tax on the returns generated in year one. For a senior couple, this figure rises to $1.775 million.

A senior couple can have $3.2 million – $1.6 million each – in superannuation pensions, plus potentially up to $1.775 million in non-super assets, and pay no tax on the returns and pension payments. But this may involve cashing out a significant amount at retirement.

Recommending cashing out funds at retirement flips on its head the previously accepted advice position of maximising funds inside superannuation, and may be a challenging proposition for some advisers.

$1.6 million in a pension, then what?

Consider Carol, a 65-year-old widow with $2.5 million in superannuation. One option for Carol is to start a pension with $1.6 million and leave the remaining $900,000 in the accumulation phase. The earnings on the accumulation phase assets will attract tax at 15 per cent or 10 per cent on capital gains if the assets are held for at least 12 months.

Another option for Carol is similar to option one, but she would cash out $900,000 from superannuation and establish a non-super portfolio in her personal name.

Other potential options, albeit less relevant to Carol’s situation, may include investing in a trust (including a family trust), a corporate entity or life insurance/investment bonds. Consideration of these options will be addressed later.

The accrual of the $900,000 is shown in Chart 1 for options one and two above.

Comparison of $900,000 inside and outside super

|

|

Option 1: $900,000 in super accumulation |

Option 2: $900,000 in personal name |

||||||

|

Year |

Opening balance |

Taxable income* (super fund) |

Net tax payable |

Closing balance |

Opening balance |

Taxable income* (personal) |

Net tax payable |

Closing balance |

|

1 |

900,000 |

30,750 |

4,613 |

961,628 |

900,000 |

29,385 |

- |

966,240 |

|

5 |

1,169,222 |

54,477 |

8,172 |

1,247,105 |

1,186,493 |

49,726 |

7,681 |

1,266,138 |

|

10 |

1,611,529 |

82,218 |

12,333 |

1,717,805 |

1,626,493 |

73,729 |

16,983 |

1,729,219 |

|

15 |

2,216,920 |

115,476 |

17,321 |

2,362,764 |

2,201,077 |

101,785 |

27,328 |

2,335,748 |

|

20 |

3,048,325 |

159,572 |

23,936 |

3,248,745 |

2,952,780 |

137,412 |

41,223 |

3,128,882 |

* Includes realised capital gains

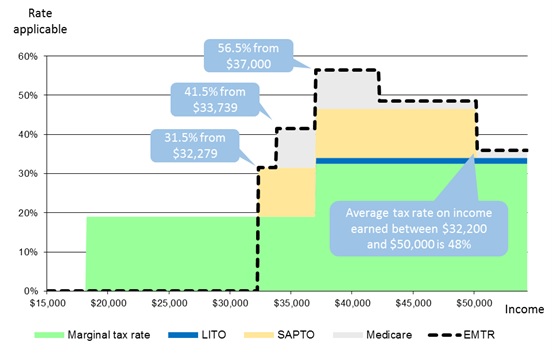

There is no tax payable in option two in year one, but this position changes quickly as taxable income grows each year with the overall portfolio growth. The effective tax-free threshold for a single person over age 65 is $32,279 and up to $28,974 for each member of a senior couple. Beyond this level, the effective marginal tax rate is high – see Chart 2 below.

The term effective marginal tax rate (EMTR) refers to the amount of tax paid on the next dollar of income in addition to the client’s existing income. From $32,279, Carol’s EMTR ranges from 31.5 per cent to 56.5 per cent. These rates arise from the combined impact of the Medicare levy (10.0 per cent initially, then 1.5 per cent), the loss of the low income tax offset (LITO, 1.5 per cent) and seniors and pensioners tax offset (SAPTO, 12.5 per cent) and the marginal income tax rate (19.0 and 32.5 per cent).

Effective tax rates on an additional $1.00 of income for single persons aged 65 and over

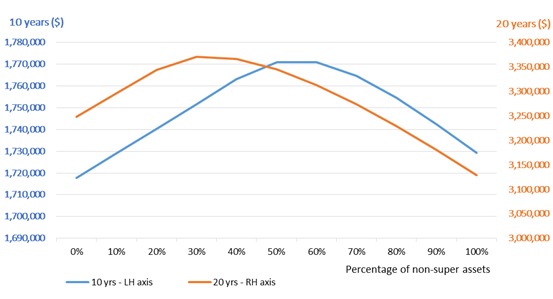

Carol’s non-super portfolio in option two above performs well on an after-tax basis for the first 10 years, but poorly compared to the superannuation option over the second 10 years because of the impact of the high effective rates of tax (shown in Chart 1) on personal income as the portfolio grows.

A hybrid solution

The challenge for Carol is to utilise the potential of her personal income effective tax-free threshold ($32,279) without exceeding it, as the superannuation accumulation tax rate is lower and preferable to the effective marginal tax rates applicable to income above $32,279. Some level of assets held in her personal name is desirable, but as the portfolio grows, the tax effectiveness decreases if the effective tax-free threshold is exceeded.

Chart 2 suggests there is an optimum mix of non-super to super accumulation assets for a given set of return assumptions and the investment time horizon. Based on our return assumptions here, over a 10-year time horizon the optimum weighting is in the range of 50-60 per cent non-super assets, whereas over 20 years the optimum weighting reduces to approximately 30 per cent

The Australian Life Tables 2010-2012 indicate that Carol can expect to live another 22.05 years. If the aim is to maximise Carol’s total account balances at her life expectancy, the optimum ratio of non-super/super ratio for the $900,000 is approximately 30/70, based on the return assumptions used in this article.

Certain measures announced in the 2016 Federal Budget may result in a renewed focus on non-super portfolios during retirement, but careful management will be required to maintain maximum tax effectiveness.

David Barrett, head of technical services, Macquarie